AGENDA

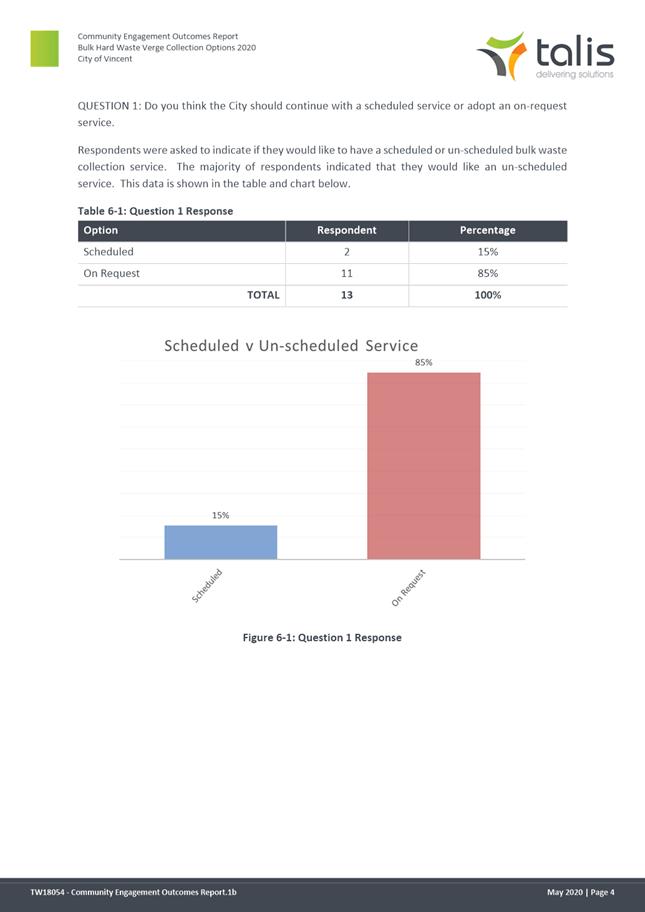

Ordinary Council Meeting

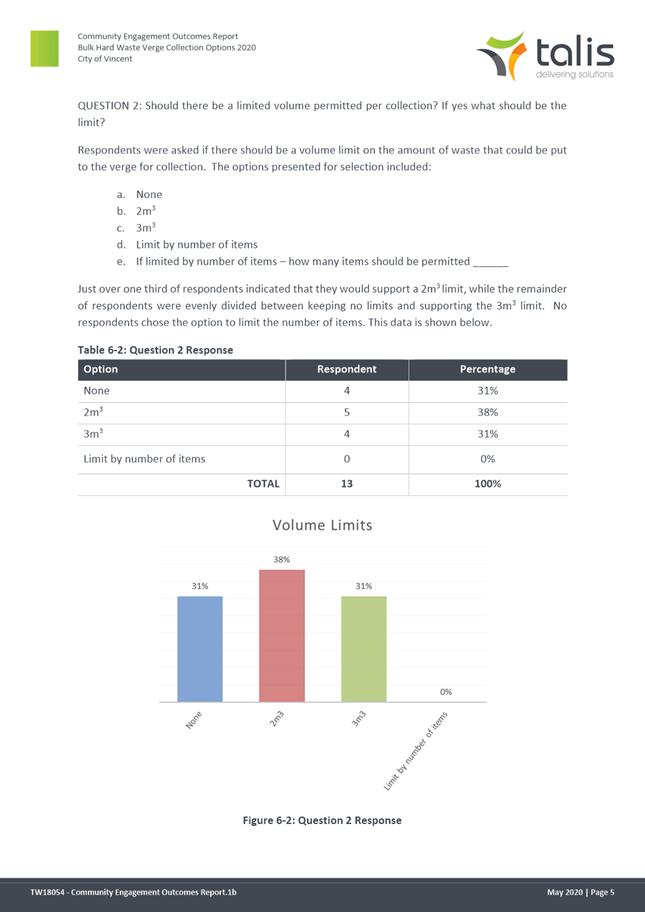

28 July 2020

|

Time:

|

6pm

|

|

Location:

|

E-Meeting and Administration and Civic Centre

244 Vincent Street, Leederville

|

David MacLennan

Chief Executive Officer

DISCLAIMER

No

responsibility whatsoever is implied or accepted by the City of Vincent (City)

for any act, omission, statement or intimation occurring during Council

Briefings or Council Meetings. The City disclaims any liability for any

loss however caused arising out of reliance by any person or legal entity on

any such act, omission, statement or intimation occurring during Council

Briefings or Council Meetings. Any person or legal entity who acts or

fails to act in reliance upon any statement, act or omission made in a Council

Briefing or Council Meeting does so at their own risk.

In

particular and without derogating in any way from the broad disclaimer above,

in any discussion regarding any planning or development application or

application for a licence, any statement or intimation of approval made by an

Elected Member or Employee of the City during the course of any meeting is not

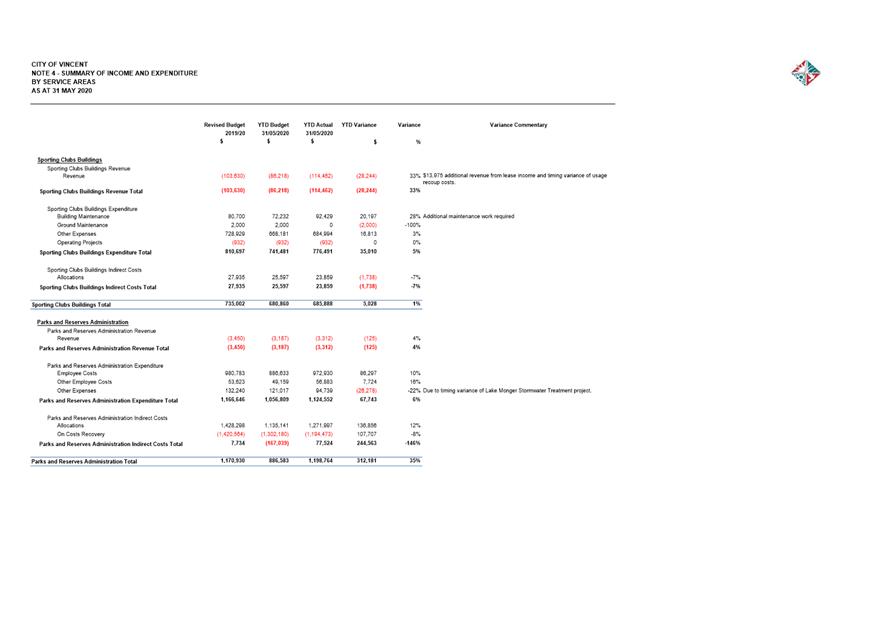

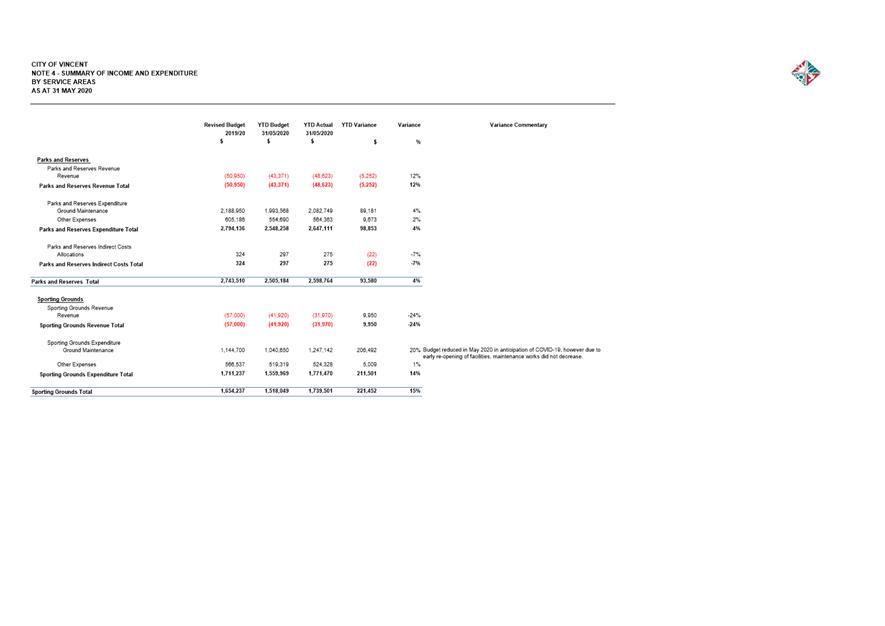

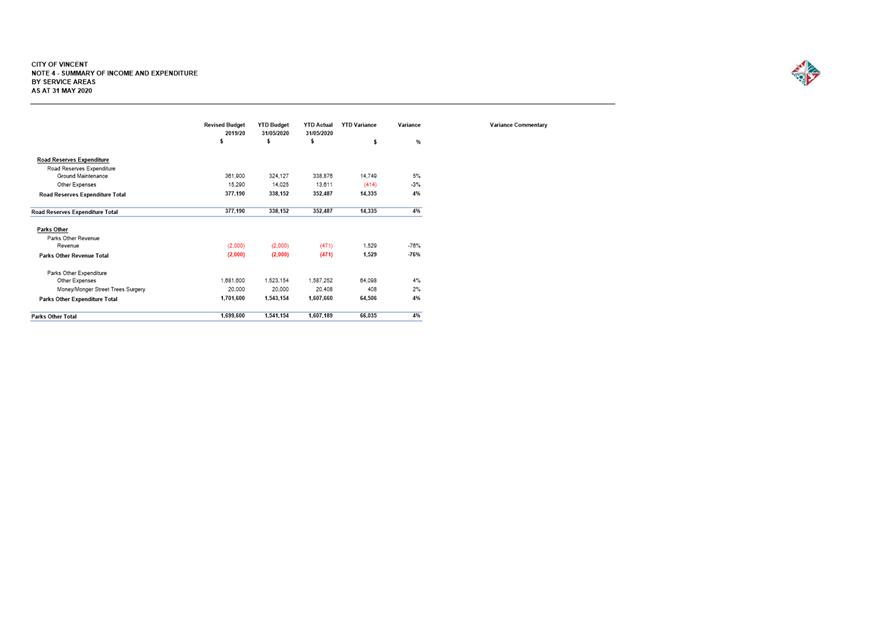

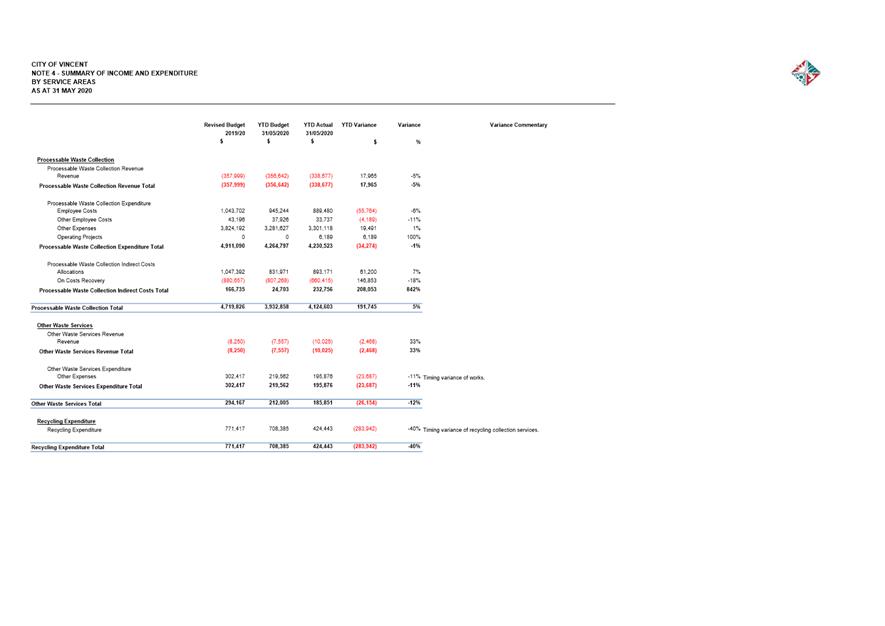

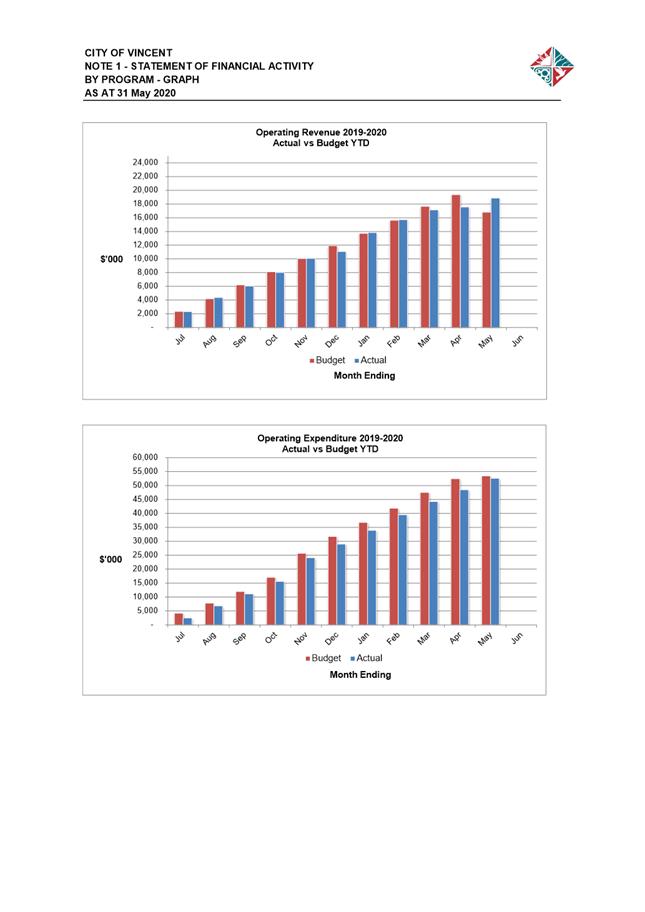

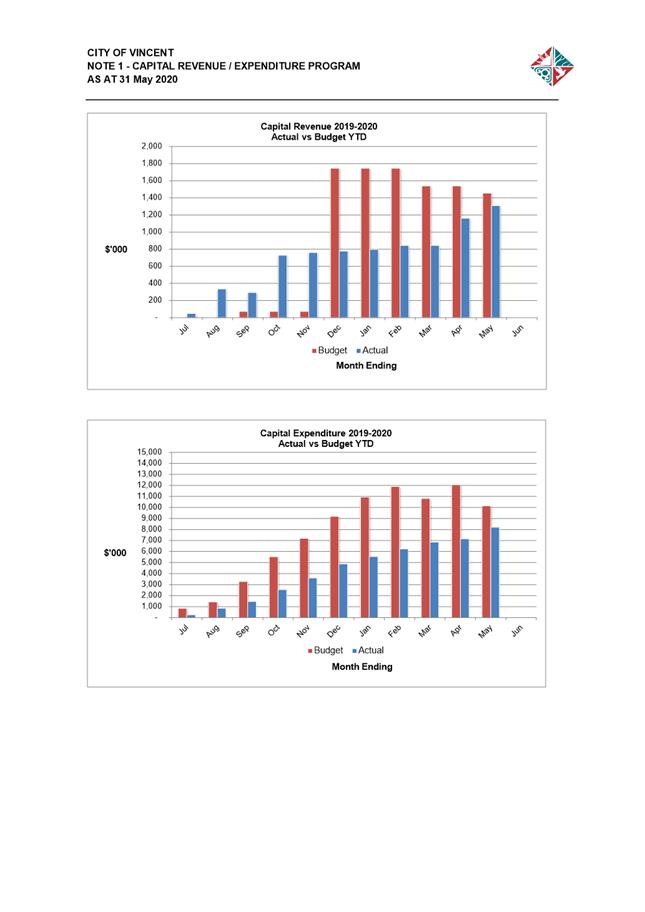

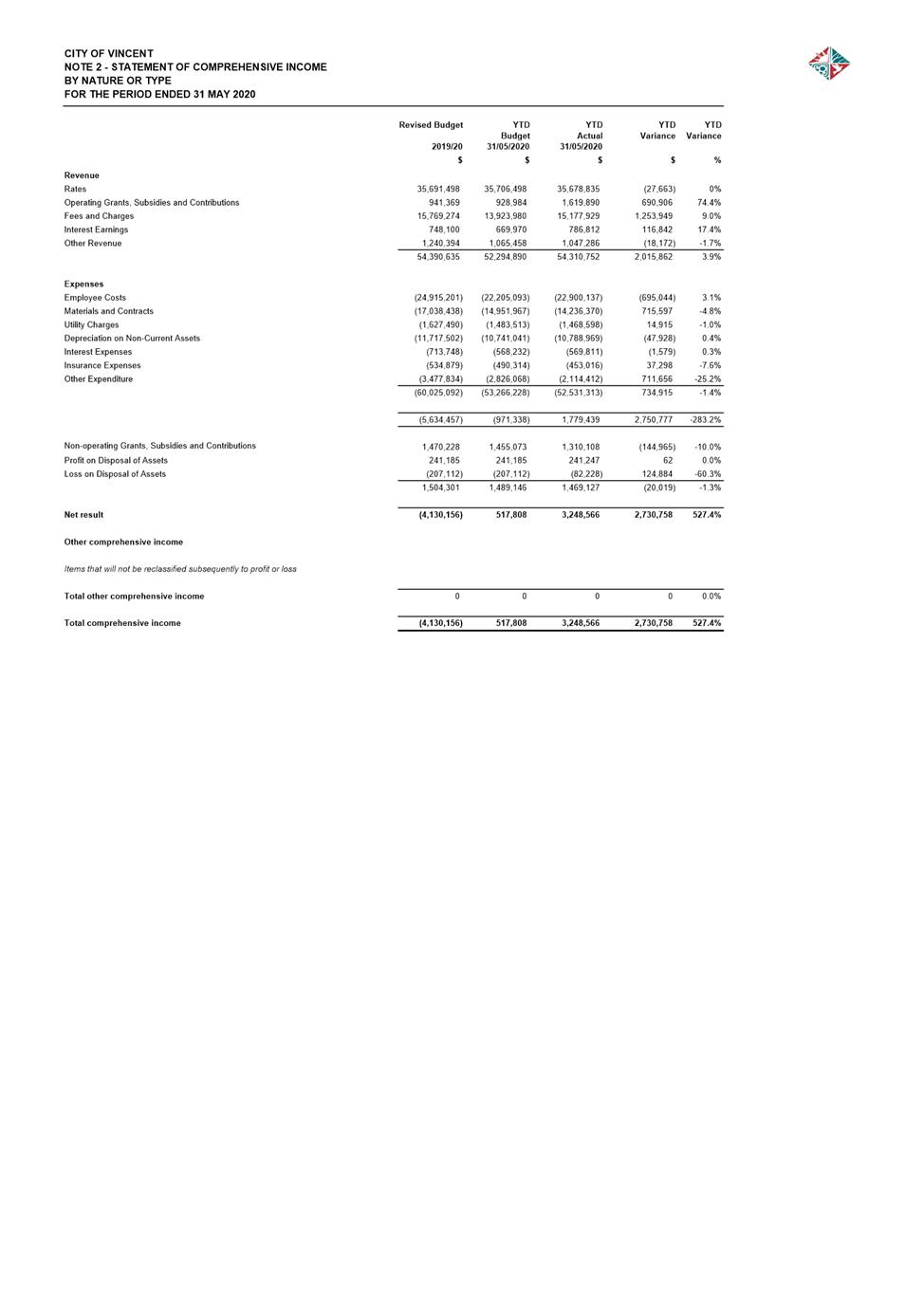

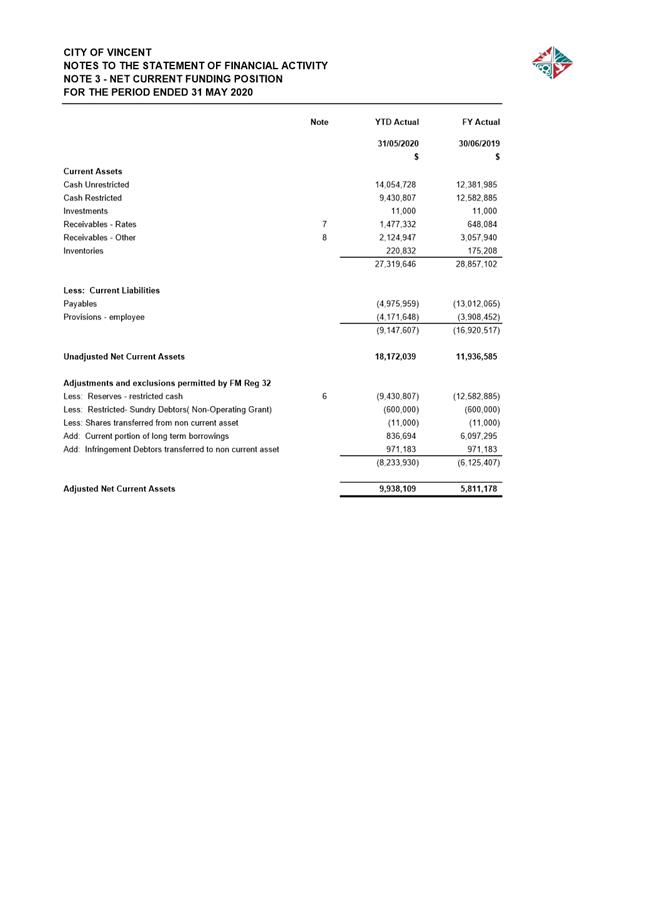

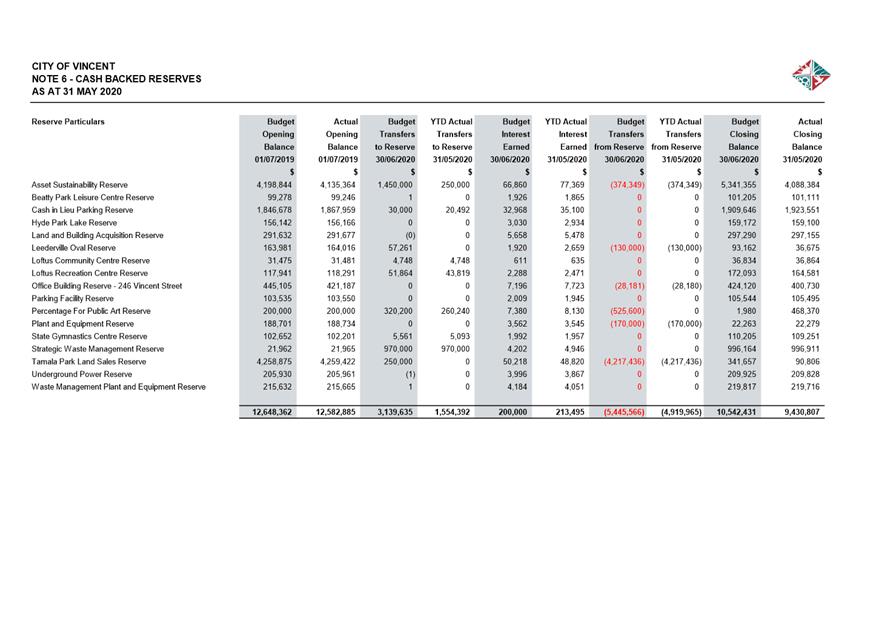

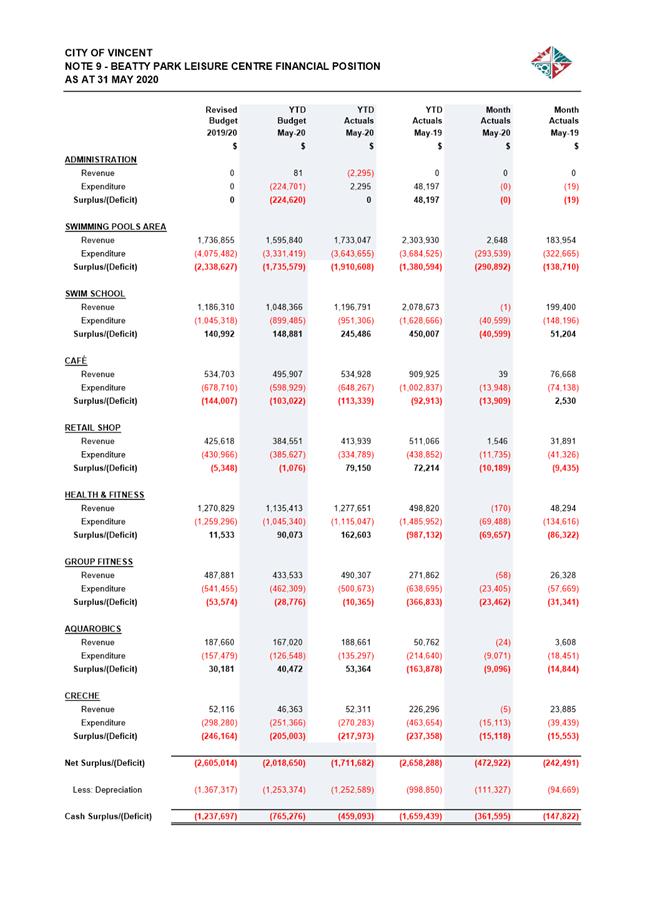

intended to be and is not to be taken as notice of approval from the

City. The City advises that anyone who has any application lodged with

the City must obtain and should only rely on WRITTEN CONFIRMATION of the

outcome of the application, and any conditions attaching to the decision made

by the Council in respect of the application.

Copyright

Any

plans or documents contained within this Agenda may be subject to copyright law

provisions (Copyright Act 1968, as amended) and that the express permission of

the copyright owner(s) should be sought prior to their reproduction. It

should be noted that Copyright owners are entitled to take legal action against

any persons who infringe their copyright. A reproduction of material that

is protected by copyright may represent a copyright infringement.

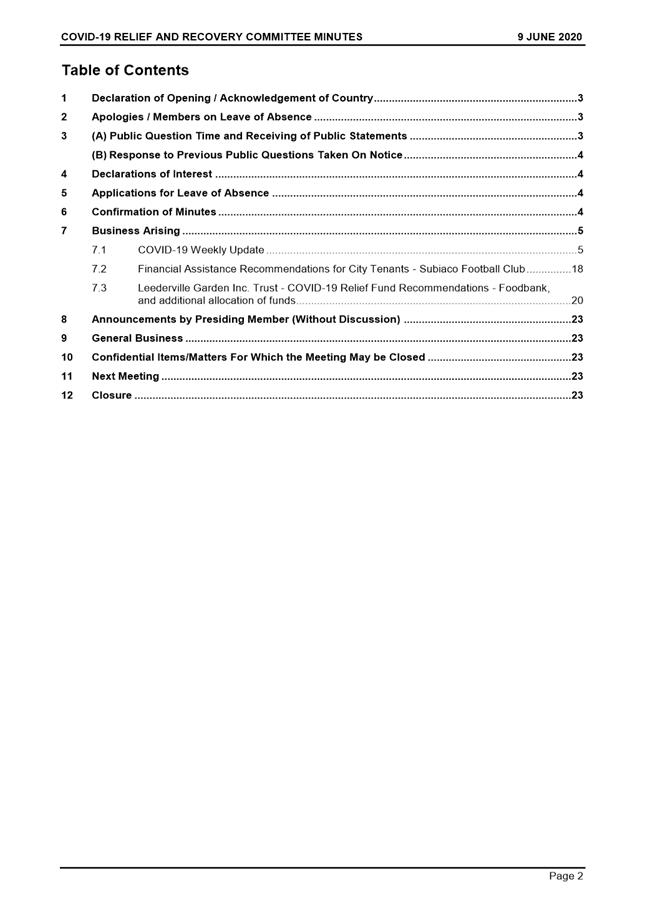

Order Of Business

1 Declaration

of Opening / Acknowledgement of Country. 7

2 Apologies

/ Members on Leave of Absence. 7

3 (A)

Public Question Time and Receiving of Public Statements. 7

(B) Response to Previous Public Questions Taken On

Notice. 7

4 Applications

for Leave of Absence. 8

5 The

Receiving of Petitions, Deputations and Presentations. 8

6 Confirmation

of Minutes. 8

7 Announcements

by the Presiding Member (Without Discussion) 8

8 Declarations

of Interest 8

9 Strategy

& Development 9

Nil

10 Infrastructure

& Environment 10

10.1 Waste

Strategy Project 2 - Bulk Hard Waste Options Appraisal - Progress Report 10

10.2 Tender

576/20 - Pavement Profiling & Supply and Laying of Hot Mixed Asphalt -

Appointment of Successful Tenderer 85

10.3 Tender

570/19 - Pavement Marking Services - Appointment of Successful Tenderer 89

10.4 Tender

577/19 - Concrete Crossovers and Cast In-situ Concrete Paths - Appointment of

Successful Tenderer 92

11 Community

& Business Services. 95

11.1 Draft

Youth Action Plan 2020-2022. 95

11.2 Advertising

of Amendment to Community Funding Policy - Emergency Relief Donations for

Seniors and the Vulnerable. 116

11.3 Investment

Report as at 31 May 2020. 129

11.4 Authorisation

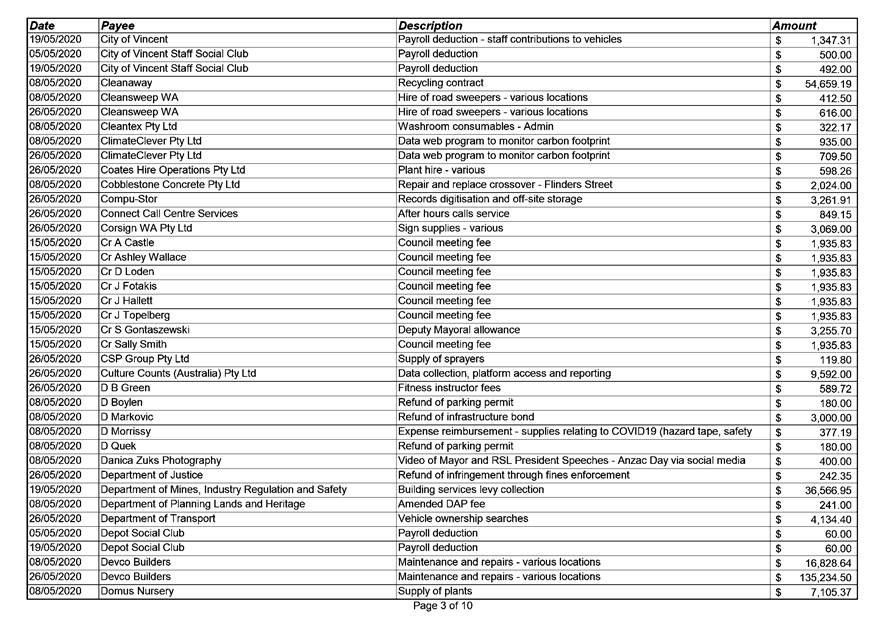

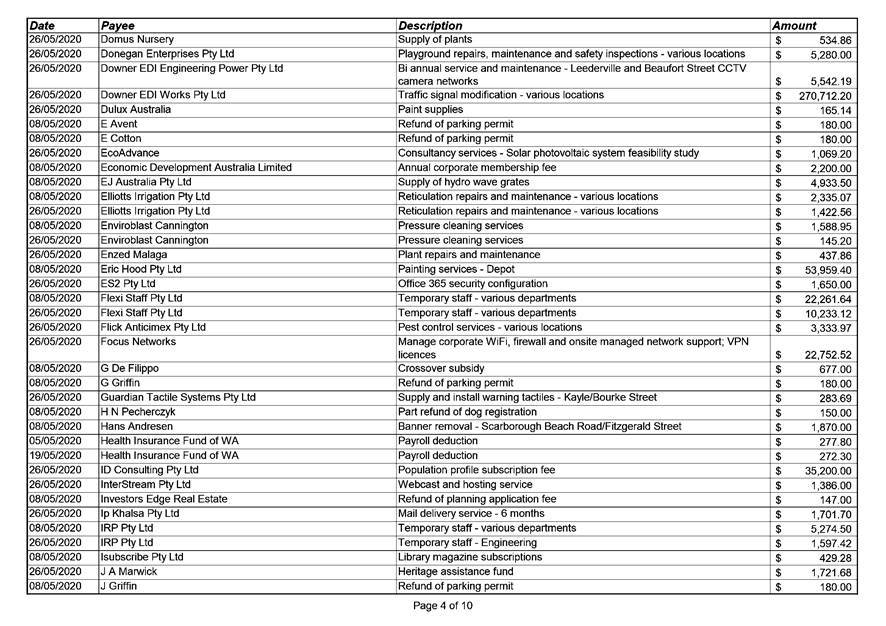

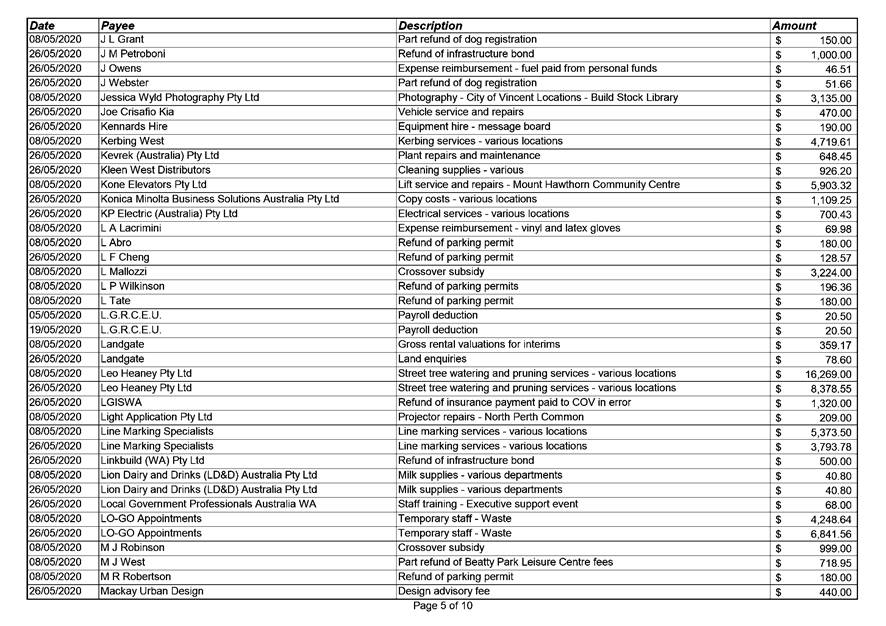

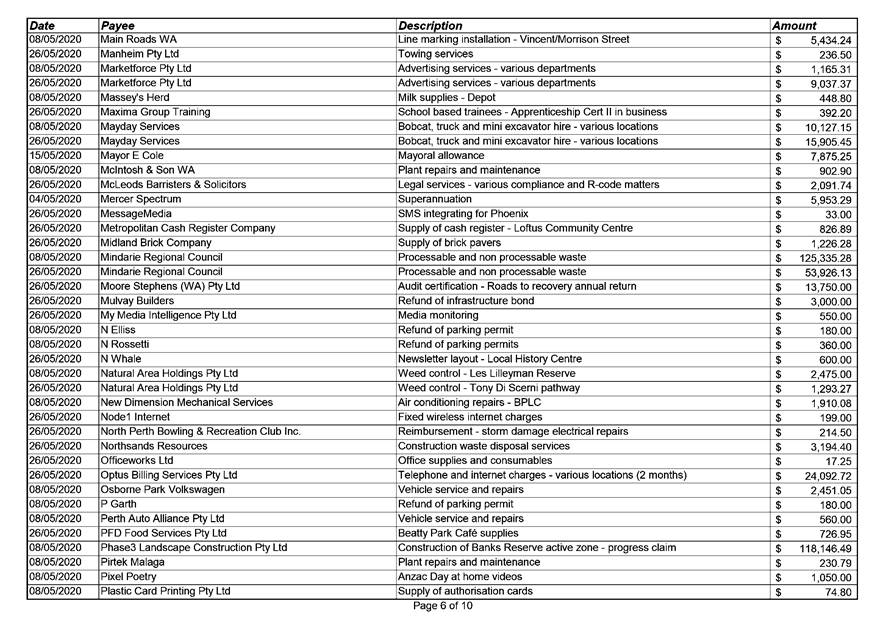

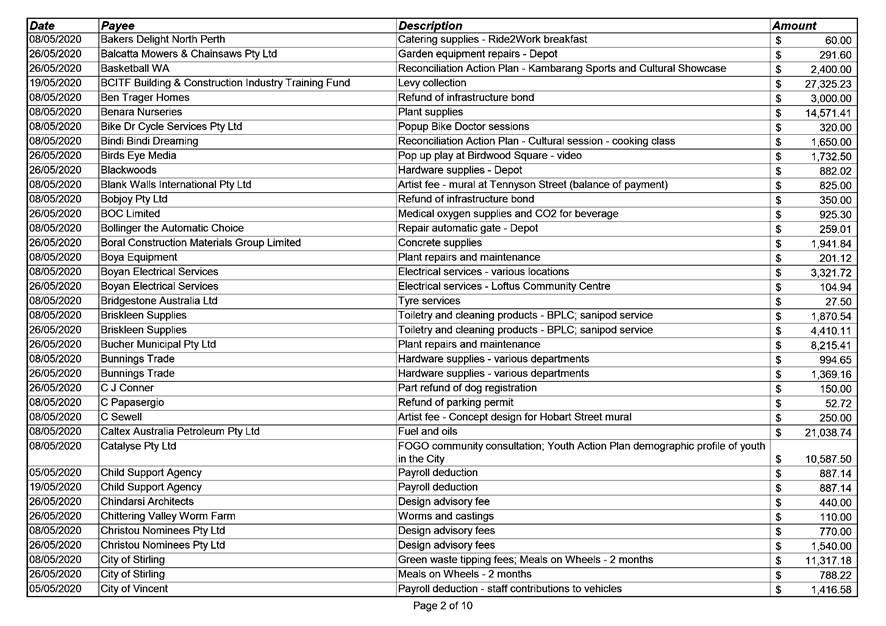

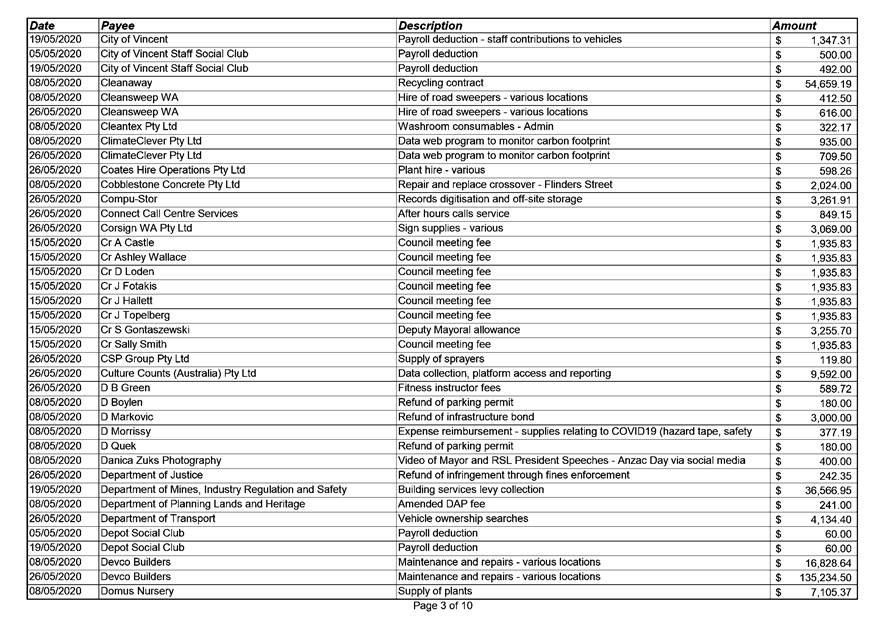

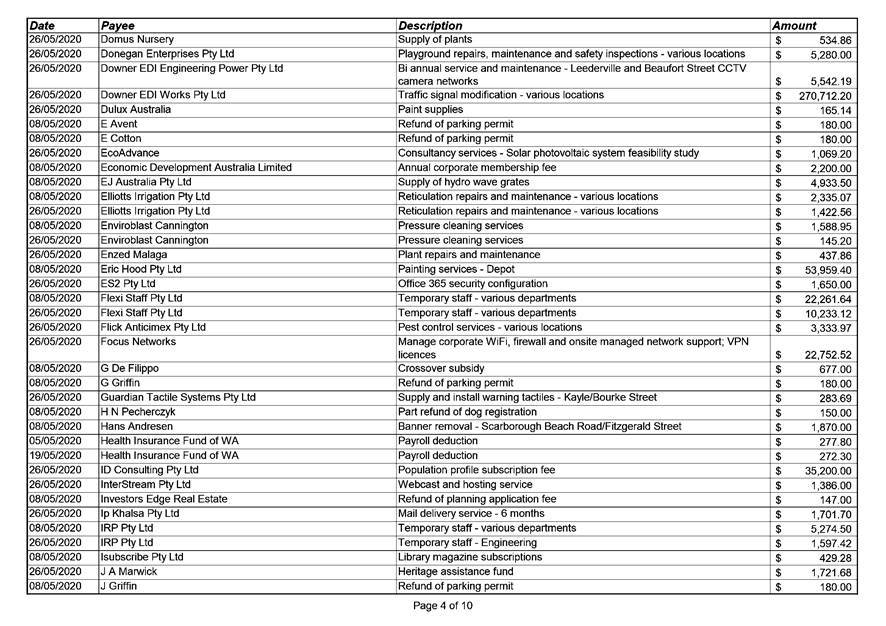

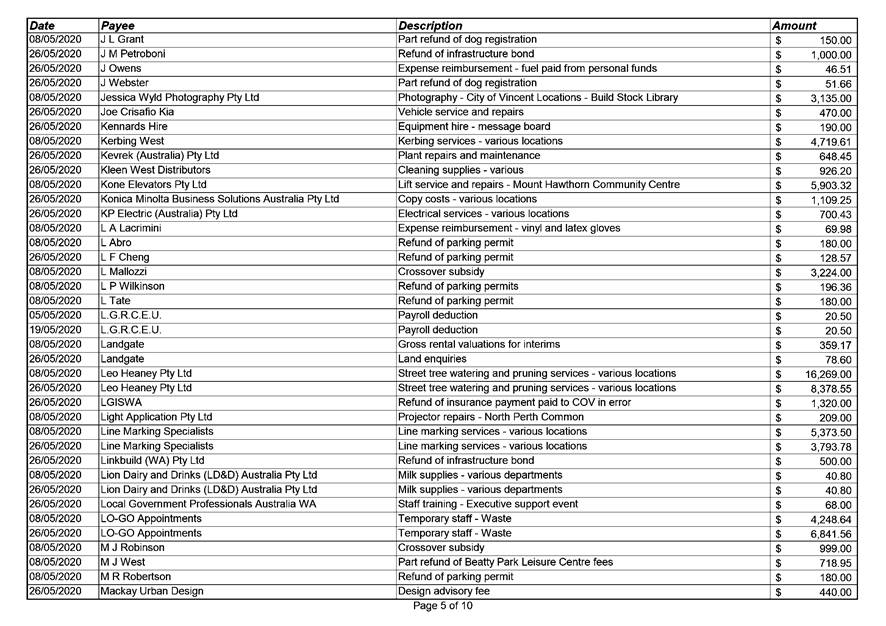

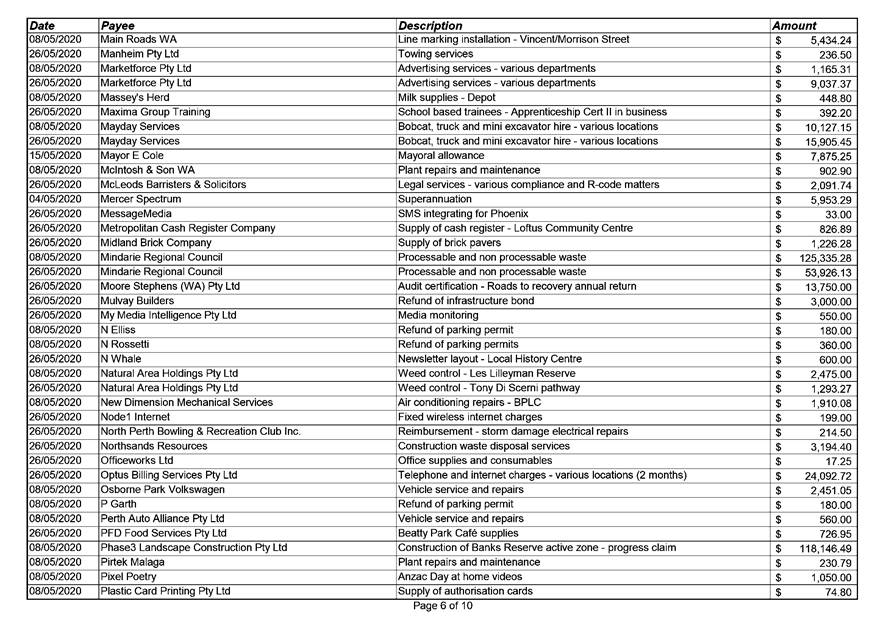

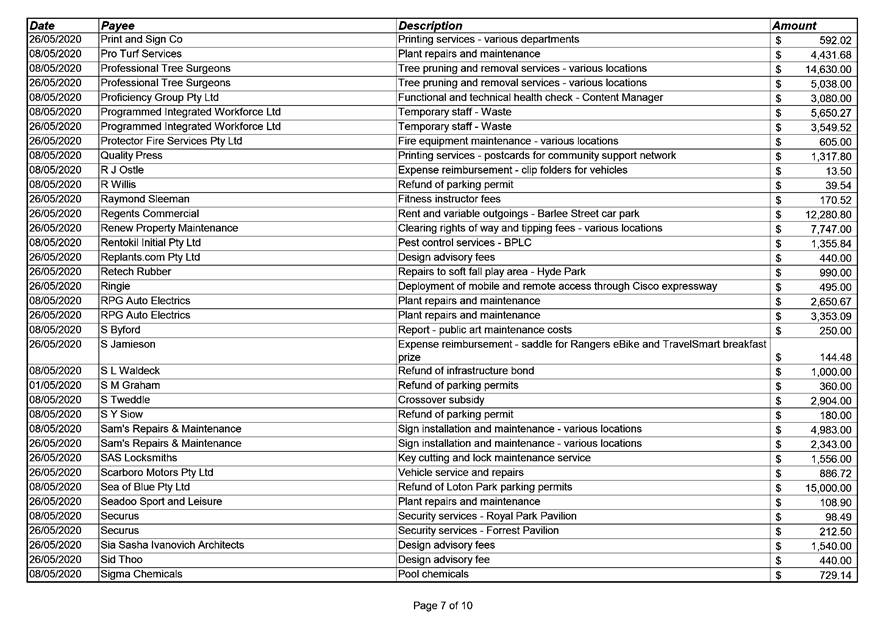

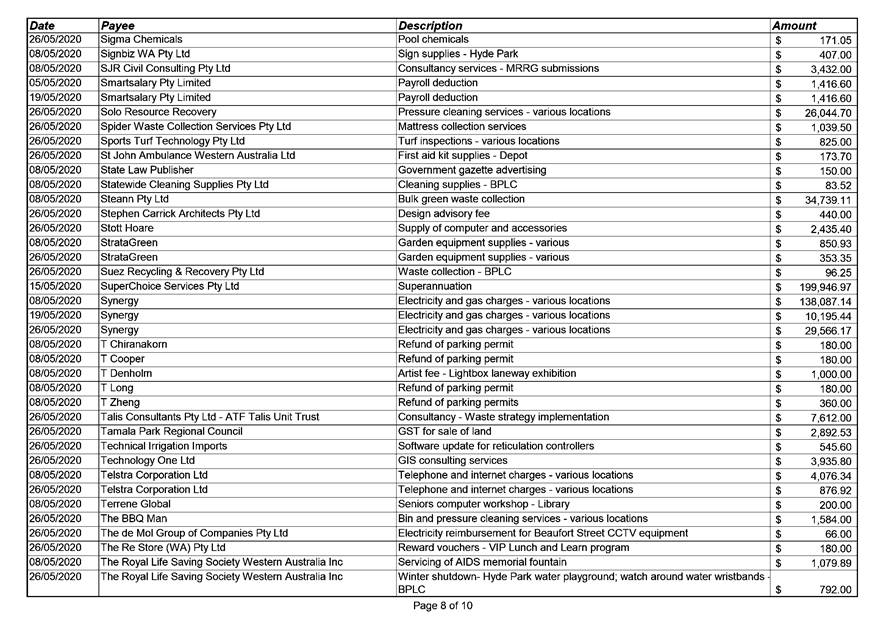

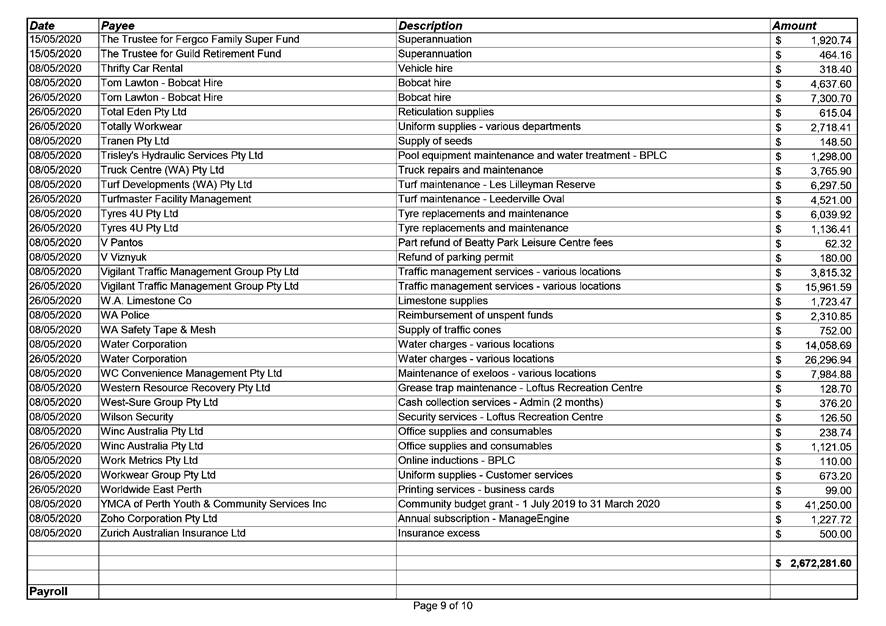

of Expenditure for the Period 1 May 2020 to 31 May 2020. 137

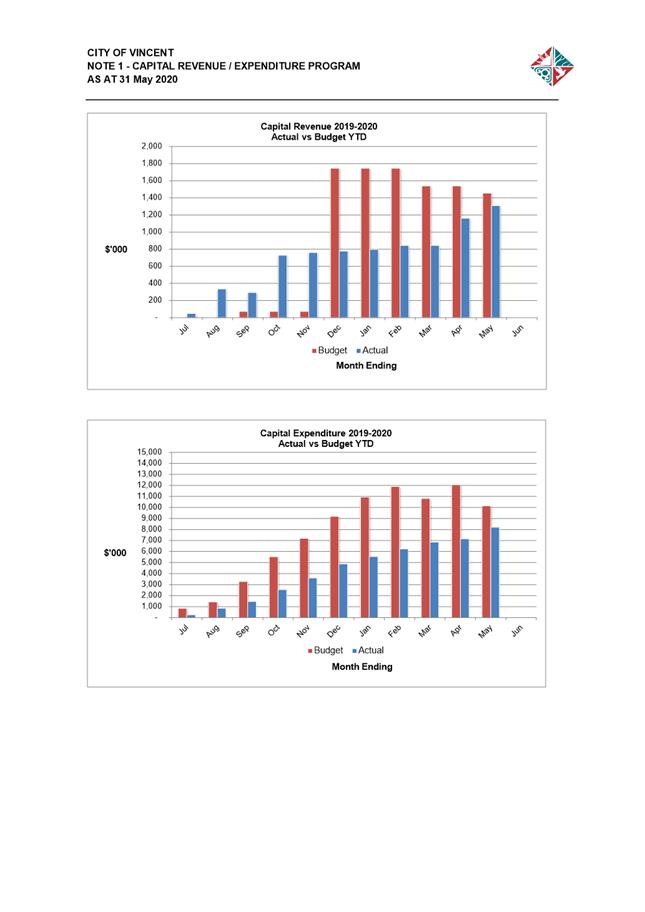

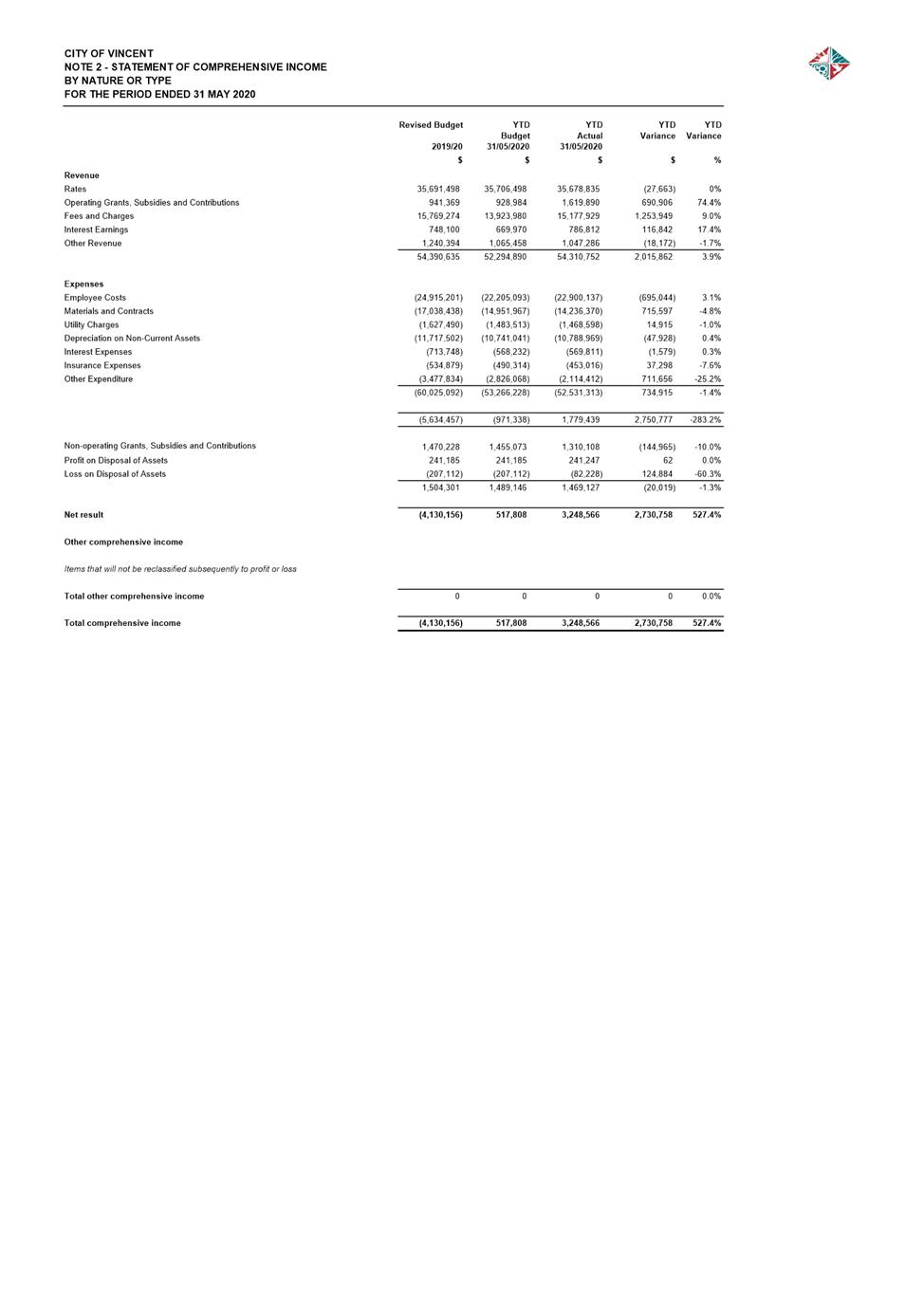

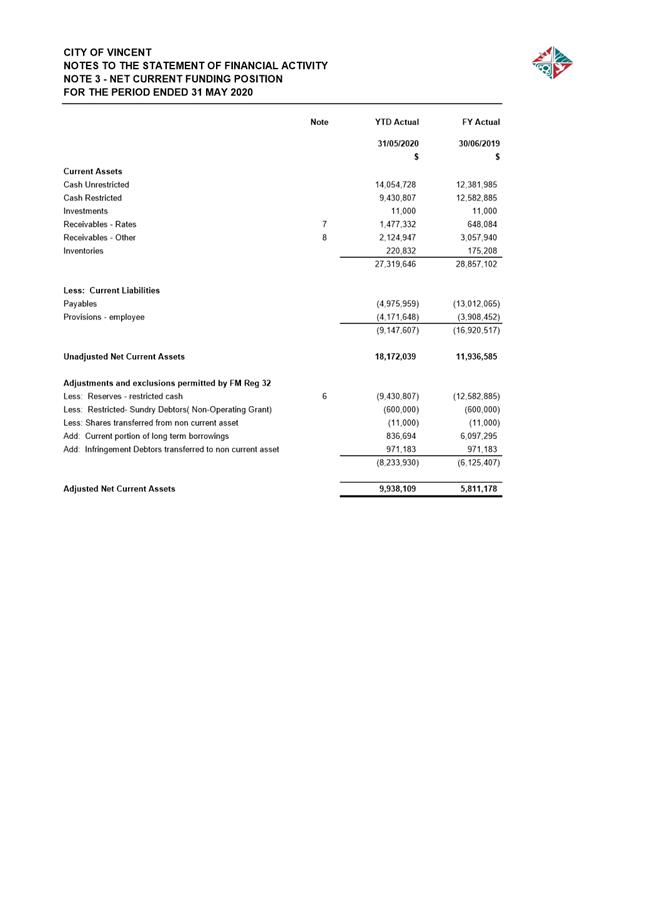

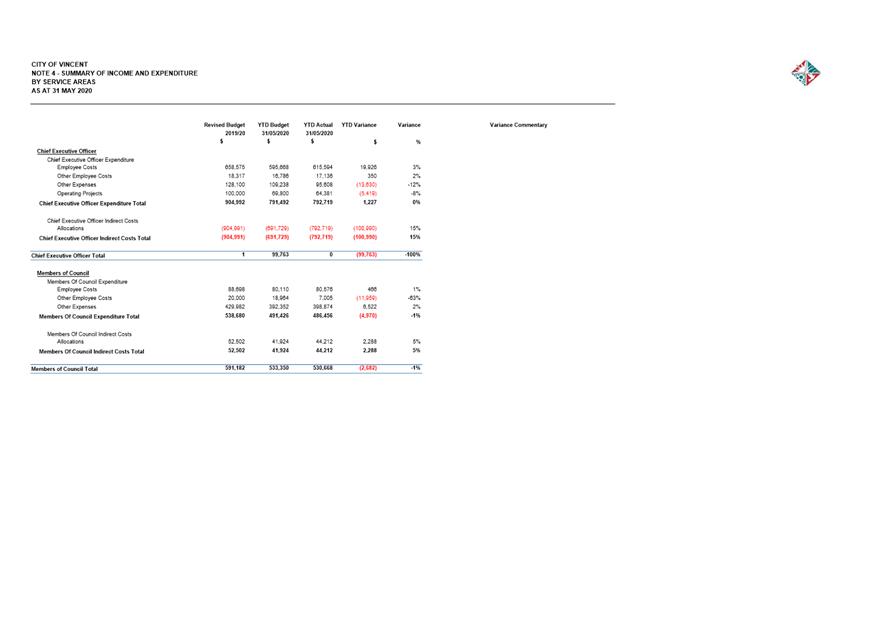

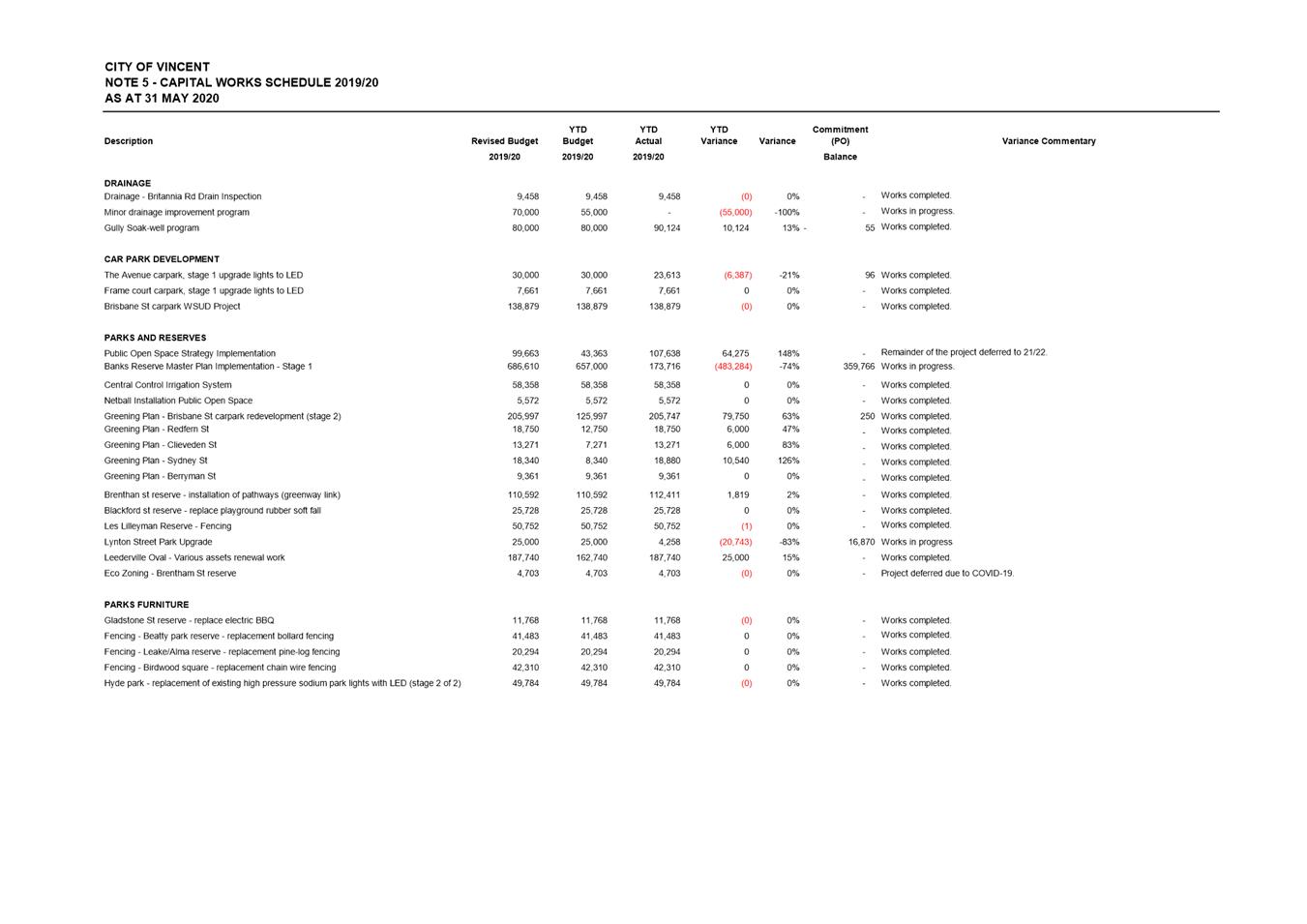

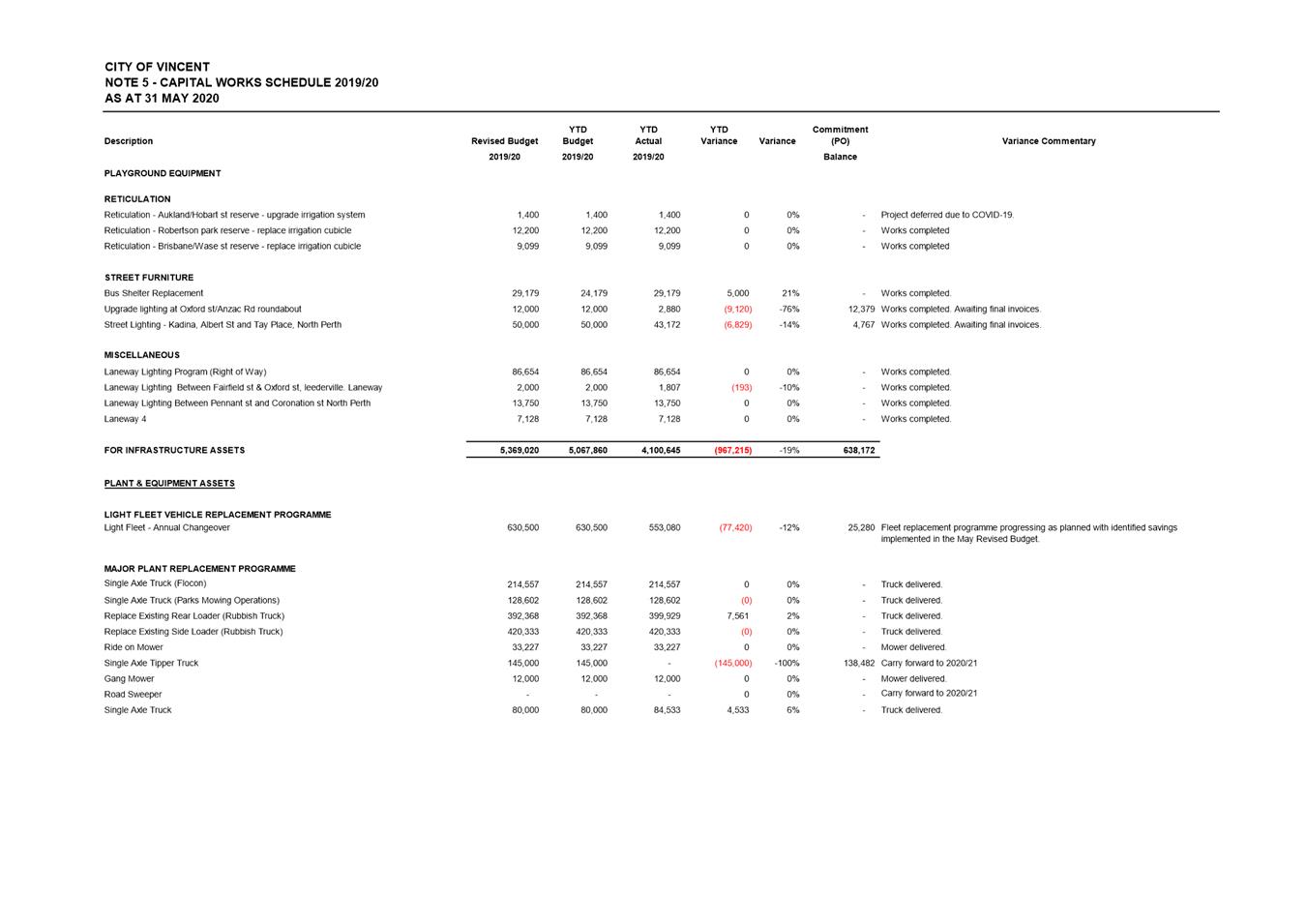

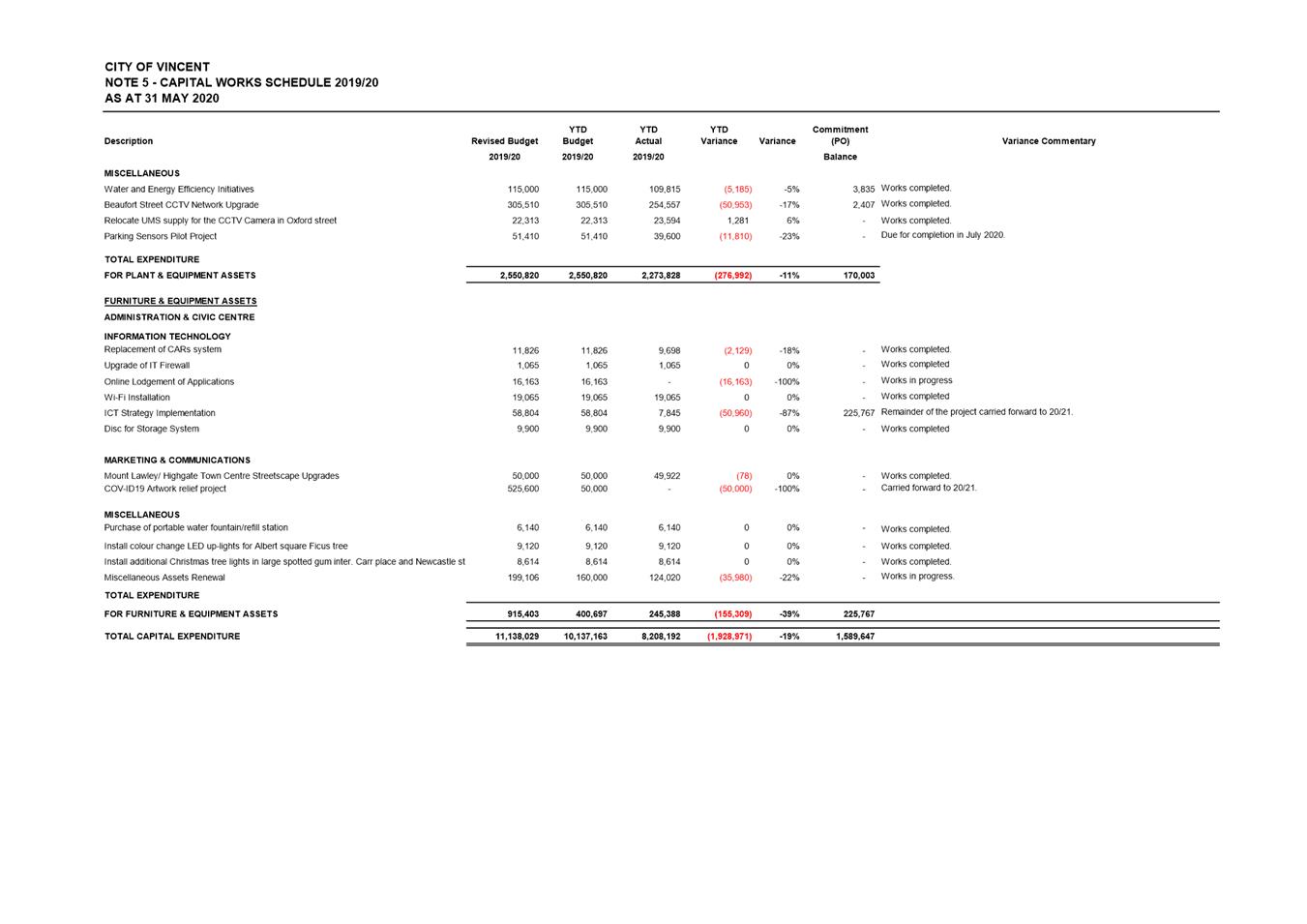

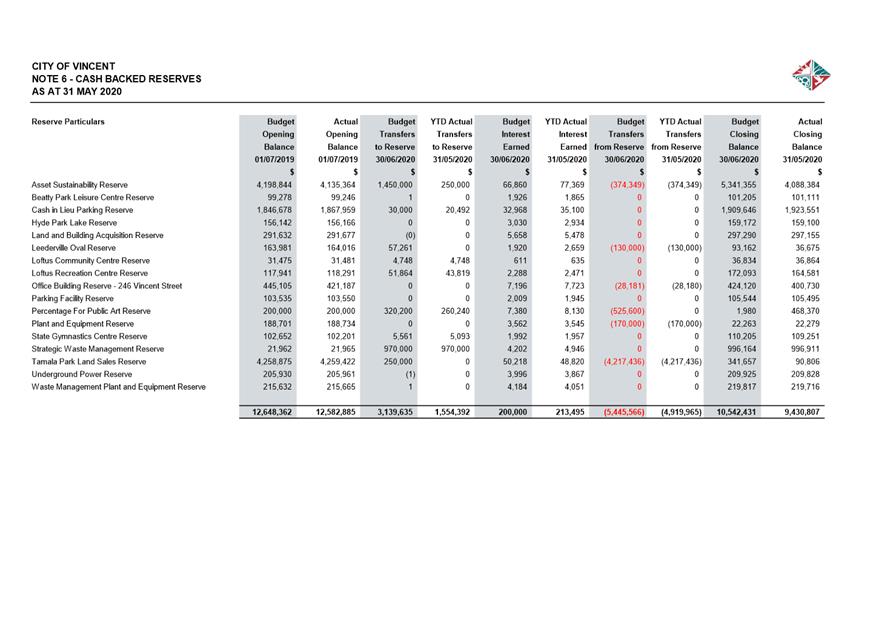

11.5 Financial

Statements as at 31 May 2020. 152

11.6 Adoption

of 2020/21 Annual Budget [ABSOLUTE MAJORITY DECISION REQUIRED] 226

12 Chief

Executive Officer 345

12.1 Report

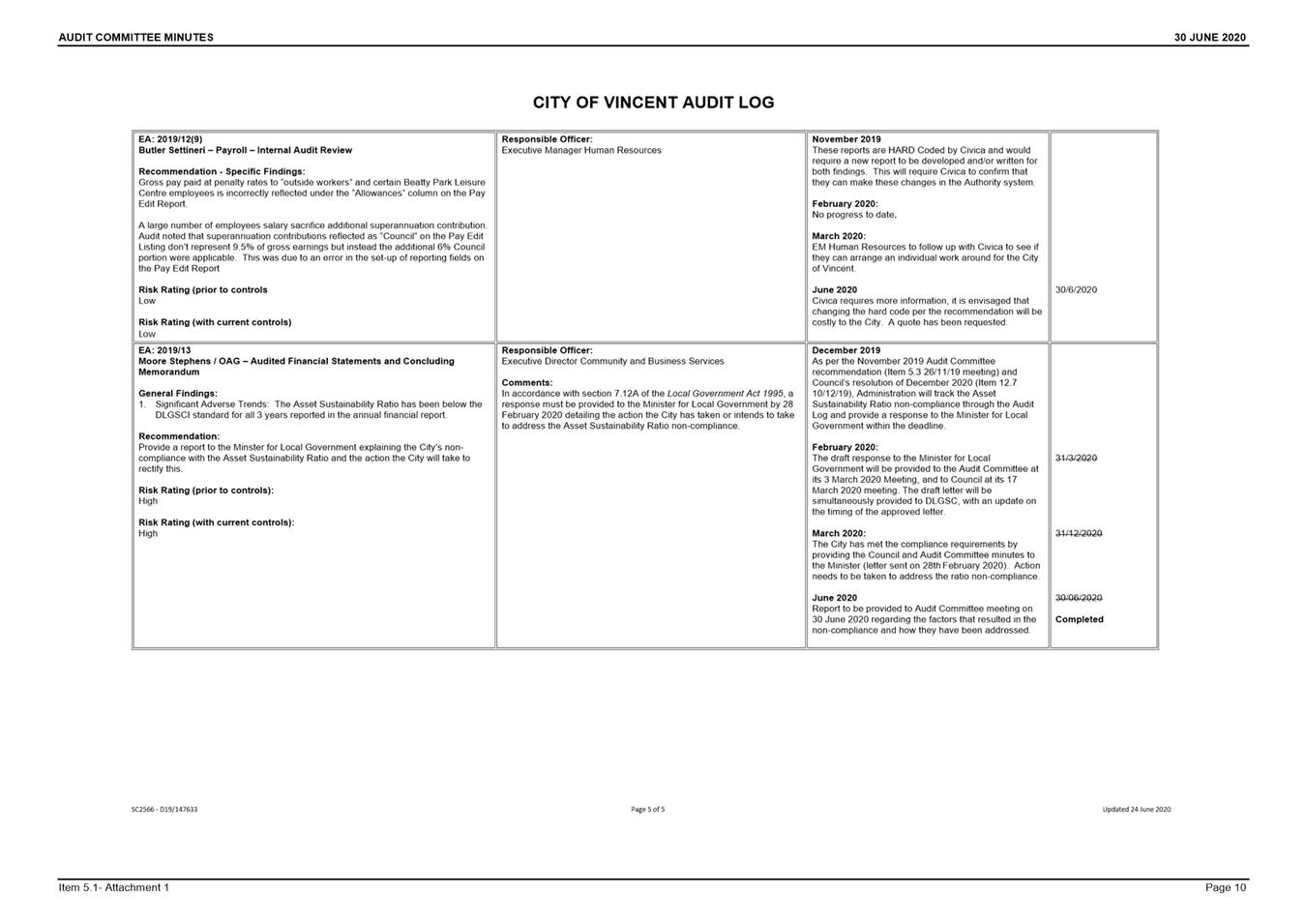

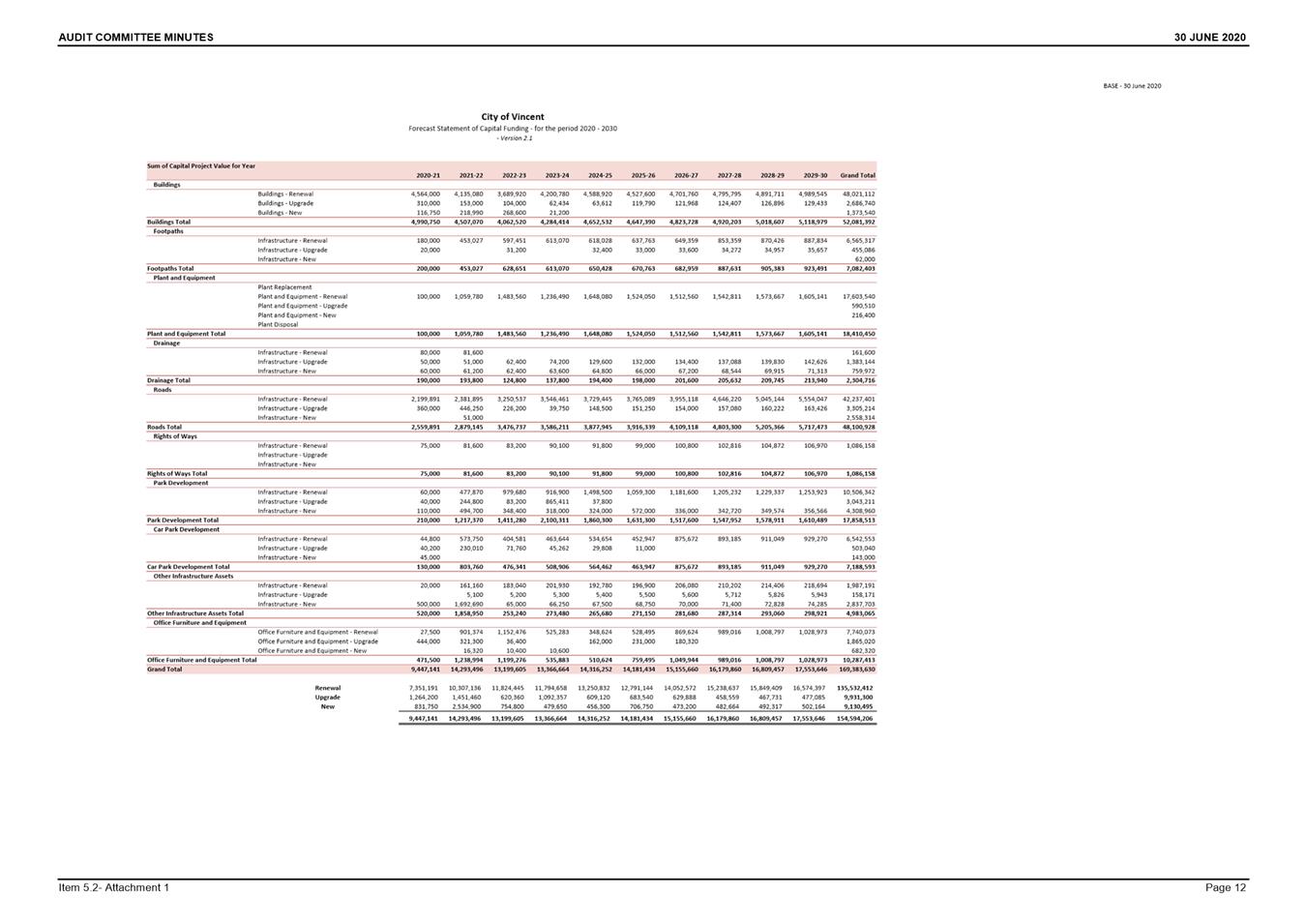

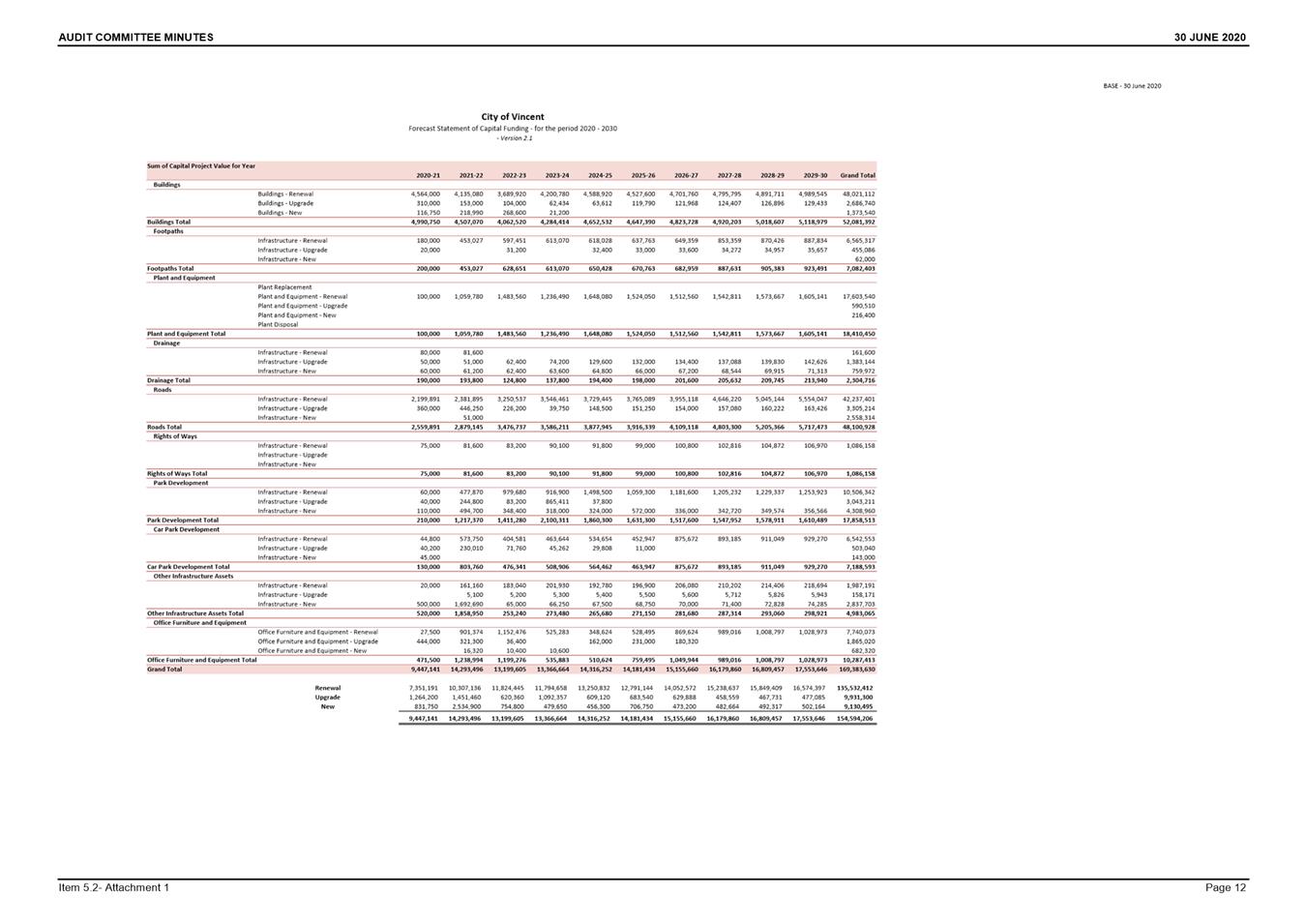

and Minutes of the Audit Commitee Meeting held on 30 June 2020. 345

12.2 Advertising

of new Meeting Procedures Policy. 367

12.3 Appointment

of Elected Members and Community Representatives to Advisory Groups. 379

12.4 Advertising

of new lease of portion of the Beatty Park Leisure Centre to Beatty Park

Physiotherapy Pty Ltd. 382

12.5 New

Lease of Robertson Park Tennis Centre to Tennis Association of Western

Australia. 387

12.6 Enabling

Model for Service Delivery and Best Practice Regulation. 391

12.7 Advertising

of new Local Government Property Local Law 2020 and new Election Signs Policy 395

12.8 Proposed

Transfer of Anzac Cottage to the National Trust of Western Australia. 459

12.9 Advertising

of amended Development on City Owned and Managed Land Policy. 471

12.10 Elected

Members Professional Development - 2019/2020. 493

12.11 Information

Bulletin. 498

13 Motions

of Which Previous Notice Has Been Given. 639

14 Questions

by Members of Which Due Notice Has Been Given (Without Discussion) 639

15 Representation

on Committees and Public Bodies. 639

16 Urgent

Business. 639

17 Confidential

Items/Matters For Which The Meeting May Be Closed. 639

18 Closure. 639

1 Declaration

of Opening / Acknowledgement of Country

“The City of Vincent would

like to acknowledge the Traditional Owners of the land, the Whadjuk people of

the Noongar nation and pay our respects to Elders past, present and

emerging”.

2 Apologies

/ Members on Leave of Absence

Cr

Ashley Wallace is on leave of absence from 21 – 28 July 2020.

3 (A) Public

Question Time and Receiving of Public Statements

(B) Response

to Previous Public Questions Taken On Notice

These questions were taken on

notice at the Ordinary Council Meeting on 16 June 2020.

3.1 Dudley

Maier of Highgate

With regards to the lease for

246 Vincent Street:

o

What would the total income from the rent component (i.e.

excluding the payment for parking) be over the 10 year period if no incentive

was involved, the initial payment was $754,800, and the rent increased by 3%

per annum?

$8,652,936

plus GST

o

What is 40% of this amount?

$3,461,174

plus GST

o

Who performed due diligence on the lease proposal?

The

responsible legal and property officer in Administration. Administration

did not engage an external property consultant to assist in the lease

discussion.

Please note that the above amount is

higher than the incentive as agreed by the City and the Department of Works

(which is $3,019,200 plus $25,000 plus GST). The incentive agreed was put

forward by the Department of Works, and did not take into account the annual 3%

rent increase. This amount was agreed by the Department and the City, and is

expressly stated in the Deed of Variation and Extension of Lease.

Now that the

lease for 246 Vincent Street has been finalised, will the Administration make

public the valuation that was Attachment 6 of the item that went to the 10

December 2019 Meeting? If not, why not?

The valuation report has commercial value to the

valuer and therefore remains confidential in accordance with section

5.23(2)(e)(ii) of the Local Government Act 1995. In respect to the market

value, it is not a statutory requirement for the City to release the market

value, and it is not Administration’s view that it is in the public

interest to release the market value.

What council

workshops have been held since 28 April and what topics were discussed at each

workshop?

There

was a Council Workshop on 26 May, the topics discussed were:

·

Public Health Plan

·

Policy Review and Development Policy

·

Proposed Meeting Procedures Policy – Council Proceedings

·

Annual Council delegations review

·

Place Management 1.9

·

Asset Management

·

Bulk Hard Waste Options Appraisal

·

Future use of 245 Vincent Street, Leederville

·

Hyde Park Café Proposal

·

Community engagement on budget

There

was also a Workshop on 23 June 2020, the topics discussed were:

·

Draft Youth Action Plan 2020-2022

·

Lease of Community Building at Woodville Reserve, 10 Farmer

Street, North Perth

·

Enabling Model for Service Delivery and Best Practice

Regulation

·

SCP Implementation Audit and Two Year Review

·

Policy and Strategy Development and Review Policy

·

Governance Framework

·

Meeting Procedure Policy

·

Future use of 1 Linwood Court,

Osborne Park

·

Local Government Property Local Law and Election Sign Policy

·

Development on City owned and managed land policy

·

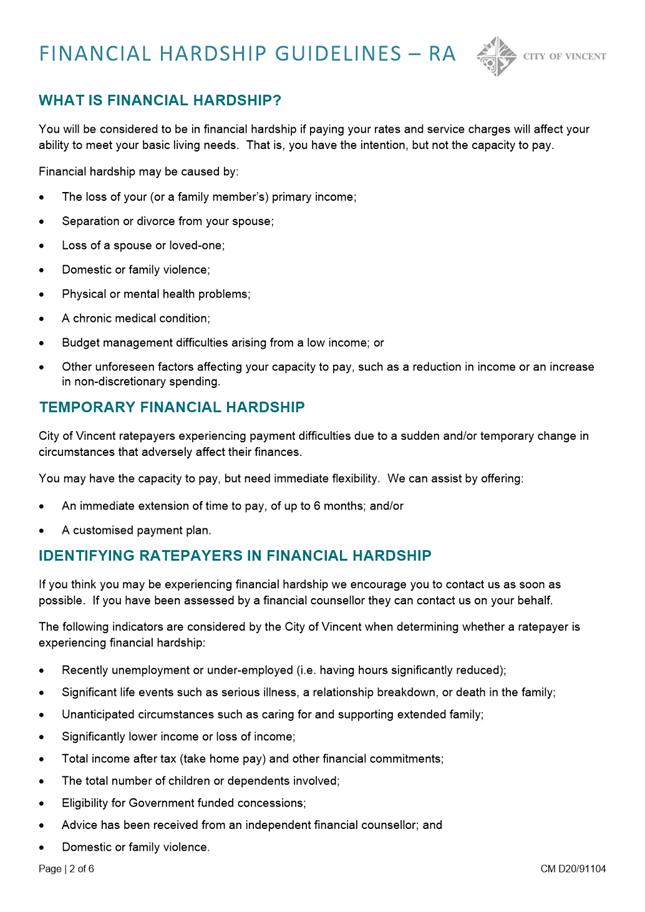

Financial Hardship Guidelines

·

Asset Management Framework

4 Applications

for Leave of Absence

5 The

Receiving of Petitions, Deputations and Presentations

6 Confirmation

of Minutes

Ordinary Meeting - 16 June 2020

7 Announcements

by the Presiding Member (Without Discussion)

8 Declarations

of Interest

8.1 Cr

Alex Castle declared an impartiality interest in Item 12.3 Appointment of Elected Members and Community

Representatives to Advisory Groups. The extent of her interest is

that she is an acquantance of several of the nominees for positions on the

Advisory Groups.

8.2 Cr

Sally Smith declared an impartiality interest in Item 12.3 Appointment of Elected Members and Community

Representatives to Advisory Groups. The extent of her interest is

that one of the community nominees was a colleague of hers.

8.3 Cr

Jonathan Hallett declared an impartiality interest in Item 12.3 Appointment of Elected Members and Community

Representatives to Advisory Groups. The extent of his interest is

that he has previously worked with one of the community applicants.

8.4 Mayor

Emma Cole declared an impartiality interest in Item 12.3 Appointment of Elected Members and Community Representatives to

Advisory Groups. The extent of her interest is that one of the community

nominees is an acquaintance of hers.

8.5 Cr

Alex Castle declared a financial interest in Item 12.8

Proposed Transfer of Anzac Cottage to the National Trust of Western Australia.

The extent of her interest is that the Friends of ANZAC Cottage are

clients of her business.

8.6 Cr

Susan Gontaszewski declared an impartiality interest in Item 12.3 Appointment of Elected Members and Community

Representatives to Advisory Groups. The extent of her interest is

that she has a personal association with one of the nominees for the Arts

Advisory Group.

9 Strategy

& Development

Nil

10 Infrastructure

& Environment

10.1 Waste

Strategy Project 2 - Bulk Hard Waste Options Appraisal - Progress Report

Attachments: 1. Community

Engagement Outcomes Report (Talis Consultants) ⇩

2. Public Engagement

and Communications Strategy ⇩

|

Recommendation:

That

Council:

1. NOTES

the refined options presented for future hard waste (junk) services

2. NOTES

the feedback from the Community Engagement Panel held on 7th March

2020

3. APPROVES

the proposed Public Engagement and Communications Strategy.

|

Purpose of Report:

The purpose of this

report is to:

· To

present further refined bulk hard waste options.

· To

present the feedback received from the Community Engagement Panel Focus Group

held in March 2020.

· To

present the proposed detailed Public Engagement and Communications Strategy,

for Council endorsement.

Background:

The City’s Waste

Strategy 2018 – 2023 has a Vision of “Zero waste to landfill by

2028”. The Strategy recognises the current collection methodology

for bulk hard waste is very out dated and encourages the generation of

waste. Additionally, only 15% of the material collected is currently recovered

through limited source separation on the verge.

During the last bulk hard

waste collection in February 2019, Council and City Administration received

numerous complaints from the community, with concerns including:

· Thoughtless

scavenging (often overnight), creating amenity and safety issues/concerns;

· Adverse

impact on visual amenity – including ransacked piles and litter;

· Presentation

time too long, leading to further illegal dumping on existing piles; and

· Verge

access/obstruction issues.

At the Ordinary

Council Meeting held on 2 April 2019, Council approved a Notice of Motion for

Administration to provide alternative options, including financial

modelling. Initial options and modelling were provided at the 25 June

2019 Ordinary Council Meeting. The decision was, that Council:

“1. NOTES

options presented for future hard waste (junk) services, resulting from a

service review undertaken as part of Waste Strategy Project 2; and

2.

DOES NOT support Option One - Cease to Provide the Service;

3.

REQUESTS further investigation of options that may be more

tailored to suit the City of Vincent community, including but not limited to:

3.1 maintenance

of an annual service with inclusion of meaningful ways to achieve higher

diversion from landfill and reduce amenity and verge obstruction issues;

3.2 more

detailed free on demand services options, including consideration of

neighbourhood or street based collection services; and

3.3 opportunities for recyclable

and reusable goods to be offered for free on verges and/or timed to coincide

with events linked to recycling, such as the Garage Sale Trail weekend;

4. REQUESTS

4.1

that further refined options are presented to the Community

Engagement Panel for feedback prior to community consultation and to inform

development of the Public Engagement and Communications Strategy;

4.2

that the proposed detailed Public Engagement and Communications

Strategy includes objectives and rationale for any change in service and is

presented to Council with the refined options for bulk hard waste collection

prior to community consultation; and

4.3

that procurement of a bulk hard waste service in February 2020 be

undertaken, with a shorter bulk waste presentation period to minimise dumping,

visual amenity and verge access issues.”

Details:

City Administration engaged the

services of Talis Consultants, to assist with the provision of further refined

options, including financial modelling. As part of this modelling,

various scheduled and on-demand collection scenarios were considered.

An

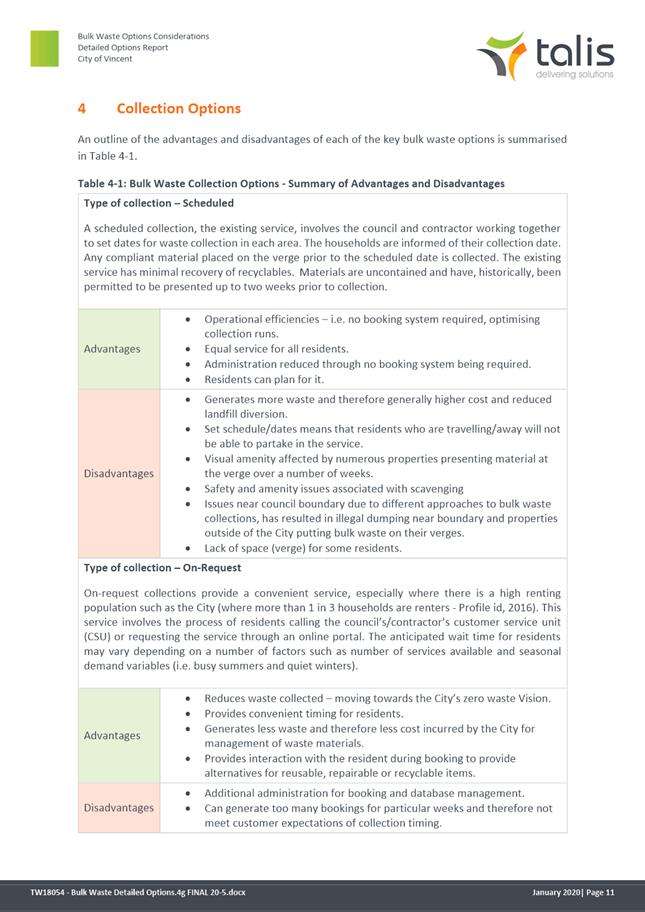

outline of the advantages and disadvantages of each of the considered bulk

waste options is summarised below.

Bulk Waste Collection Options - Summary of

Advantages and Disadvantages

|

Type of collection – Scheduled

A scheduled collection, the existing service, involves

the council and contractor working together to set dates for waste collection

in each area. The households are informed of their collection date. Any

compliant material placed on the verge prior to the scheduled date is

collected. The existing service has minimal recovery of recyclables.

Materials are uncontained and have, historically, been permitted to be

presented up to two weeks prior to collection.

|

|

Advantages

|

· Operational efficiencies – i.e. no booking system

required, optimising collection runs.

· Equal service for all residents.

· Administration reduced through no booking system being

required.

· Residents can plan for it.

|

|

Disadvantages

|

· Generates more waste and therefore generally higher cost

and reduced landfill diversion.

· Set schedule/dates means that residents who are

travelling/away will not be able to partake in the service.

· Visual amenity affected by numerous properties presenting

material at the verge over a number of weeks.

· Issues near council boundary due to different approaches

to bulk waste collections, has resulted in illegal dumping near boundary and

properties outside of the City putting bulk waste on their verges.

· Lack of space (verge) for some residents.

|

|

|

|

Type of collection – On-Request

On-request collections provide a convenient service,

especially where there is a high renting population such as the City (where

more than 1 in 3 households are renters - Profile id, 2016). This service

involves the process of residents calling the council’s/contractor’s

customer service unit (CSU) or requesting the service through an online

portal. The anticipated wait time for residents may vary depending on a

number of factors such as number of services available and seasonal demand

variables (i.e. busy summers and quiet winters).

|

|

Advantages

|

· Reduces waste collected – moving towards the

City’s zero waste Vision.

· Provides convenient timing for residents.

· Generates less waste and therefore less cost incurred by

the City for management of waste materials.

· Provides interaction with the resident during booking to

provide alternatives for reusable, repairable or recyclable items.

|

|

Disadvantages

|

· Additional administration for booking and database

management.

· Can generate too many bookings for particular weeks and

therefore not meet customer expectations of collection timing.

|

|

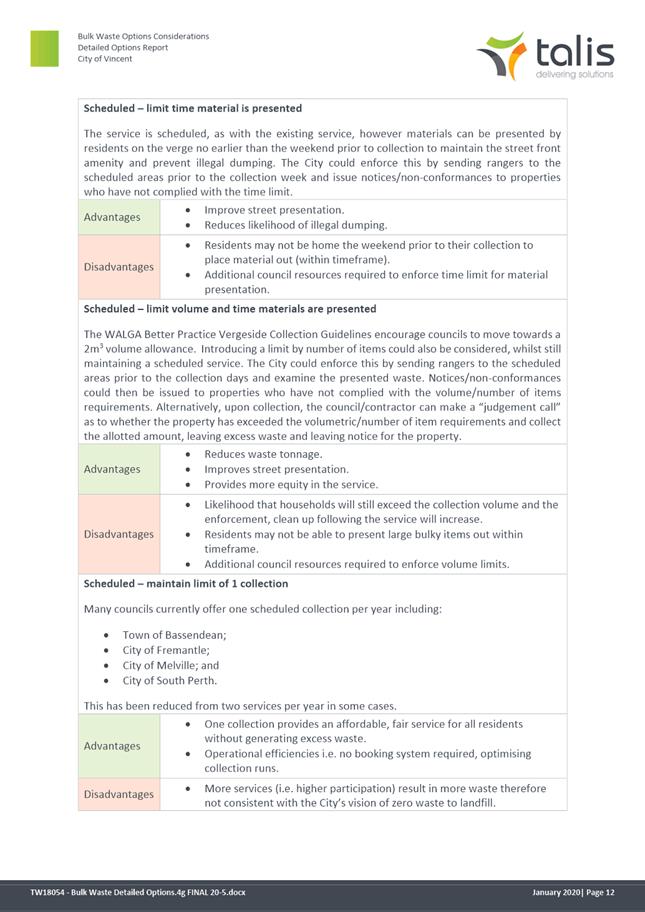

Scheduled – limit time material is presented

The service is scheduled, as with the existing service,

however materials can be presented by residents on the verge no earlier than

the weekend prior to collection to maintain the street front amenity and

prevent illegal dumping. The City could enforce this by sending rangers to

the scheduled areas prior to the collection week and issue

notices/non-conformances to properties who have not complied with the time

limit.

|

|

Advantages

|

· Improve street presentation.

· Reduces likelihood of illegal dumping.

|

|

Disadvantages

|

· Residents may not be home the weekend prior to their

collection to place material out (within timeframe).

· Additional council resources required to enforce time

limit for material presentation.

|

|

Scheduled – limit volume and time materials are

presented

The WALGA Better Practice Vergeside Collection Guidelines

encourage councils to move towards a 2m3 volume allowance.

Introducing a limit by number of items could also be considered, whilst still

maintaining a scheduled service. The City could enforce this by sending

rangers to the scheduled areas prior to the collection days and examine the

presented waste. Notices / non-conformances could then be issued to

properties who have not complied with the volume/number of items

requirements. Alternatively, upon collection, the council/contractor can make

a “judgement call” as to whether the property has exceeded the

volumetric requirements and collect the allotted amount, leaving excess waste

and leaving notice for the property.

|

|

Advantages

|

· Reduces waste tonnage.

· Improves street presentation.

· Provides more equity in the service.

|

|

Disadvantages

|

· Likelihood that households will still exceed the

collection volume and the enforcement, clean up following the service will

increase.

· Residents may not be able to present large bulky items

out within timeframe.

· Additional council resources required to enforce volume

limits.

|

|

|

|

Scheduled – maintain limit of 1 collection

Many councils currently offer one scheduled collection

per year including:

· Town of Bassendean;

· City of Fremantle;

· City of Melville; and

· City of South Perth.

This has been reduced from two services per year in some

cases.

|

|

Advantages

|

· One collection provides an affordable, fair service for

all residents without generating excess waste.

· Operational efficiencies i.e. no booking system required,

optimising collection runs.

|

|

Disadvantages

|

· More services (i.e. higher participation) result in more

waste therefore not consistent with the City’s vision of zero waste to

landfill.

· If residents are away or move into a property after the

annual service date, they effectively do not get a collection for the year.

|

|

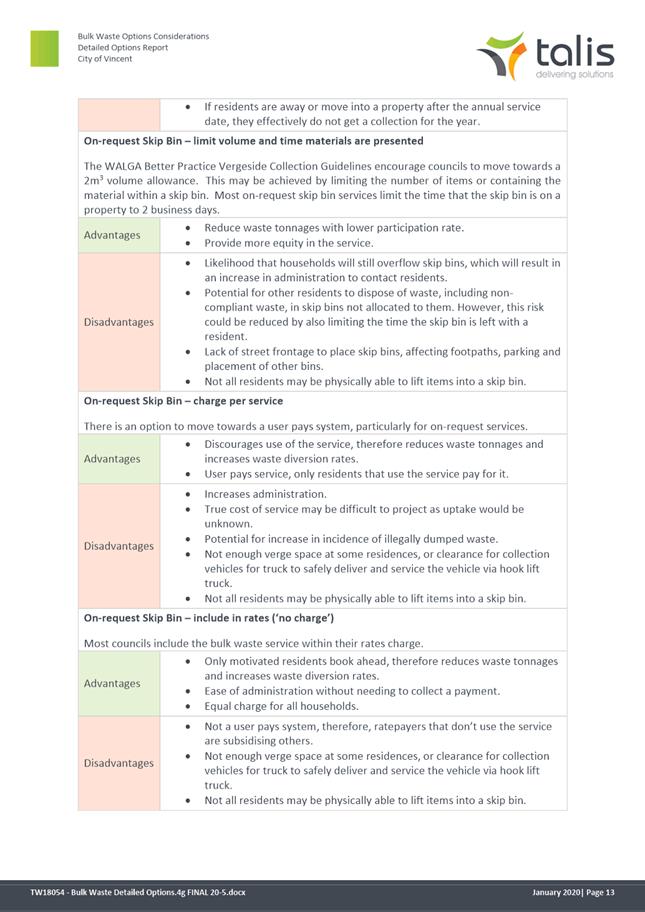

On-request Skip Bin – limit volume and time

materials are presented

The WALGA Better Practice Vergeside Collection Guidelines

encourage councils to move towards a 2m3 volume allowance. A

limit by number of items or containing the material within a skip bin could

also be considered. Most on-request skip bin services limit the time that the

skip bin is on a property to 2 business days.

|

|

Advantages

|

· Reduce waste tonnages with lower participation rate.

· Provide more equity in the service.

|

|

Disadvantages

|

· Likelihood that households will still overflow skip bins,

which will result in an increase in administration to contact residents.

· Potential for other residents to dispose of waste,

including non-compliant waste, in skip bins not allocated to them. However,

this risk could be reduced by also limiting the time the skip bin is left

with a resident.

· Lack of street frontage to place skip bins, affecting

footpaths, parking and placement of other bins.

|

|

On-request Skip Bin – charge per service

There is an option to move towards a user pays system,

particularly for on-request services.

|

|

Advantages

|

· Discourages use of the service, therefore reduces waste

tonnages and increases waste diversion rates.

· User pays service, only residents that use the service

pay for it.

|

|

Disadvantages

|

· Increases administration.

· True cost of service may be difficult to project as

uptake would be unknown.

· Potential for increase in incidence of illegally dumped

waste.

· Not enough verge space at some residences, or clearance

for collection vehicles for truck to safely deliver and service the vehicle

via hook lift truck.

|

|

On-request Skip Bin – include in rates (‘no

charge’)

Most councils include the bulk waste service within their

rates charge.

|

|

Advantages

|

· Only motivated residents book ahead, therefore reduces

waste tonnages and increases waste diversion rates.

· Ease of administration without needing to collect a

payment.

· Equal charge for all households.

|

|

Disadvantages

|

· Not a user pays system, therefore, ratepayers that

don’t use the service are subsidising others.

· Not enough verge space at some residences, or clearance

for collection vehicles for truck to safely deliver and service the vehicle

via hook lift truck.

|

|

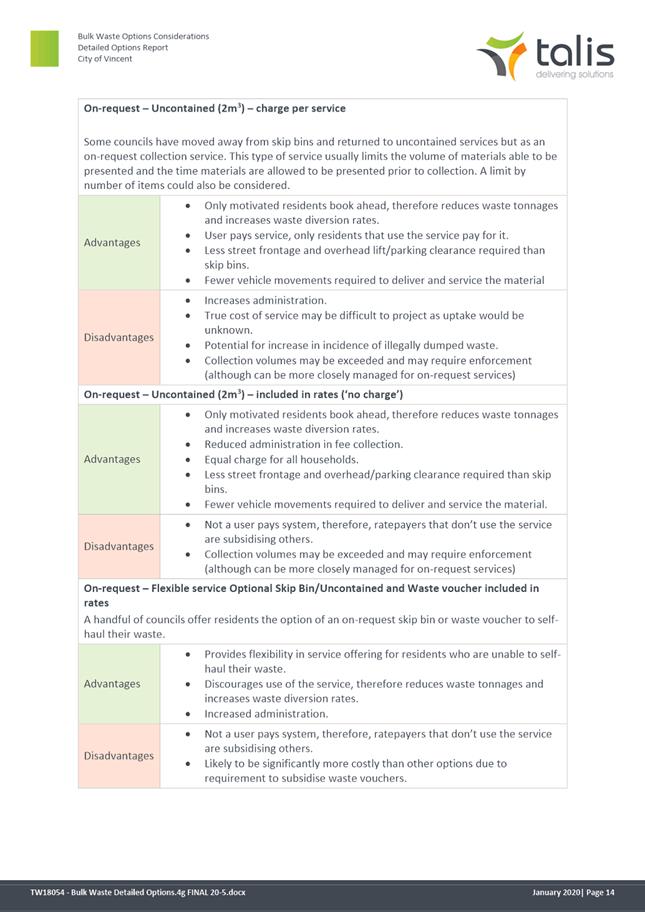

On-request –

Uncontained (2m3) – charge per service

Some councils have moved

away from skip bins and returned to uncontained services but as an on-request

collection service. This type of service usually limits the volume of

materials able to be presented and the time materials are allowed to be

presented prior to collection.

|

|

Advantages

|

· Only motivated residents book ahead, therefore reduces

waste tonnages and increases waste diversion rates.

· User pays service, only residents that use the service

pay for it.

· Less street frontage and overhead lift/parking clearance

required than skip bins.

· Fewer vehicle movements required to deliver and service

the material

|

|

Disadvantages

|

· Increases administration.

· True cost of service may be difficult to project as

uptake would be unknown.

· Potential for increase in incidence of illegally dumped

waste.

|

|

On-request –

Uncontained (2m3) – included in rates (‘no

charge’)

|

|

Advantages

|

· Only motivated residents book ahead, therefore reduces

waste tonnages and increases waste diversion rates.

· Reduced administration in fee collection.

· Equal charge for all households.

· Less street frontage and overhead/parking clearance

required than skip bins.

· Fewer vehicle movements required to deliver and service

the material.

|

|

Disadvantages

|

· Not a user pays system, therefore, ratepayers that

don’t use the service are subsidising others.

|

|

On-request – Flexible

service Optional Skip Bin/Uncontained and Waste voucher included in rates

A handful of councils offer residents the option of an

on-request skip bin or waste voucher to self-haul their waste.

|

|

Advantages

|

· Provides flexibility in service offering for residents

who are unable to self-haul their waste.

· Discourages use of the service, therefore reduces waste

tonnages and increases waste diversion rates.

· Increased administration.

|

|

Disadvantages

|

· Not a user pays system, therefore, ratepayers that

don’t use the service are subsidising others.

· Likely to be significantly more costly than other options

due to requirement to subsidise waste vouchers.

|

|

On-request –

Uncontained, charity partnership

The City could look to engage in a partnership

arrangement with a charity, or charities, to collect suitable, resalable

items put out for collection prior to the contractor undertaking collections.

This type of service would work best with an uncontained, rather than skip

bin, on-request service – facilitating charities to easily view what

has been presented when they arrive at properties and collect suitable items.

There would be benefits in including limits of time items can be presented to

reduce the time items are left on the verge.

|

|

Advantages

|

· Provides flexibility in service offering for residents

who are unable to self-haul their waste.

· Encourage additional diversion of waste from landfill

with charity involvement.

|

|

Disadvantages

|

· Cost prohibitive.

· Increased administration for bookings and collections.

· Uncertainty of degree of waste diversion from this type

of service.

· Historically charity take up of this option is low as

shopfront charities require quality goods.

· Time consuming engaging with charities to find the right

fit.

· Contractually challenging.

|

|

On-request – Street or neighbourhood based

collections (1)

Everyone

in the street/neighbourhood coordinated their collection at the same time so

that all material is placed out at once.

|

|

Advantages

|

· Optimise opportunities for reuse / swapping within the

area;

· Collection efficiencies for council (minimal impact).

|

|

Disadvantages

|

· Potentially not enough verge space for all material to be

placed out at once, reduced street amenity at that time;

· It’s likely that the selected date is not optimal

for all households in the area therefore lose the advantage of an on-request

date that is convenient for the householder;

· Requires the neighbours to agree and negotiate and

potentially create dispute if not all households agree;

· No administrative saving for council.

|

|

On-request – Street or neighbourhood based collections

(2)

A

group of neighbours could coordinate their bookings so that effectively if 6

households rotated their bookings all neighbours could contribute a small

amount of waste every 2 months, or 12 households monthly.

|

|

Advantages

|

· Potentially optimising the service availability for the

neighbourhood.

|

|

Disadvantages

|

This

only works if all neighbours involved in the agreement act equitably. There

are a large number of things that could go wrong with this model including:

· Its highly likely that the size of the collection pile

would exceed the permitted limit for some collections, in which case it is

unclear who is responsible but the resident that makes the booking could be

penalised

· Not all of the neighbours may make their booking at the

required time leading to a shortfall in the agreement.

· Non-complying material may be placed out and it may be

difficult to identify the waste owner.

Any of

these issues could result in a neighbourhood dispute or dispute with council

that could be avoided if only the resident that makes the booking is

permitted by council to place waste on the pile.

|

Refined options were

subsequently taken to the Community Engagement Panel on 7 March 2020, as

detailed below.

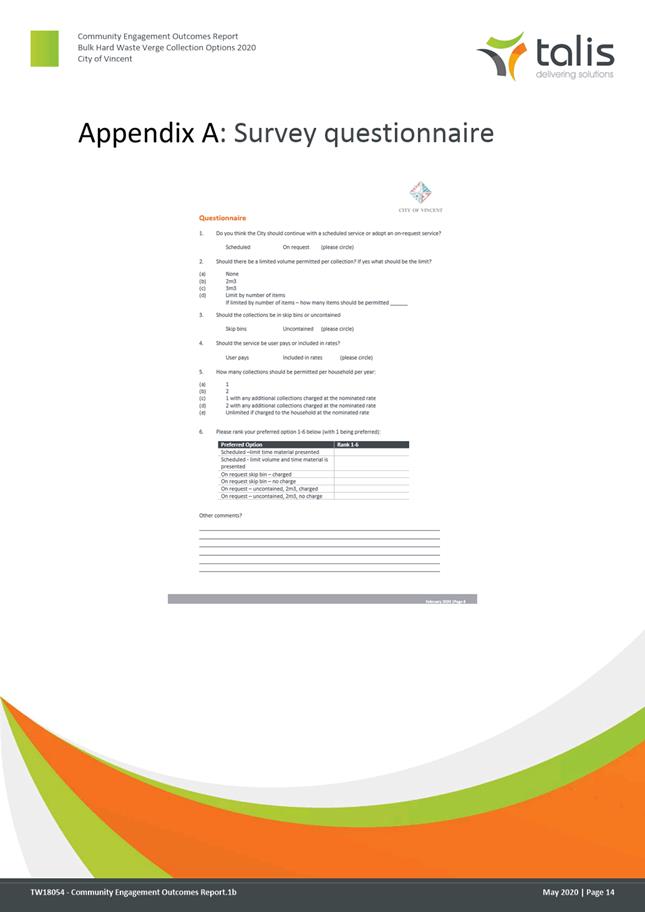

Consultation/Advertising:

On 7 March 2020, City

Administration held a Community Engagement Panel Workshop, which was

facilitated by Talis Consultants. During the workshop session, Talis

presented the following six refined options and discussed/considered any other

ideas voiced by the panel attendees.

Options considered:

|

1a - Scheduled –

limit time material is presented 48 hours prior

|

|

1b - Scheduled –

limit time material is presented and limit volume 2m3

|

|

2a – On request

skip bin – charged/service

|

|

2b – On request

skip bin – no charge

|

|

3a – On request

– uncontained 2m3, 48 hours prior, charged

|

|

3b – On request

– uncontained 2m3, 48 hours prior, no charge

|

The two

Street/Neighbourhood based collection options, although considered and

discussed, were not specifically included in the ranking, as they cannot

operate as core “stand-alone” service options and as such were

considered complimentary measures to the on-demand service options.

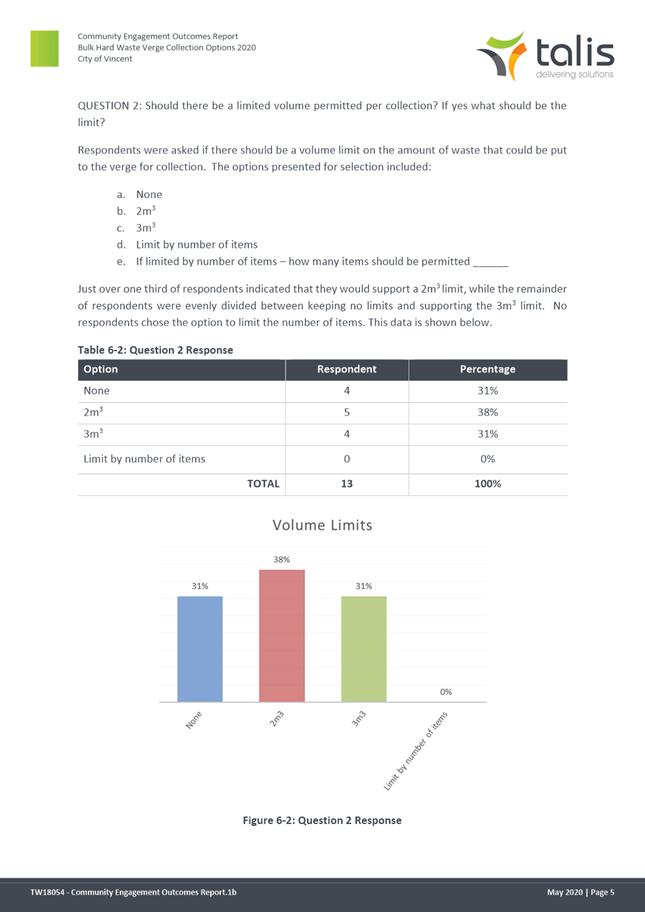

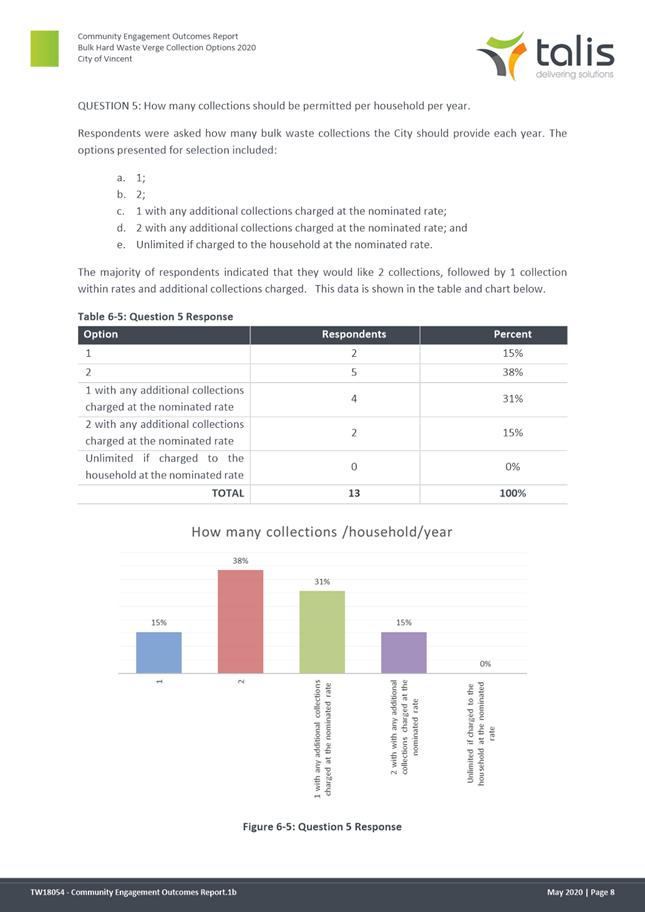

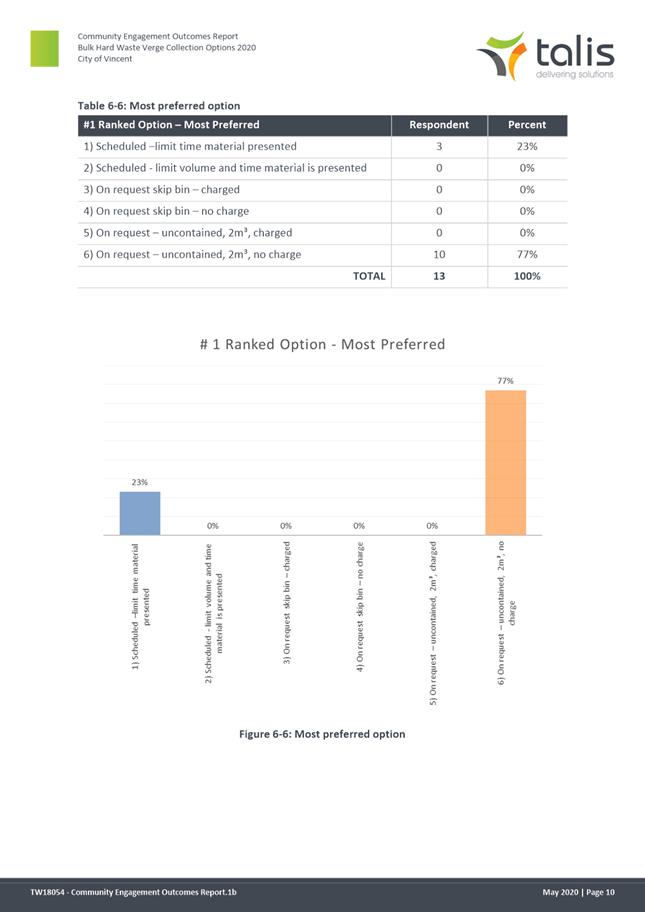

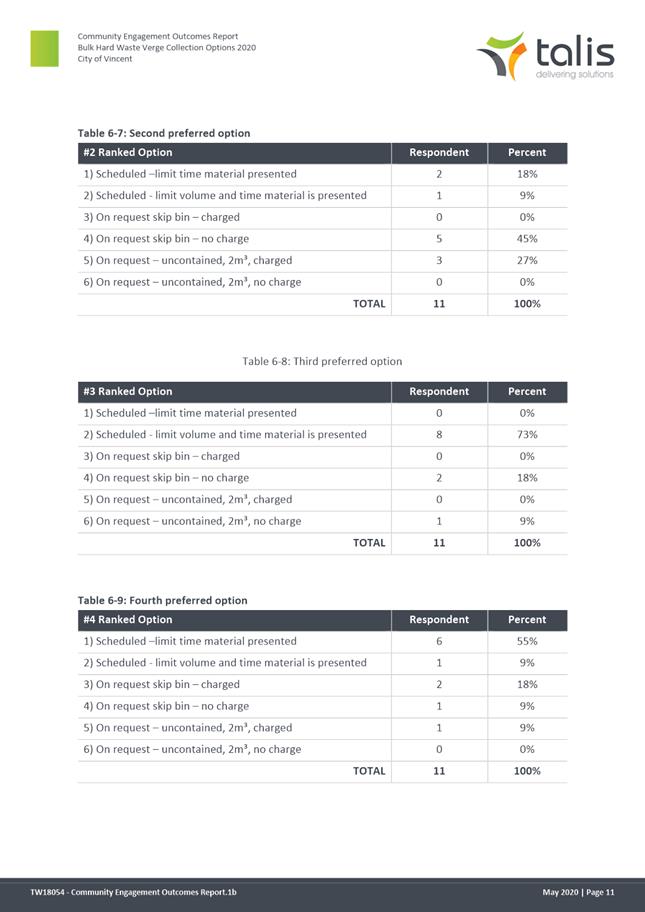

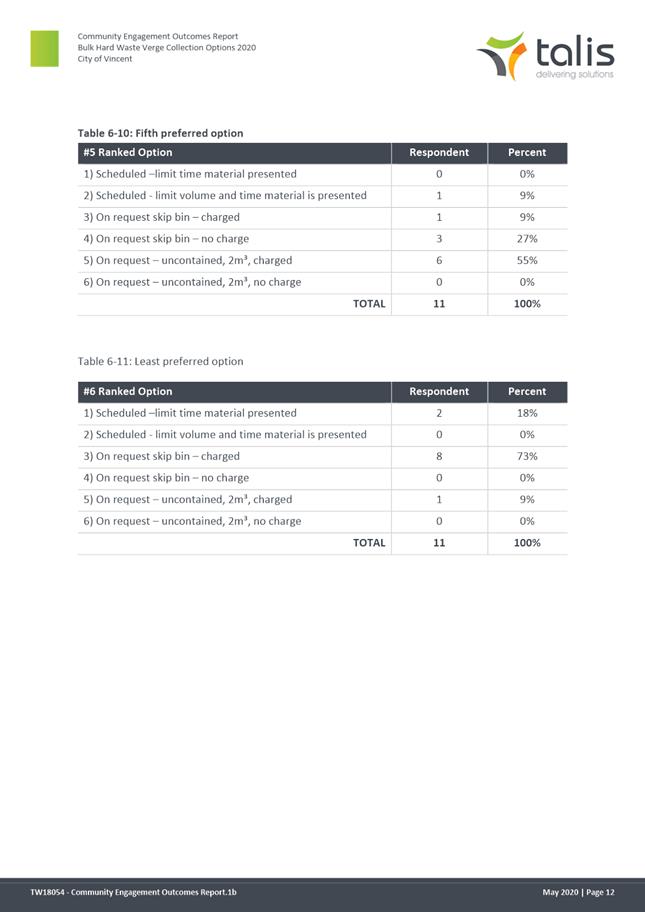

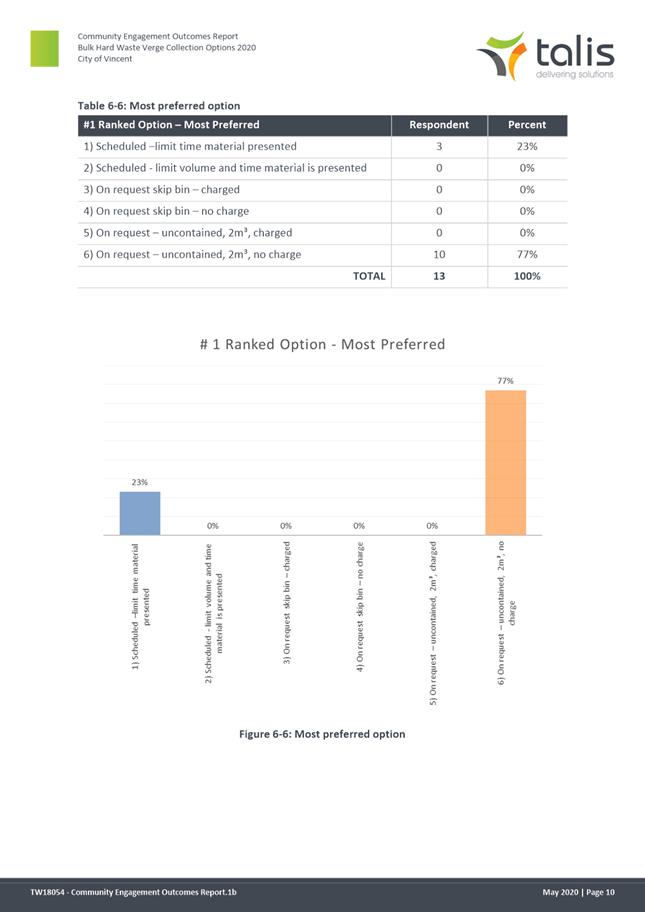

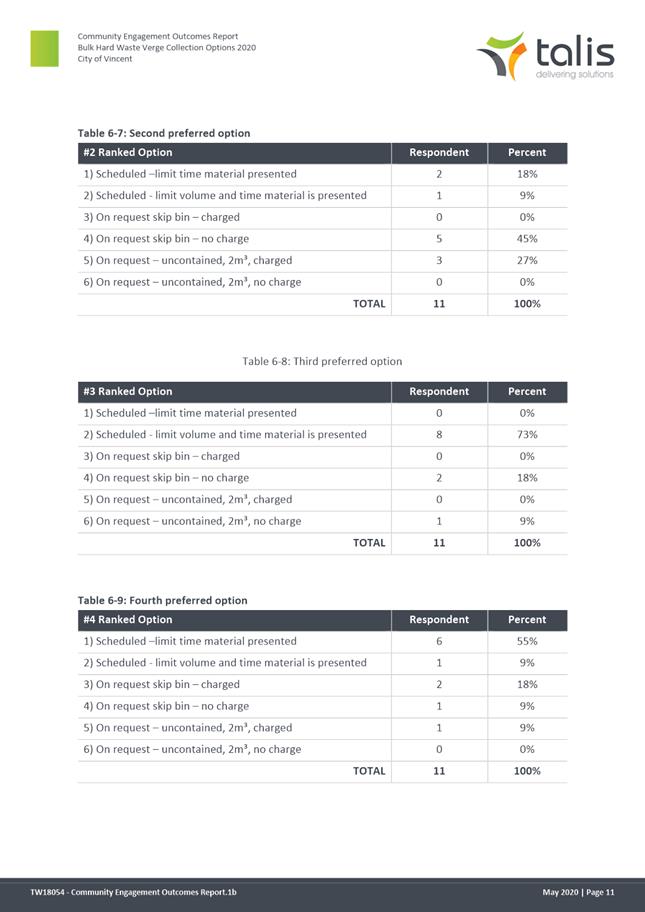

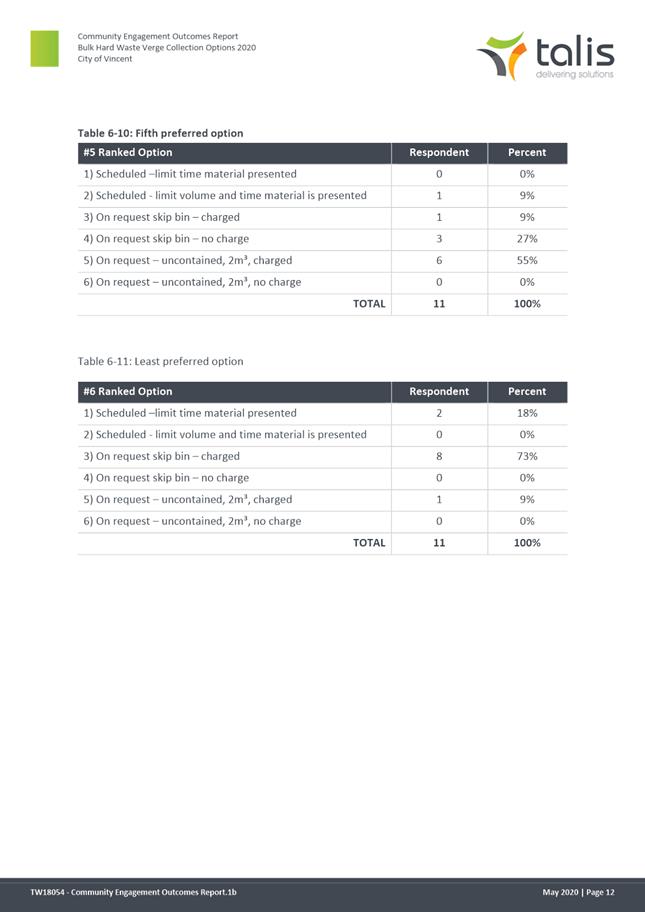

13 Community Panel

residents participated. Feedback was sought through small group discussions and

individual participant surveys.

Three breakout groups

provided feedback and reached broad consensus that the City should adopt:

- an

on-request, uncontained bulk waste collection service,

- limit

volume to 2m3 per collection,

- costs

for the service included within the City’s annual rates (rather than a

user pays service).

This outcome was also

reflected as the preferred option in the individual survey responses.

Respondents

also indicated that they would like the option of a second, on request

collection to be available at cost to the resident (i.e. a user pays additional

service).

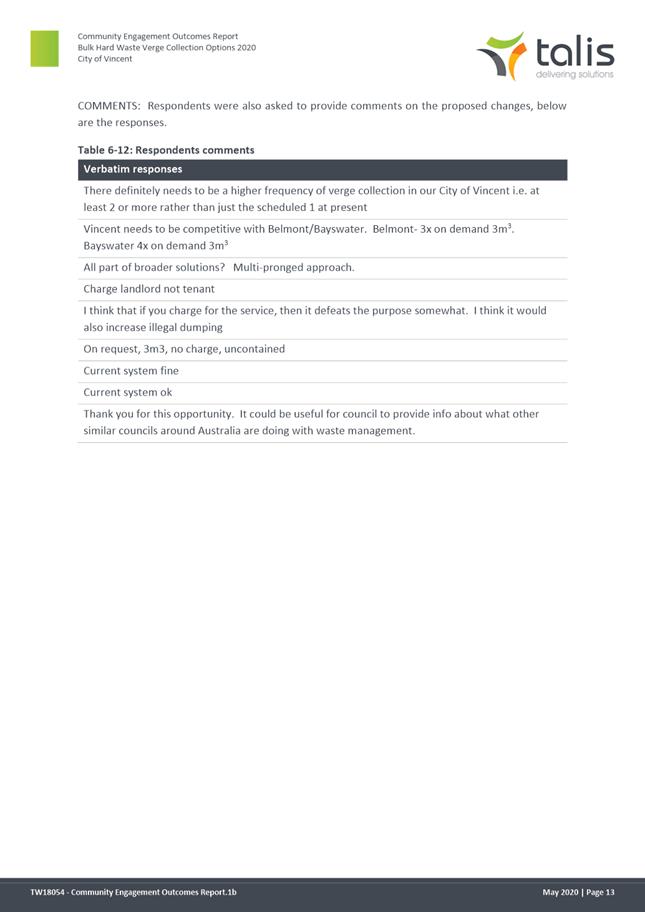

Further details

of the Community Engagement Panel findings are included in the attached Community

Engagement Outcomes Report (Talis Consultants) - Attachment 1,

as presented to the 26 May 2020 Council Workshop.

Proposed

Next Steps

The

findings from the Community Engagement Panel have been used to inform the

development of the Public Engagement and Communications Strategy

(Attachment 2). This Strategy outlines the engagement objectives

and rationale for change in service and details the proposed approach,

including phasing and delivery timeline.

Legal/Policy:

Aligns with the

City’s Waste Strategy 2018-2023 and the Waste Strategy 2030.

Legislation: The

Waste Avoidance and Resource Recovery Act 2007

Risk Management Implications:

Medium: Community acceptance of

proposed changes. It is essential that the City embark on a detailed consultation

and communications campaign. As part of the campaign, the City will consult

with the community to gauge their support and thoughts on the available

options and provide opportunities for

resident concerns to be heard and responded to. The City will subsequently

inform, educate, and promote any service changes and

encourage correct waste behaviours.

Medium: The City must address the

diversion targets in accordance with the WA Waste Strategy 2030 and the

City’s Waste Strategy Vision.

Low: MRC

cost increases. As member councils remove their residual waste from the

MRC facilities, this adversely impacts the remaining member councils as gate

fees increase. It is estimated that for every 10,000 tonnes removed the

gate fee will increase in the region of $5 per tonne. Failure to divert waste

will incur even higher costs as MRC gate fees and the landfill levy continue to

rise.

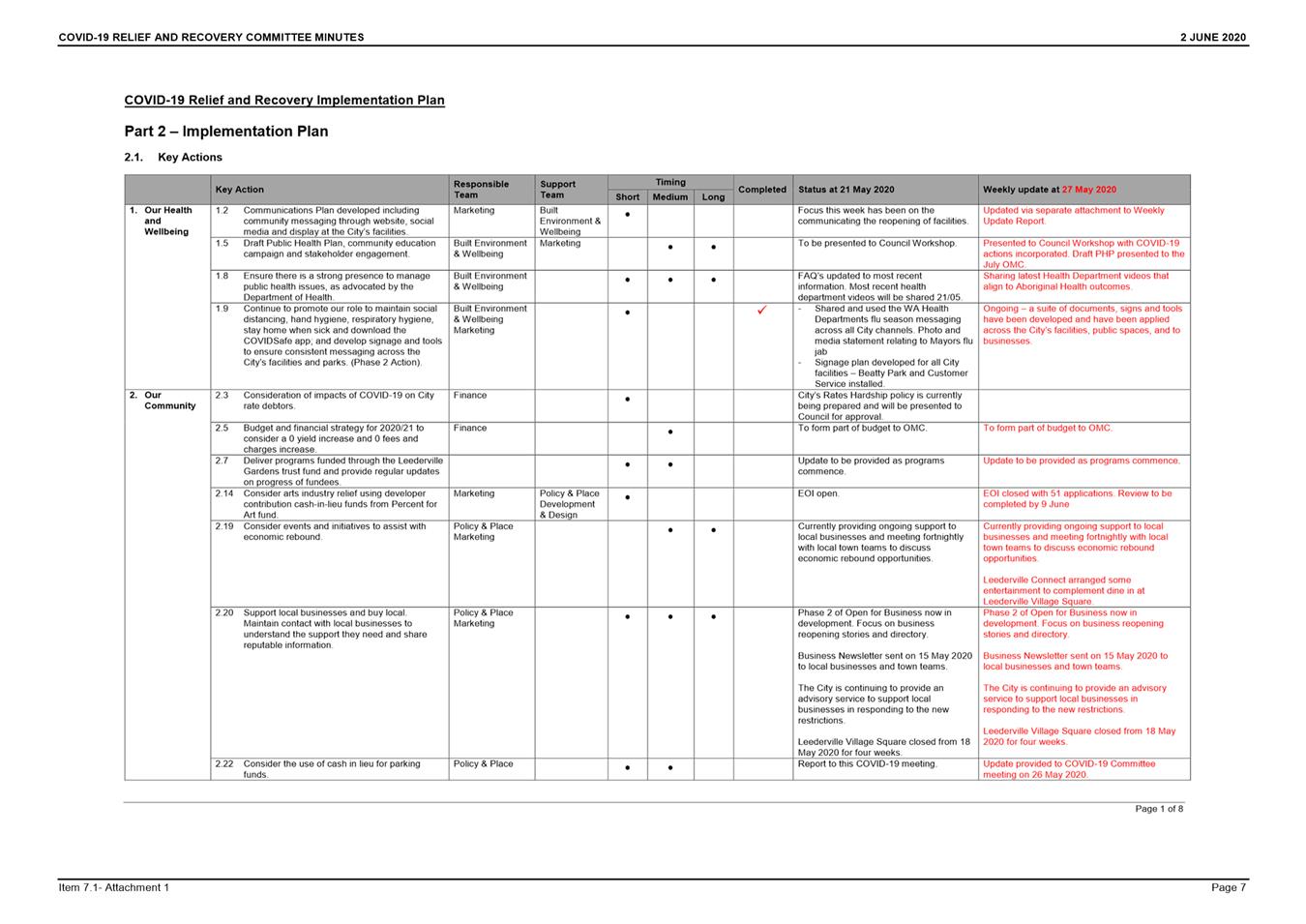

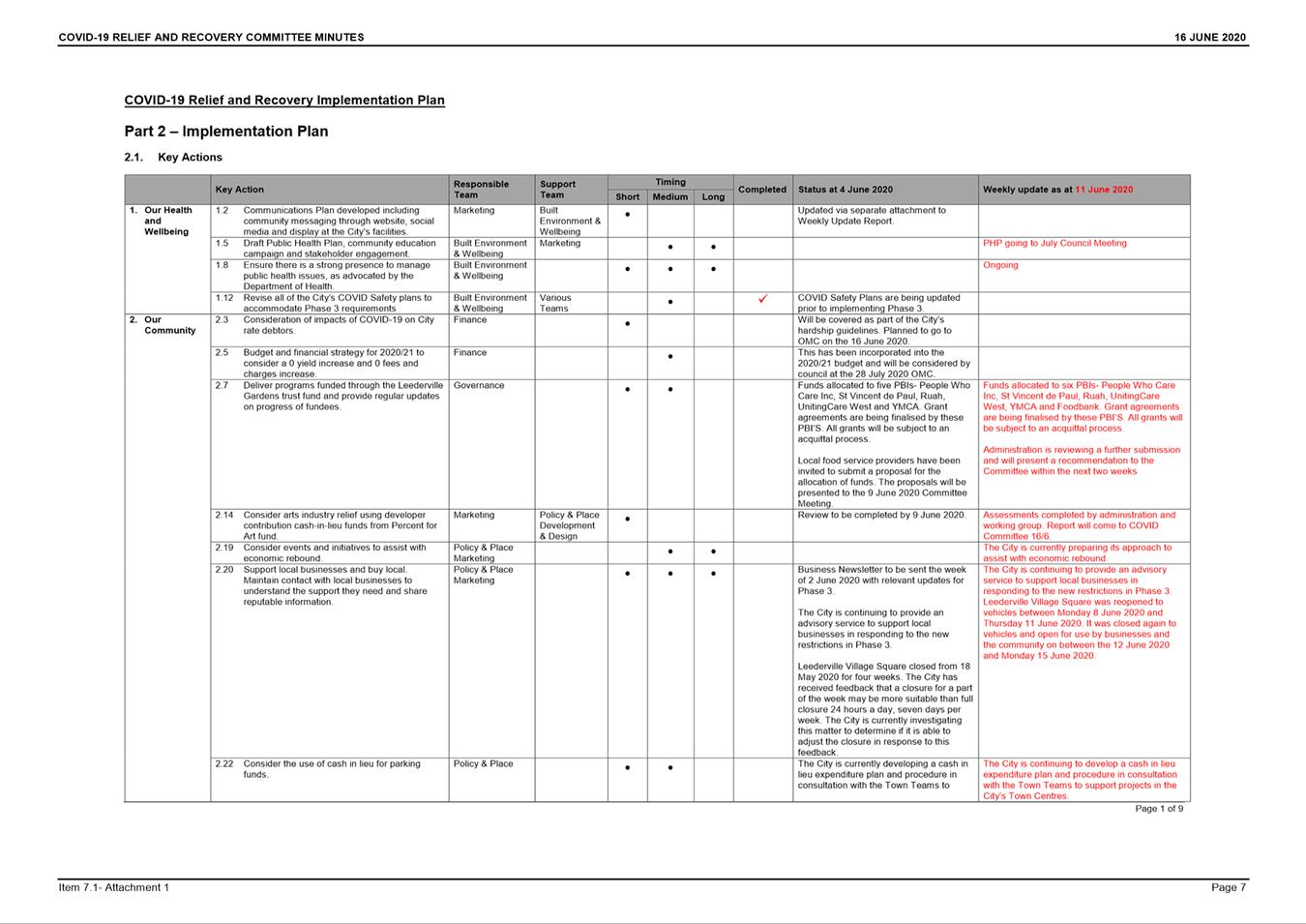

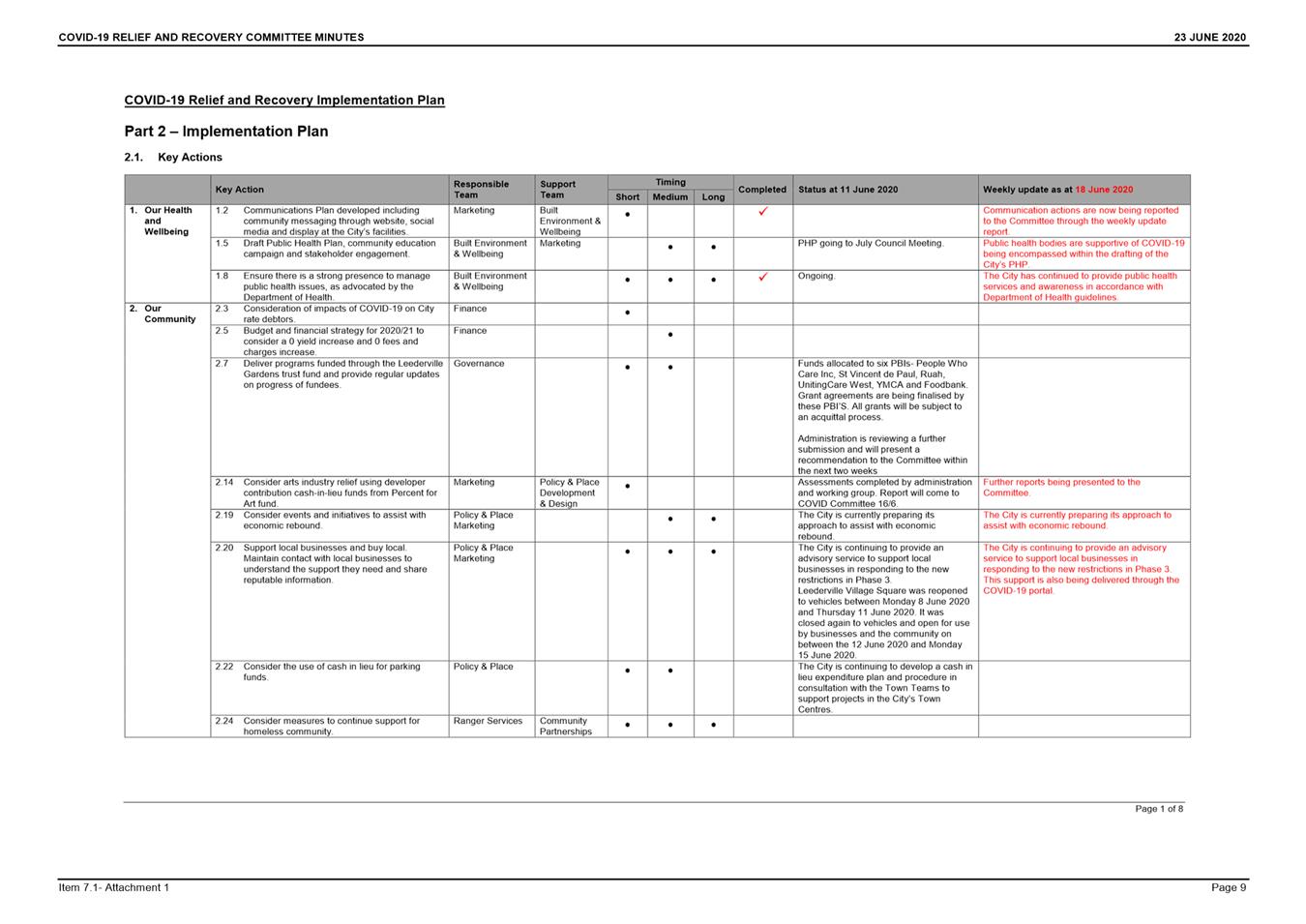

Strategic Implications:

Project 2 of the

City’s Waste Strategy 2018-2023 will assist in the delivery of: the City’s

Waste Strategy, the Waste Strategy 2030 and the City’s SCP objectives.

This is in keeping with the

City’s Strategic Community Plan 2018-2028:

Enhanced

Environment

We have improved resource efficiency and waste management.

Minimise our impact on the environment

SUSTAINABILITY IMPLICATIONS:

Will support the

City’s Waste Strategy vision of sending ‘Zero Waste to

Landfill’.

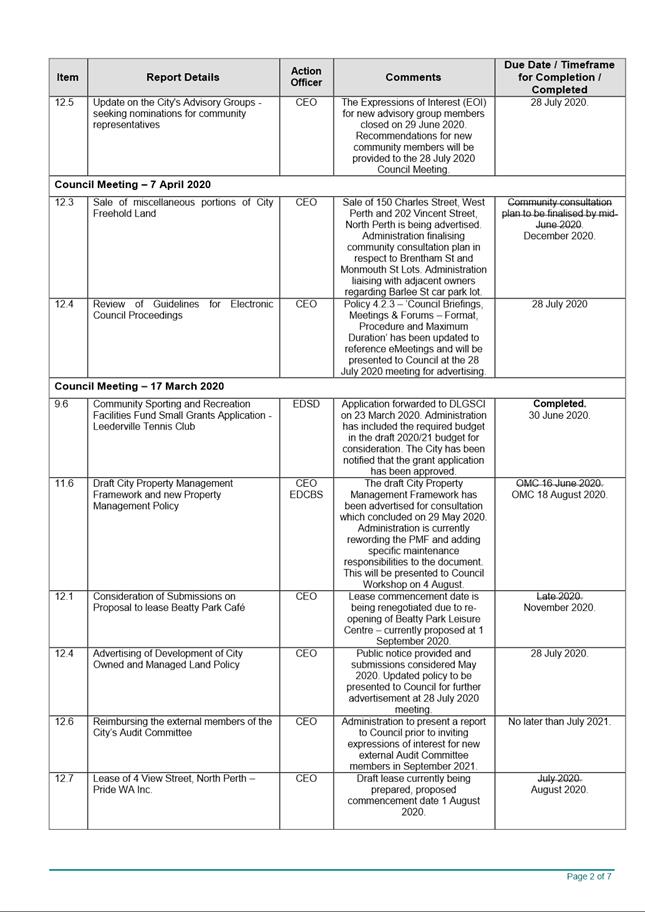

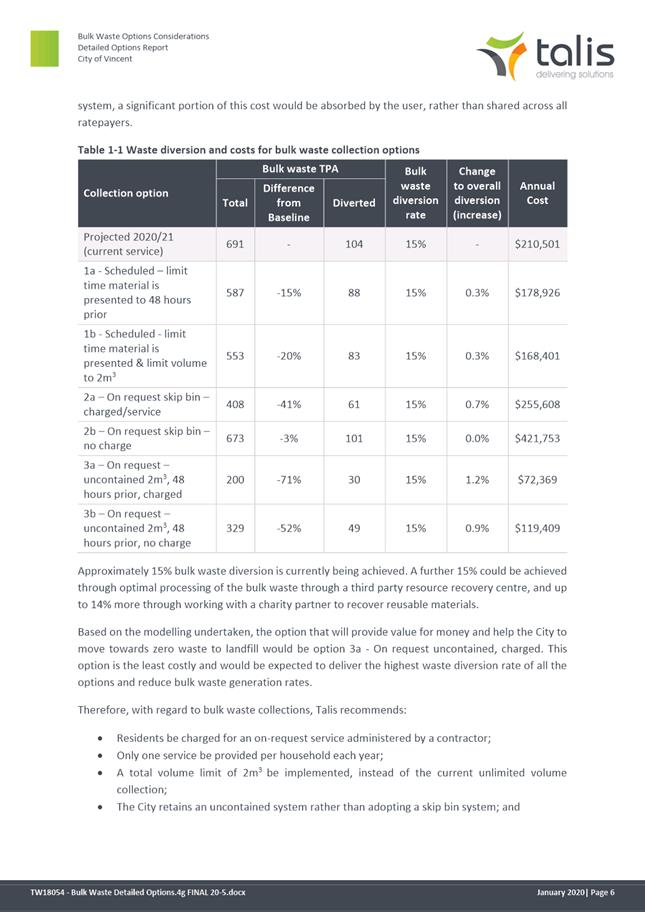

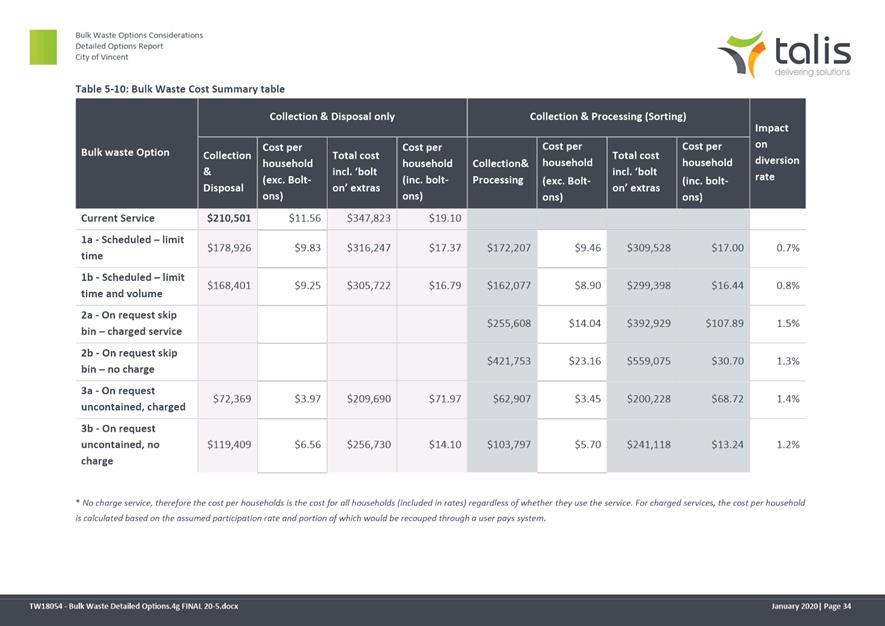

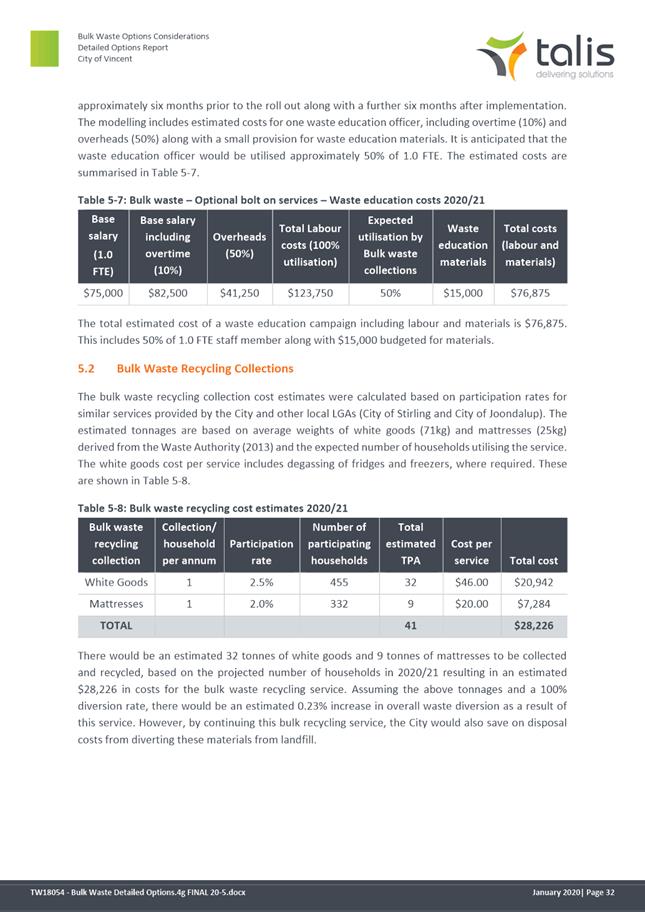

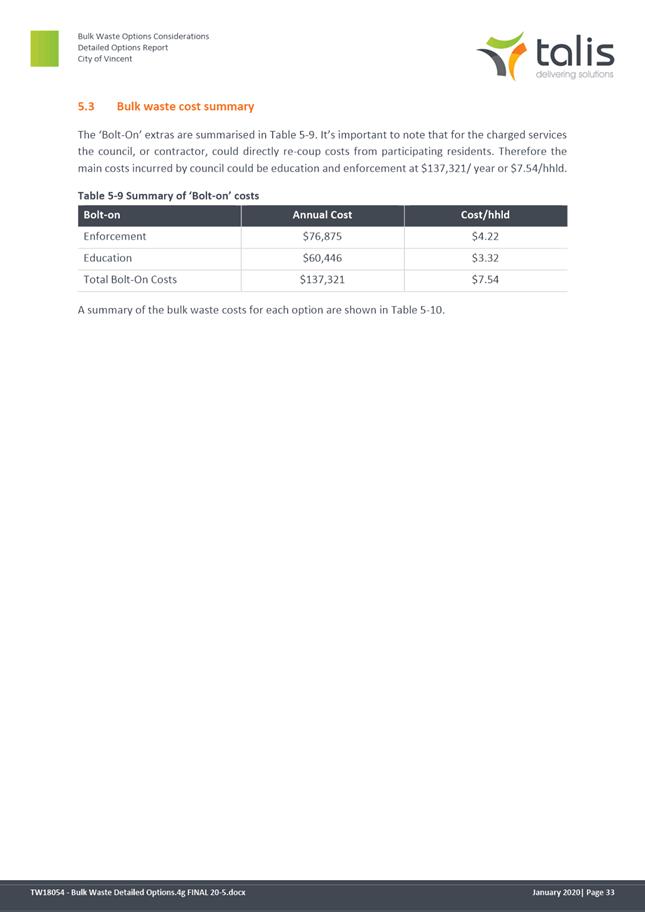

Financial/Budget Implications:

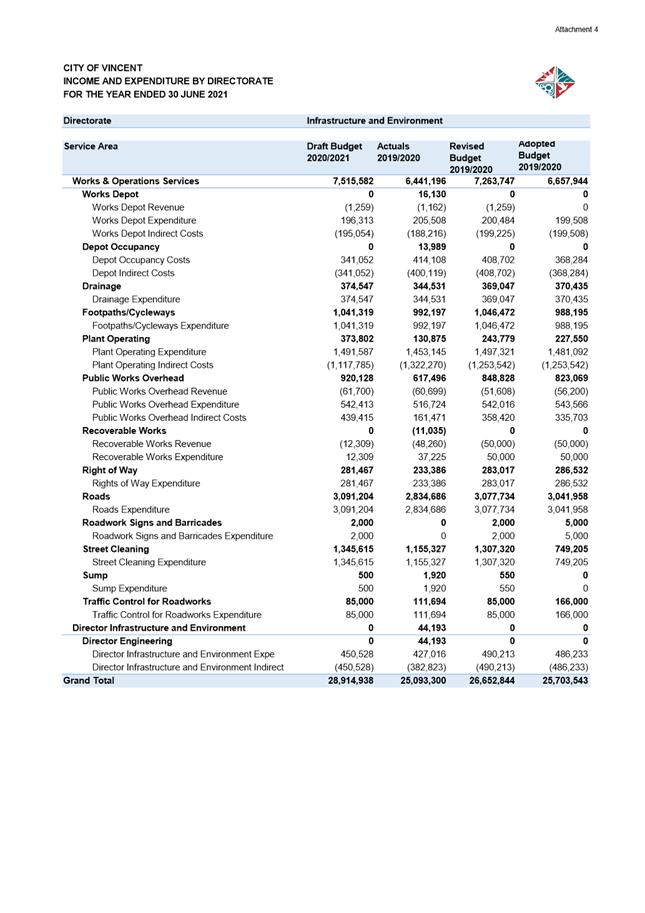

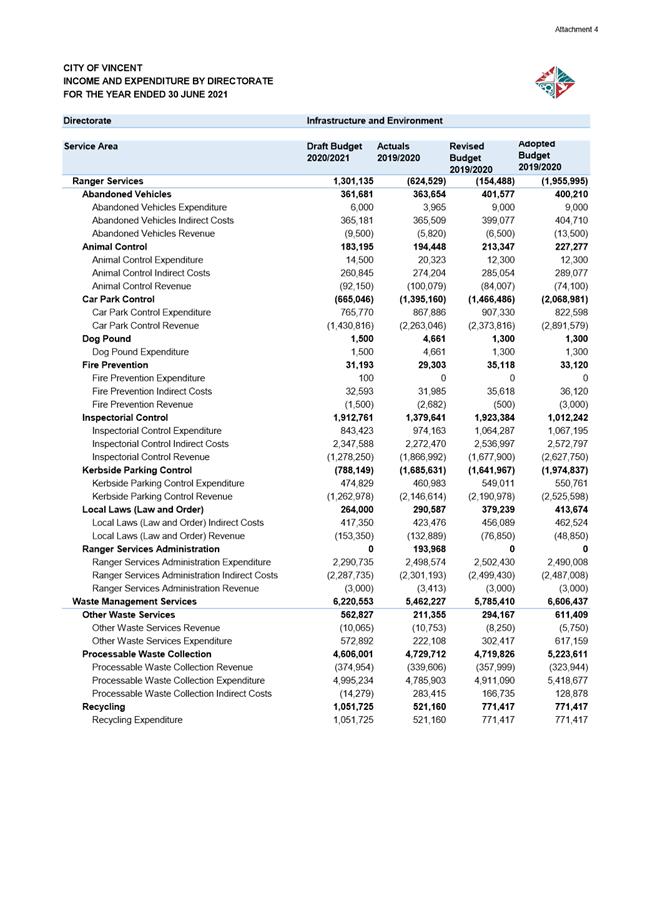

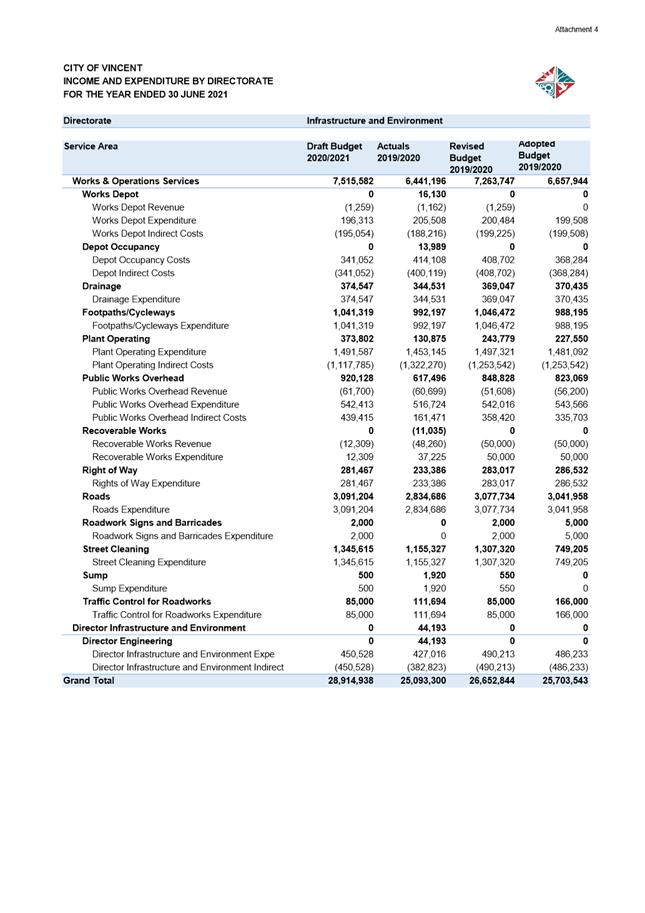

None directly arising

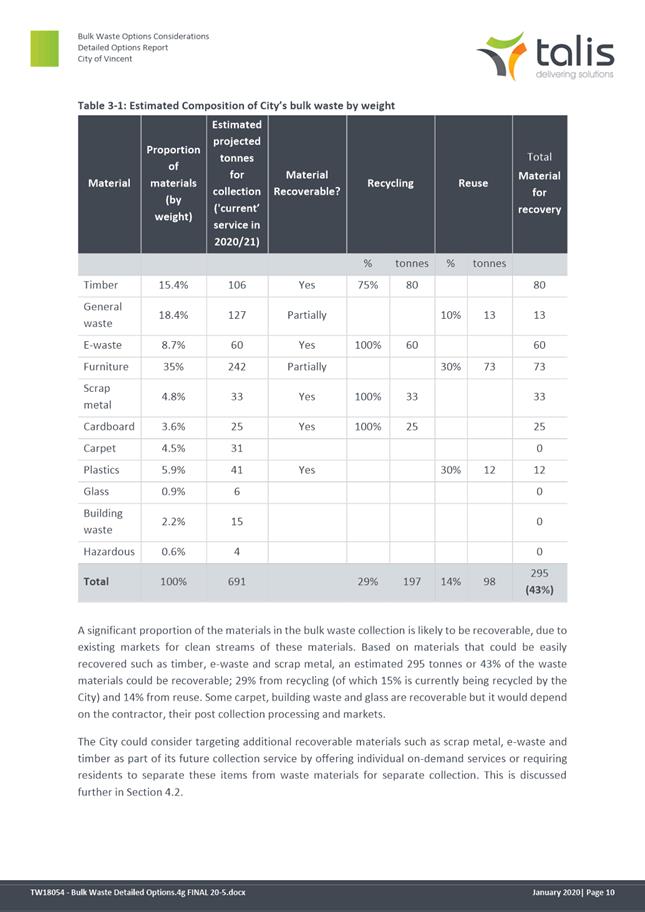

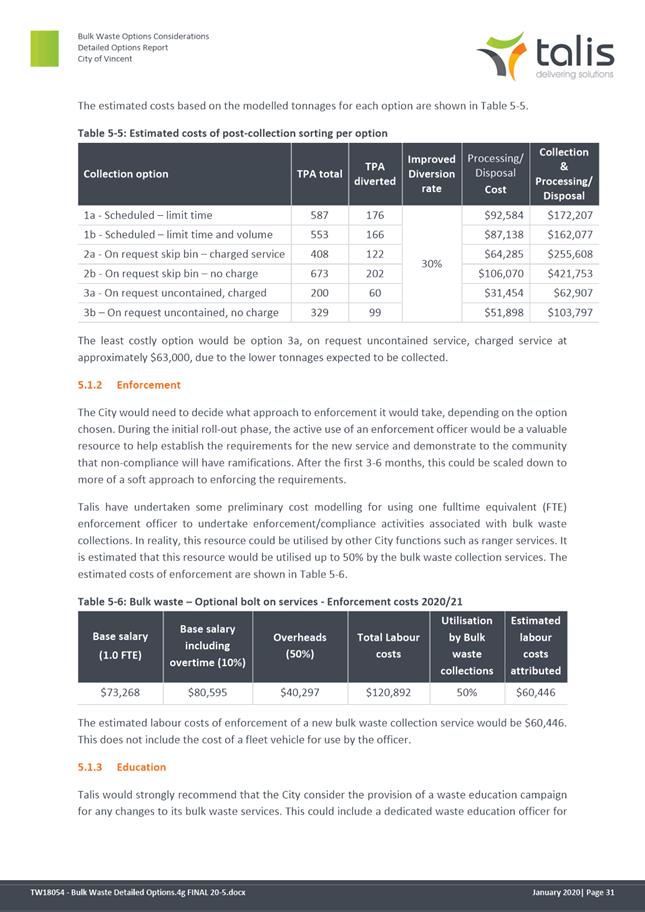

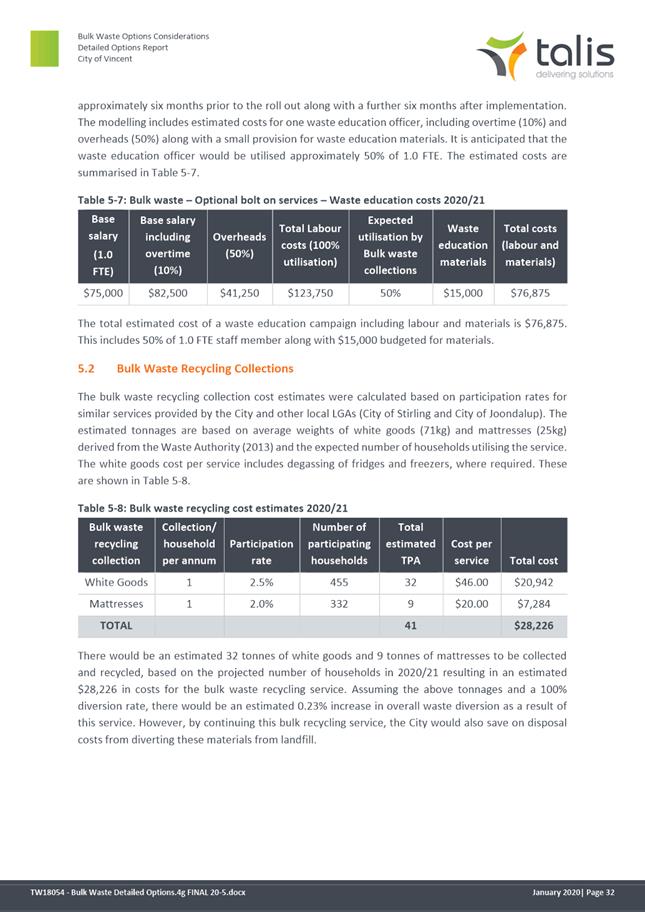

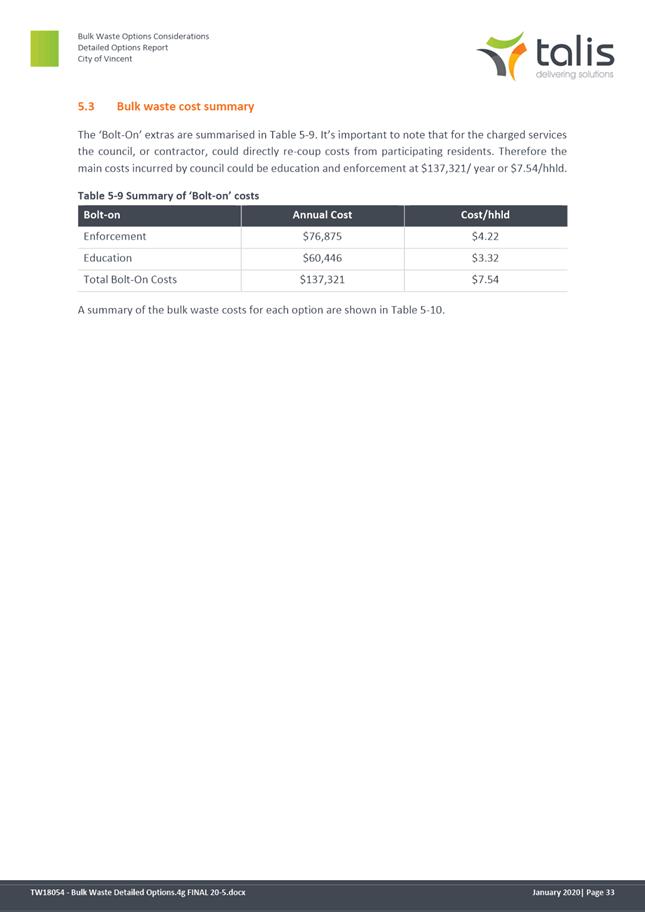

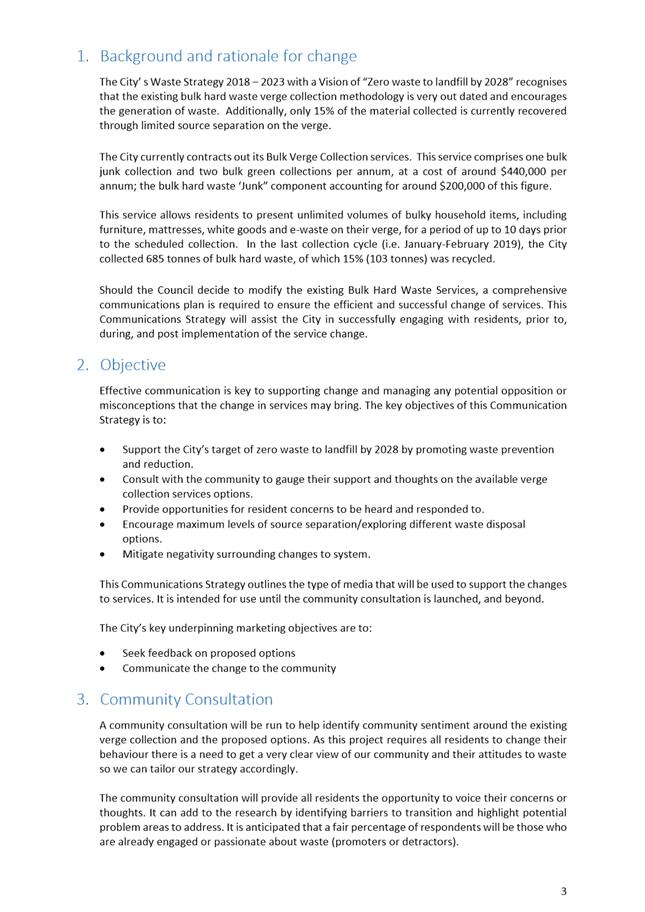

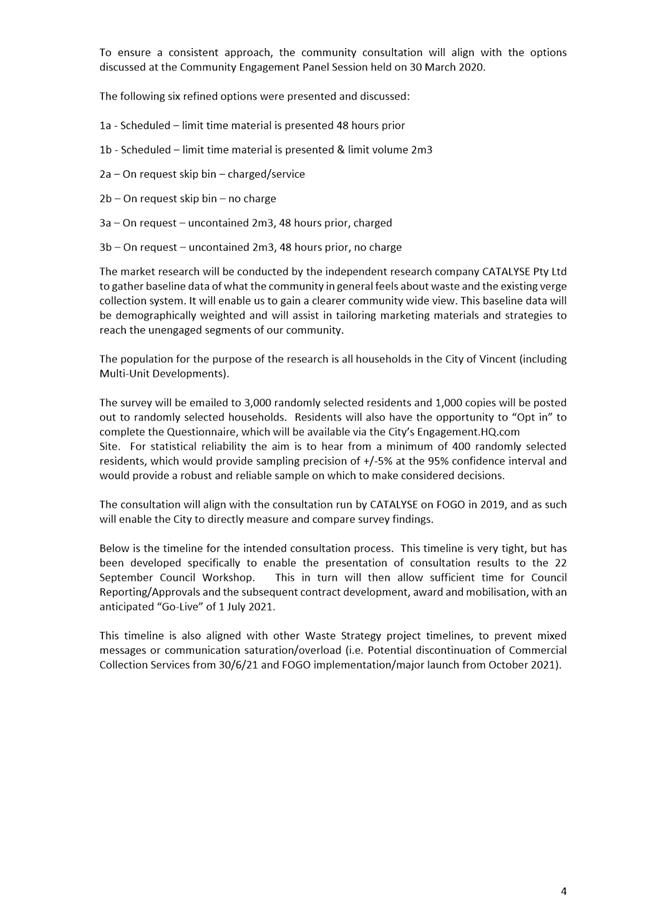

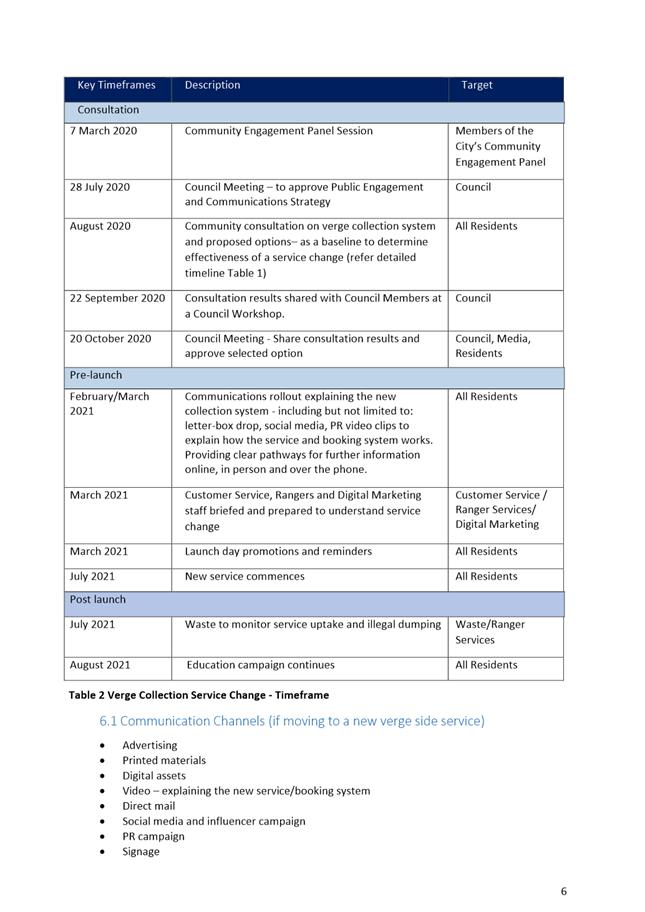

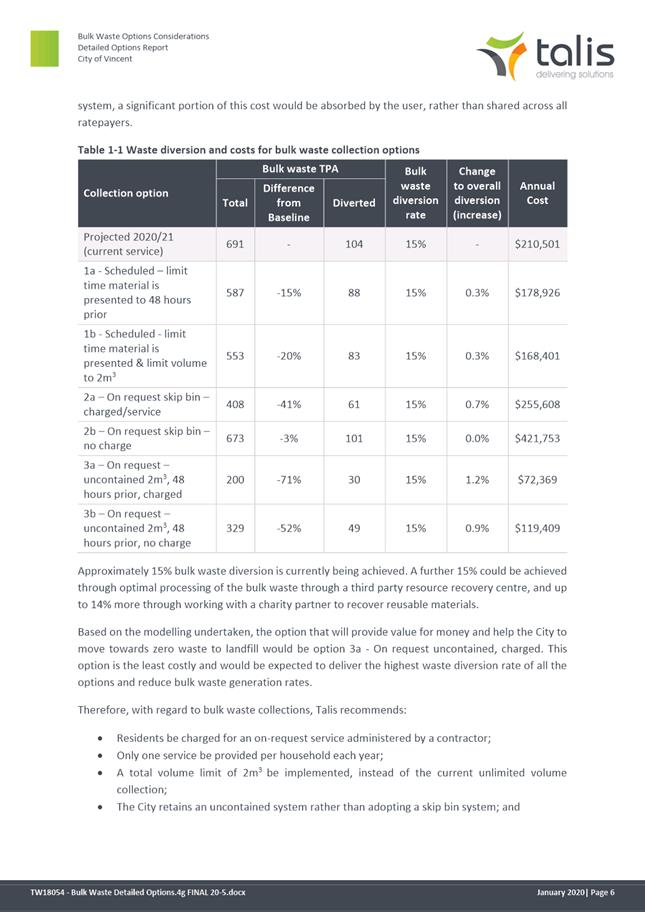

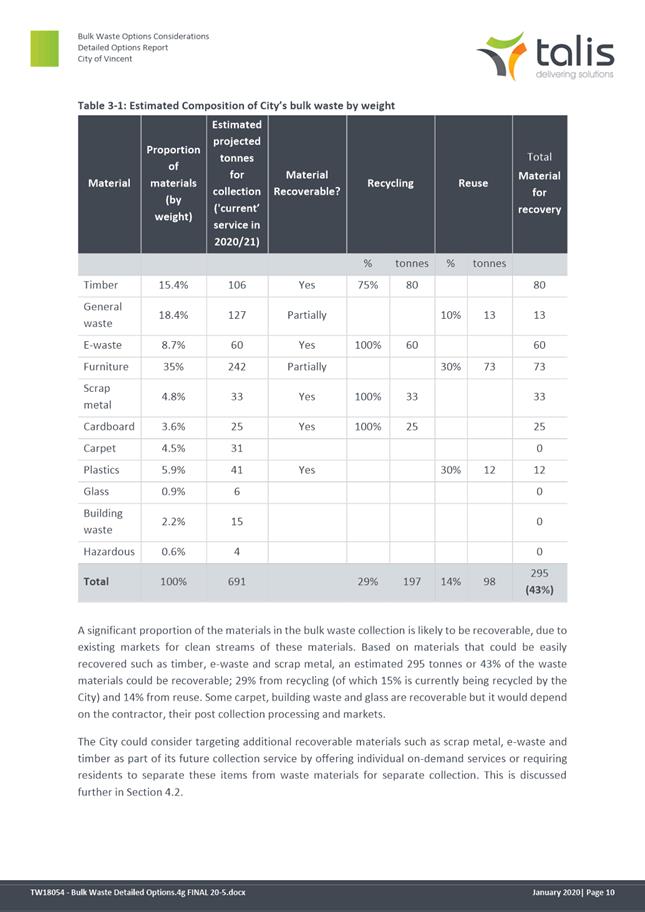

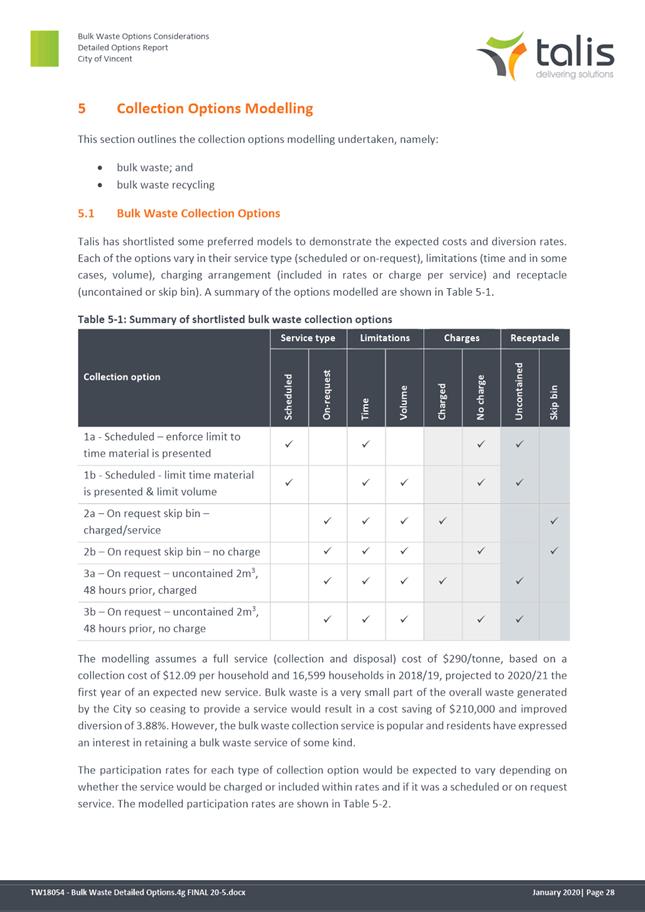

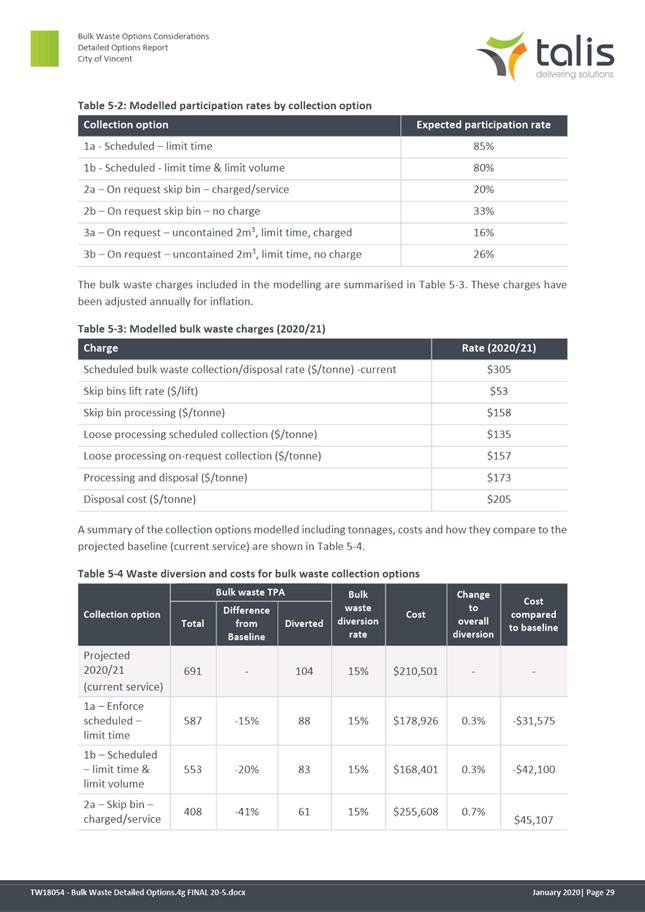

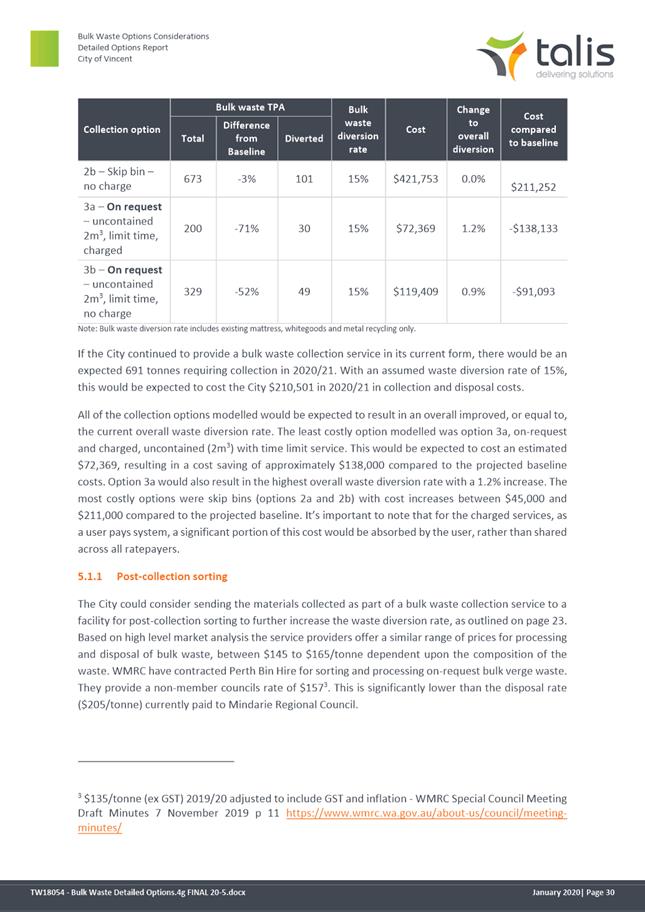

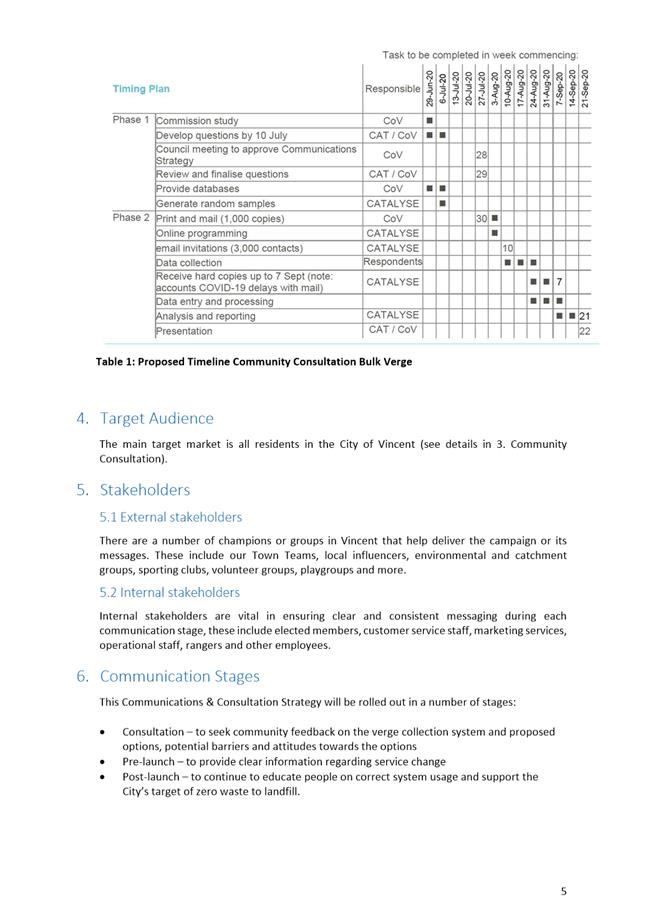

from this report. The table below indicates the key findings from high level modelling

undertaken on each of the options for service change:

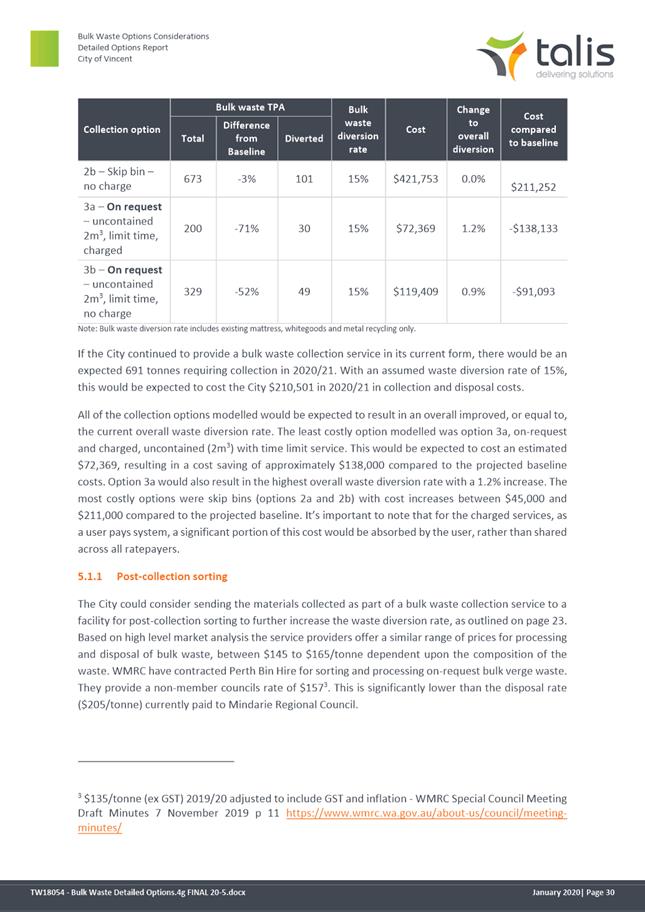

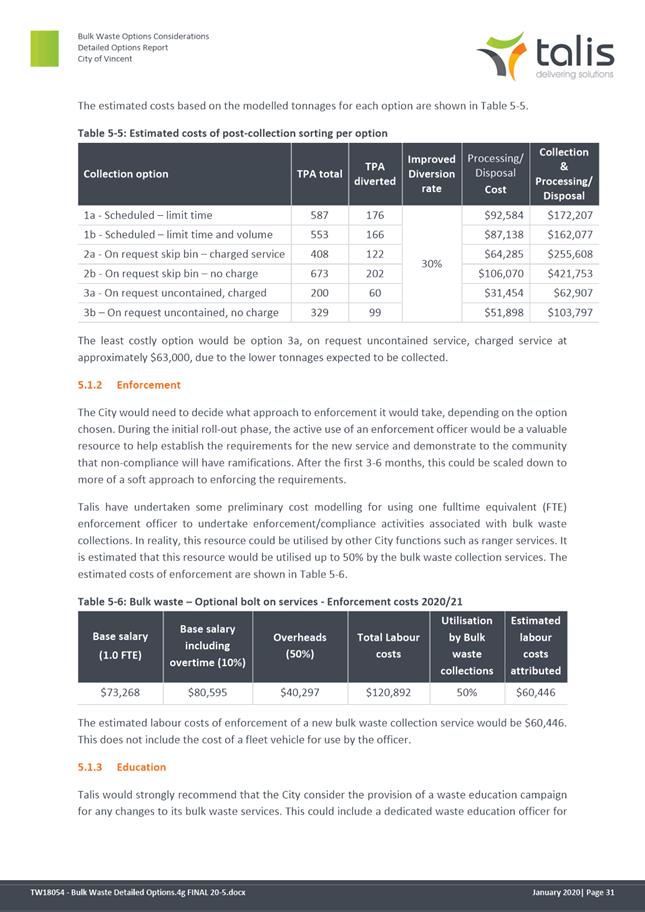

Estimated tonnes collected and annual costs for bulk waste

collection options

|

Collection option

|

Bulk waste tonnes pa

|

Estimated Annual Cost

|

|

Total

|

Difference from Baseline

|

|

Projected 2021/22 (current service)

|

691

|

-

|

$210,501

|

|

1a - Scheduled – limit

time material is presented 48 hours prior

|

587

|

-15%

|

$178,926

|

|

1b - Scheduled - limit time material is presented &

limit volume 2m3

|

553

|

-20%

|

$168,401

|

|

2a – On request skip bin – charged/service

|

408

|

-41%

|

$255,608

|

|

2b – On request skip bin – no charge

|

673

|

-3%

|

$421,753

|

|

3a – On request – uncontained 2m3,

48 hours prior, charged

|

200

|

-71%

|

$72,369

|

|

3b – On request – uncontained 2m3,

48 hours prior, no charge

|

329

|

-52%

|

$119,409

|

Detailed

financial modelling will be updated as contract rates become available and will

be used to inform the annual budget process.

Ordinary Council Meeting Agenda 28

July 2020

Ordinary

Council Meeting Agenda 28

July 2020

10.2 Tender

576/20 - Pavement Profiling & Supply and Laying of Hot Mixed Asphalt -

Appointment of Successful Tenderer

Attachments: 1. Evaluation

Schedule - Confidential

|

Recommendation:

That

Council ACCEPTS the tenders submitted from WestCoast Profilers Pty

Ltd, for profiling services, and Asphaltech Pty Ltd, for the supply and

laying of hot mixed asphalt, for Tender 576/20 for Pavement Profiling &

Supply and Laying of Hot Mixed Asphalt.

|

Purpose of Report:

To report to Council the

outcome of Tender 576/20 and to recommend the acceptance of tenderers.

Background:

The City regularly

undertakes significant capital works road projects and programs, such as the

annual Metropolitan Regional Roads Grants (MRRG) program, Roads to Recovery

(R2R) and Local Roads Programs, that require the profiling of a road surface

and the laying of a new hot mixed asphalt wearing course.

In the past the City has

advertised for these two services as separate tenders. However, in this

instance it was advertised as one to test the markets capacity and willingness

to combine both in a single tender. A number of the larger civil

contractors provide both services and the rational was that a single contract

may provide better ‘value for money’ in both pricing and

coordination of works.

However, in

acknowledgement that some specialist’s contractors, specifically the

profilers, may be locked out from tendering if they were required to submitted

prices for both services, the City’s tender was written so that it could

be for a specific service, i.e. profiling or asphalt alone, or a single

contract for both.

The tender documentation

included the following (in part) clause:

‘Each of the two

services are considered a separable portion of the contract. The City may

accept both separable portions from the same supplier or each from separate

suppliers…..’

Details:

Tender Advertising

The estimated value of

the combined tender over three years is in excess of $3,500,000. As the

total budget exceeds $250,000, Policy No. 1.2.3 – Purchasing, it

requires an open public tender process.

Under CEO Delegation

1.19, the Executive Director Infrastructure and Environment approved the

Procurement Plan, which included the following Evaluation Criteria:

|

Qualitative Criteria

|

Weighting

|

|

Respondents

must, as a minimum, provide the following information:

1

– Relevant Experience

Provide details of experience

and expertise in providing pavement marking services to local government

and/or similar organisations.

|

40%

|

|

2

– Resources

Provide evidence that the tenderer has the required

plant, equipment and appropriately skilled staff to undertake the works the

City requires.

|

40%

|

|

3

– Demonstrated Understanding

Tenderer to demonstrate they understand the scope of

works required by providing the process for delivering the services, identify

potential issues/risks and how these will be mitigated, proposed methodology

for delivering services on time.

|

20%

|

The Request for Tender

576/20 was publicly advertised in the West Australian on Monday 23 March 2020

and invited submissions until Monday 13 April 2020.

At the close of the

advertising period, ten (10) tender responses were received, all of which were

compliant, from the following companies:

· Asphaltech

Pty Ltd.

· Boral

Resources (WA) Ltd.

· Downer

EDI Works Pty Ltd.

· Dowsing

Group Pty Ltd.

· Fulton

Hogan Industries Pty Ltd.

· KEE

Surfacing Pty Ltd.

· Roads

2000 Pty Ltd.

· Stateline

Asphalt Pty Ltd.

· WA

Profiling and Stabilisation Pty Ltd.

· WestCoast

Profilers Pty Ltd.

Of the ten submissions

seven (7) tendered for both portions of the contract while three (3) tendered

for the profiling portion only.

Tender Assessment

The tenders were assessed

by members of the Tender Evaluation Panel (below) and each tender was assessed

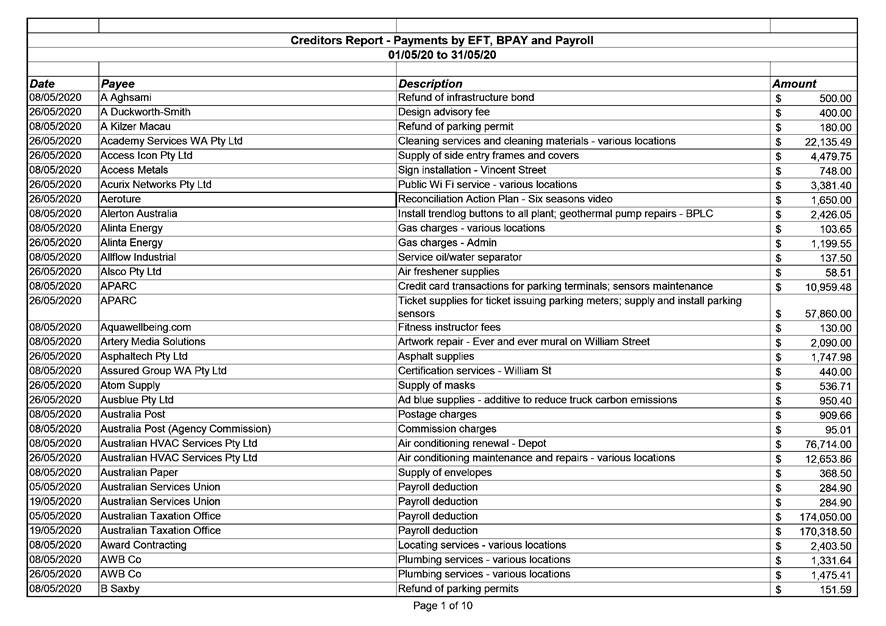

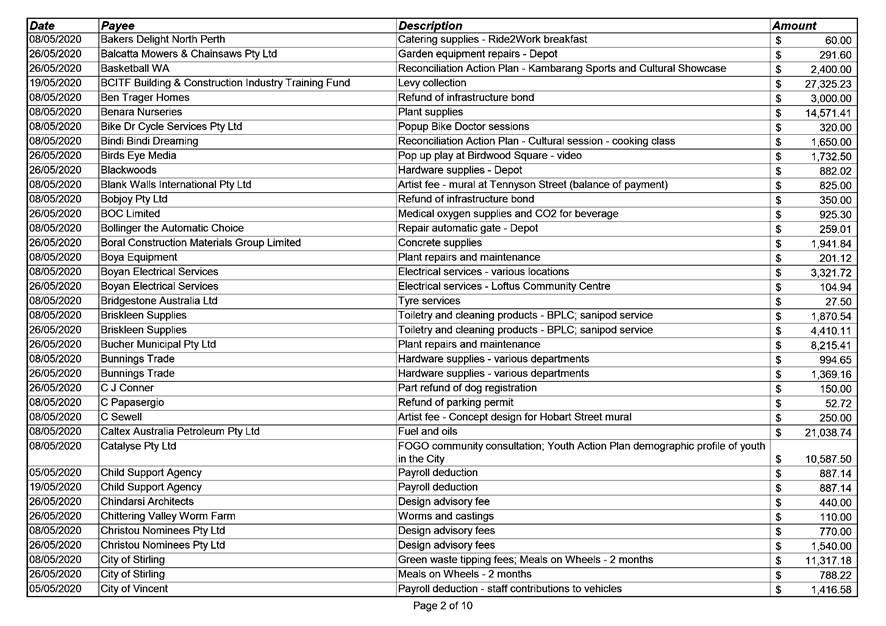

using the above Evaluation Criteria, with a scoring system being used as part

of the assessment process.

|

Title

|

Role

|

|

Manager Engineering

|

Voting

|

|

Depot Operations

Supervisor

|

Voting

|

|

Coordinator Engineering

Operations

|

Voting

|

|

Procurement &

Contracts Officer

|

Non-voting

|

Evaluation

When evaluating the

tenders the panel established that the specialist asphalt only contractors

intended upon sub-contracting profiling portion of the contract to third

parties, two of whom had tendered for the profiling portion of the contract in

their own right.

Several of the larger

companies have the capability to provide both services in-house.

To determine the best

‘value for money’ while endeavouring to minimise the risk, of each

of the tenderers submitted rates were applied to a number of past work

scenarios and projects.

The resultant matrix

demonstrated that splitting the tender into two, Pavement Profiling and Supplying

and Laying Hot Mixed Asphalt, delivered the best outcome to the City.

The panel unanimously

agreed on the following as the preferred tenderers.

Asphalt.

A summary table for the

top three Tenderers is provided below. A full outline of the Qualitative

Evaluation Criteria for each tenderer and pricing is contained within Confidential

Attachment 1.

|

Company

|

Qualitative Score/100

|

Ranking

|

|

Asphaltech Pty Ltd

|

90.00

|

1

|

|

Downer EDI Works Pty

Ltd

|

88.00

|

2

|

|

Fulton Hogan Industries

Pty Ltd

|

88.00

|

3

|

Based on the evaluation

panel discussion, the submission from Asphaltech was the highest ranked

submission against the Qualitative Evaluation Criteria.

Profiling.

A summary table for the

top two Tenderers is provided below. A full outline of the Qualitative

Evaluation Criteria for each tenderer and pricing is contained within Confidential

Attachment 1.

|

Company

|

Qualitative Score/100

|

Ranking

|

|

WestCoast Profilers Pty

Ltd

|

90.00

|

1

|

|

WA Profiling and

Stabilisation Pty Ltd

|

90.00

|

2

|

|

KEE Surfacing Pty Ltd

|

84.00

|

3

|

Given that the top two

tenderers finished with the same Qualitative score, the evaluation panel then

made a value judgement taking into consideration both risk and ‘value for

money’ to separate them and award a ranking.

The tender from WestCoast

Profilers Pty Ltd was adjudged the highest ranked submission.

Consultation/Advertising:

The Request for Tender

576/20 was advertised in the West Australian on 23 March 2020 and on both the

City’s website and Tenderlink portal between 23 March and 13 April 2020.

Legal/Policy:

The

RFT was prepared and advertised in accordance with the City’s Purchasing

protocols: Policy No. 1.2.3 – Purchasing.

Risk Management Implications:

Medium Project

delays and safety considerations.

Strategic Implications:

This is in keeping with the

City’s Strategic Community Plan 2018-2028:

Thriving Places

Our physical assets are efficiently and effectively managed

and maintained.

Innovative

and Accountable

Our resources and assets are planned and managed in an

efficient and sustainable manner.

SUSTAINABILITY IMPLICATIONS:

A

competent and efficient profiling and asphalt contractor is essential to

completing key capital works projects and programs in a timely and cost

effective manner.

Financial/Budget Implications:

Costs associated with both the pavement profiling and laying

of asphalt are charged against the various Engineering Operations capital works

projects and operating accounts.

The annual expenditure under this tender varies from year to

year dependant on work requirements, however based on previous years, it is

estimated that the combined total value will be in excess of $1,000,000 per

financial year.

Comments:

The submissions for WestCoast Profiling Pty Ltd and

Asphaltech Pty Ltd comply with all the tender requirements. The submissions

were well presented and included all specified information. The Evaluation

Panel deemed the responses to be convincing and credible; demonstrating the

capability, capacity and experience relevant to the Evaluation Criteria.

The Evaluation Panel

recommends that WestCoast Profiling Pty Ltd and Asphaltech Pty Ltd be accepted

for their respective portions of Tender 576/20 as they presented the best

overall value for money to the City.

10.3 Tender

570/19 - Pavement Marking Services - Appointment of Successful Tenderer

Attachments: 1. Evaluation

Worksheet - Confidential

|

Recommendation:

That

Council ACCEPTS the tender submitted by Line Marking Specialists (Bay

Corporation Pty Ltd) for Tender 570/19 for Pavement Marking Services.

|

Purpose of Report:

To report to Council the

outcome of Tender 570/19 and to recommend the acceptance of a tenderer.

Background:

The City regularly

undertakes capital works projects and maintenance programs that require the

engagement of a specialist pavement* marking contractor. The vast

majority of the work relates to parking and the delineation of both approved,

and illegal, parking zones.

*typically referred to as

‘line’ marking.

Details:

Tender Advertising

The estimated value of

the tender over three years is in excess of $500,000. As the total budget

exceeds $250,000, Policy No. 1.2.3 – Purchasing, it requires an

open public tender process.

Under CEO Delegation

1.19, the Executive Director Infrastructure and Environment approved the

Procurement Plan, which included the following Evaluation Criteria:

|

Qualitative Criteria

|

Weighting

|

|

Respondents

must, as a minimum, provide the following information:

1

– Relevant Experience

Provide details of

experience and expertise in providing pavement marking services to local

government and/or similar organisations.

|

40%

|

|

2

– Resources

Provide evidence that the tenderer has the required

plant, equipment and appropriately skilled staff to undertake the works the

City requires.

|

40%

|

|

3

– Demonstrated Understanding

Tenderer to demonstrate they understand the scope of

works required by providing the process for delivering the services, identify

potential issues/risks and how these will be mitigated, proposed methodology

for delivering services on time.

|

20%

|

The Request for Tender

570/19 was publicly advertised in the West Australian on Wednesday 18 March

2020 and invited submissions until Wednesday 8 April 2020.

At the close of the

advertising period, three tender responses were received, of which two were

judged compliant, from the following companies:

· Line

Marking Specialists (Bay Corporation Pty Ltd).

· Linemarking

WA Pty Ltd.

Tender Assessment

The tenders were assessed

by members of the Tender Evaluation Panel (below) and each tender was assessed

using the above Evaluation Criteria, with a scoring system being used as part

of the assessment process.

|

Title

|

Role

|

|

Manager Engineering

|

Voting

|

|

Depot Operations

Supervisor

|

Voting

|

|

Coordinator Engineering

Operations

|

Voting

|

|

Procurement &

Contracts Officer

|

Non-voting

|

Evaluation

A summary table for each

compliant Tenderer is provided below. A full outline of the Qualitative

Evaluation Criteria for each tenderer and pricing is contained within Confidential

Attachment 1.

|

Company

|

Qualitative Score/100

|

Ranking

|

|

Line Marking Specialists

(Bay Corporation Pty Ltd).

|

84

|

1

|

|

Linemarking WA Pty Ltd.

|

84

|

2

|

Based upon panel’s

assessment of the Qualitative Evaluation Criteria, both submissions were judged

as demonstrating that they were capable of meeting the City’s

requirements.

Given that both tenderers

finished with the same Qualitative score, the evaluation panel then made a

value judgement taking into consideration both risk and ‘value for

money’ to separate them and award a ranking.

To determine ‘value

for money’ each of the tenderers submitted rates were applied to a number

of past work scenarios for which the preferred tenderer would have resulted in

the lowest cost.

Consultation/Advertising:

The Request for Tender

570/19 was advertised in the West Australian on 18 March 2020 and on both the

City’s website and Tenderlink portal between 18 March and 8 April 2020.

Legal/Policy:

The

RFT was prepared and advertised in accordance with the City’s Purchasing

protocols: Policy No. 1.2.3 – Purchasing.

Risk Management Implications:

Medium Project

delays and safety considerations.

Strategic Implications:

This is in keeping with the

City’s Strategic Community Plan 2018-2028:

Thriving Places

Our physical assets are efficiently and effectively managed

and maintained.

SUSTAINABILITY IMPLICATIONS:

The

hire of competent and efficient pavement marking contractors is essential to

completing key capital works projects and programs in a timely and cost

effective manner.

Financial/Budget Implications:

Costs associated with pavement marking are charged against

the various Engineering Operations capital works projects and operating

accounts.

The annual expenditure under this tender varies from year to

year dependant on work requirements, however based on previous years, it is

estimated that the total value will be in the order of $170,000 per financial

year.

Comments:

The submission from Line Marking Specialists (Bay

Corporation Pty Ltd) complies with all the tender requirements. The submission

was well presented and included all specified information. The Evaluation Panel

deemed the response to be convincing and credible; demonstrating the

capability, capacity and experience relevant to the Evaluation Criteria.

The Evaluation Panel

recommends that Line Marking Specialists (Bay Corporation Pty Ltd).be accepted

for Tender 570/19 as they presented the best overall value for money to the

City.

10.4 Tender

577/19 - Concrete Crossovers and Cast In-situ Concrete Paths - Appointment of

Successful Tenderer

Attachments: 1. Evaluation

Schedule - Confidential

|

Recommendation:

That

Council ACCEPTS the tender submitted by Cobblestone Concrete Pty Ltd

for Tender 577/19 for the construction of Concrete Crossovers and Cast

In-situ Concrete Paths.

|

Purpose of Report:

To report to Council the

outcome of Tender 577/19 and to recommend the acceptance of a tenderer.

Background:

The City regularly

undertakes capital projects and operating programs that involves either

significant or specialist concreting works for which the City relieves upon an

external contractor engaged under tender.

Details:

Tender Advertising

The estimated value of

the tender over three years is in excess of $750,000. As the total budget

exceeds $250,000, Policy No. 1.2.3 – Purchasing, it requires an

open public tender process.

Under CEO Delegation

1.19, the Executive Director Infrastructure and Environment approved the

Procurement Plan, which included the following Evaluation Criteria:

|

Qualitative Criteria

|

Weighting

|

|

Respondents

must, as a minimum, provide the following information:

1

– Relevant Experience

Provide details of experience and expertise in providing

concreting services to local government and/or similar organisations.

|

40%

|

|

2

– Resources

Provide evidence that the tenderer has the required

plant, equipment and appropriately skilled staff to undertake the works the

City requires.

|

40%

|

|

3

– Demonstrated Understanding

Tenderer to demonstrate they understand the scope of

works required by providing the process for delivering the services, identify

potential issues/risks and how these will be mitigated, proposed methodology

for delivering services on time.

|

20%

|

The Request for Tender

577/19 was publicly advertised in the West Australian on Wednesday 18 March

2020 and invited submissions until Wednesday 8 April 2020.

At the close of the

advertising period, four tender responses were received, all of which were

judged compliant, from the following companies:

· Dowsing

Group Pty Ltd.

· Cobblestone

Concrete Pty Ltd.

· Axiis

Contracting Pty Ltd.

· Techsand

Pty Ltd.

Tender Assessment

The tenders were assessed

by members of the Tender Evaluation Panel (below) and each tender was assessed

using the above Evaluation Criteria, with a scoring system being used as part

of the assessment process.

|

Title

|

Role

|

|

Manager Engineering

|

Voting

|

|

Depot Operations

Supervisor

|

Voting

|

|

Coordinator Engineering

Operations

|

Voting

|

|

Procurement &

Contracts Officer

|

Non-voting

|

Evaluation

A summary table for each

compliant Tenderer is provided below. A full outline of the Qualitative

Evaluation Criteria for each tenderer and pricing is contained within Confidential

Attachment 1.

|

Company

|

Qualitative Score/100

|

Ranking

|

|

Cobblestone Concrete Pty

Ltd.

|

82

|

1

|

|

Dowsing Group Pty Ltd.

|

82

|

2

|

|

Axiis Contracting Pty

Ltd.

|

82

|

3

|

|

Techsand Pty Ltd.

|

80

|

4

|

Based upon panel’s

assessment of the Qualitative Evaluation Criteria, all of the submissions were

judged as demonstrating that they were capable of meeting the City’s

requirements.

Given that three of the

tenderers finished with the same Qualitative score, the evaluation panel then

made a value judgement taking into consideration both risk and ‘value for

money’ to separate the top three and award a ranking.

To determine ‘value

for money’ each of the tenderers submitted rates were applied to a number

of past work scenarios for which the preferred tenderer would have resulted in

the lowest cost.

Consultation/Advertising:

The Request for Tender

577/19 was advertised in the West Australian on 18 March 2020 and on both the

City’s website and Tenderlink portal between 18 March and 8 April 2020.

Legal/Policy:

The Request for Tender

was prepared and advertised in accordance with the City’s Purchasing

protocols, Policy No. 1.2.3 – Purchasing.

Risk Management Implications:

Medium Project

delays and safety considerations.

Strategic Implications:

This is in keeping with the

City’s Strategic Community Plan 2018-2028:

Thriving Places

Our physical assets are efficiently and effectively managed

and maintained.

SUSTAINABILITY IMPLICATIONS:

The hire of a competent and efficient concrete contractor is

essential to completing key capital works projects and maintenance programs in

a timely and cost effective manner.

Financial/Budget Implications:

Costs associated with the construction of concrete

crossovers and cast in-situ concrete footpaths, along with other

‘grano’ works, are charged against the various Engineering

Operations capital works projects and operating accounts.

The annual expenditure under this tender varies from year to

year dependant on work requirements, however based on previous years, it is

estimated that the total value will be in the order of $250,000 per financial

year.

Comments:

The submission from Cobblestone Concrete Pty Ltd complies

with all the tender requirements. The submission was well presented and

included all specified information. The Evaluation Panel deemed the response to

be convincing and credible; demonstrating the capability, capacity and

experience relevant to the Evaluation Criteria.

The Evaluation Panel

recommends that Cobblestone Concrete Pty Ltd be accepted for Tender 577/19 as

they presented the best overall value for money to the City.

11 Community

& Business Services

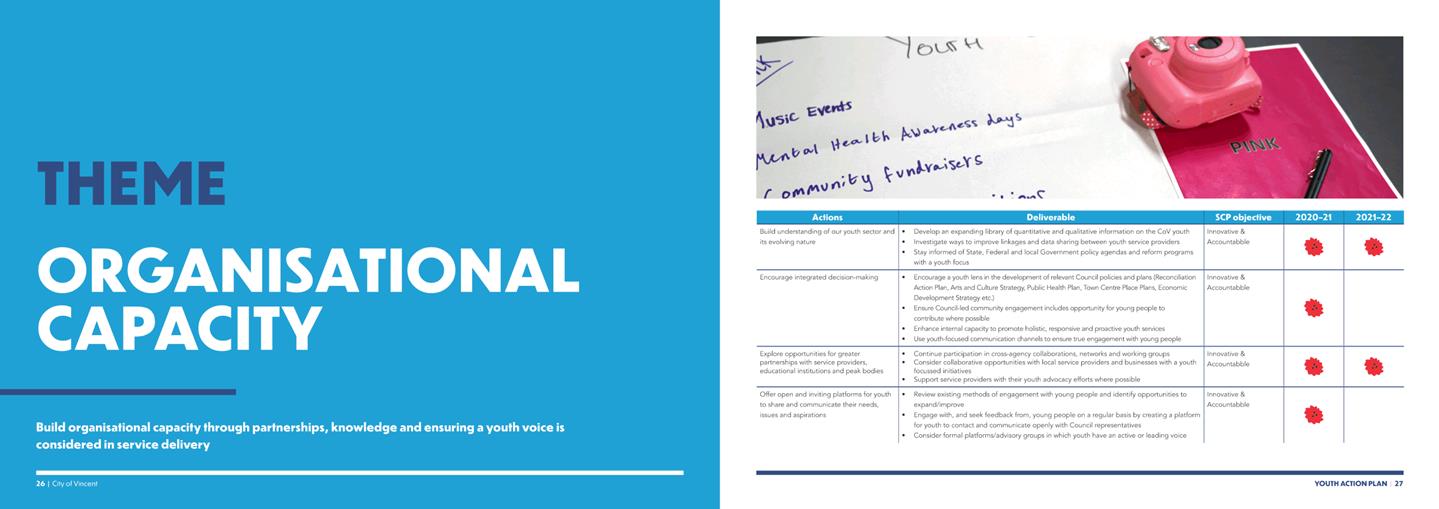

11.1 Draft

Youth Action Plan 2020-2022

Attachments: 1. Draft

Youth Action Plan 2020-2022 ⇩

|

Recommendation:

That

Council:

1. RECEIVES

the Draft Youth Action Plan 2020-2022, at Attachment 1;

2. AUTHORISES

the Chief Executive Officer to provide local public notice of the Draft Youth

Action Plan 2020-2022 for public comment for a period of 21 days, inviting

written submissions in accordance with Council Policy No. 4.1.5 –

Community Consultation;

3. NOTES

that a further report will be presented to the Ordinary Council Meeting in

September 2020 detailing any submissions received during the public comment

period; and

4. NOTES

that the Draft Youth Action Plan 2020-2022 will be modified to improve formatting,

styling and graphic design, as determined by the Chief Executive Officer,

prior to publication.

|

Purpose of Report:

To receive the Draft

Youth Action Plan 2020-2022 for the purposes of advertising for public comment

prior to further consideration and adoption.

Background:

At the Ordinary Meeting

of Council on 25 June 2019, Council endorsed a Councillor Budget Submission for

the development of the City’s first Youth Action Plan (YAP). The

development of the Plan was subsequently included as Objective 3.10 within the City

of Vincent’s Corporate Business Plan 2019-2020.

Whilst Administration has

been active in the children and young people space for many years, the absence

of a framework has resulted in a disjointed approach to how we work with young

people, schools, networks and service agencies. The YAP is designed to

provide a more formalised approach through a framework to enable a holistic and

integrated service delivery.

Details:

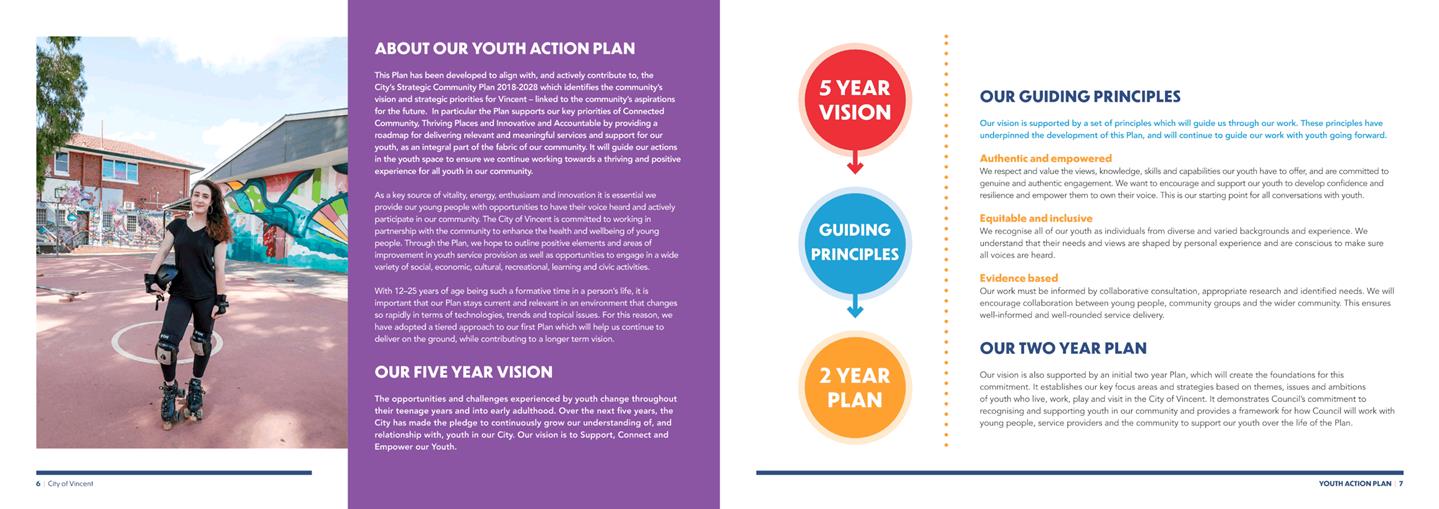

The Draft YAP 2020-2022

has been developed to be ambitious but achievable and is primarily designed to

lay the foundations for establishing and creating opportunities to strengthen

our connections with, and understanding of, our young people. More

specifically, it:

· demonstrates

the City’s commitment to recognising and supporting our youth community;

· provides

a framework for how the City will work with young people, service providers and

the community to support our youth over the life of the Plan;

· provides

guiding principles for ensuring the City’s services and programs consider

the impact on youth and allow for synergies and integration with existing plans

and strategies; and

· provides

targeted objectives for how the City can support, connect and empower its young

people.

An extensive consultation

and engagement process has been undertaken in an effort to capture the

diversity of views, opinions and knowledge of our youth, community and youth‑focused

service delivery organisations. Consultation focused around the areas of:

· health

and wellbeing;

· recreation;

· community

support and opportunities; and

· employment

and education.

To ensure the YAP stays a

meaningful and relevant resource for the City and the public, it incorporates a

strategic long‑term (five year) vision and mid‑term

(two year) deliverables which will be reviewed and refined through an

evaluation process. The document comprises background and context, a vision and

guiding principles, summary of feedback and tangible deliverables.

Subsequent YAPs will leverage off the achievements of this first Plan, as our

understanding and engagement in the youth space matures over time.

The deliverables have

been developed under the umbrella of four focus areas, or themes, identified

through stakeholder feedback. An operational‑level work plan is being

developed by Community Partnerships to support the implementation of the

deliverables. It is also anticipated that the Children & Young

Peoples’ Advisory Group (CYPAG) and the Vincent Youth Network will assist

in the implementation of the YAP through identifying, advocating and exploring

ways of addressing the issues and needs of young people in the City of Vincent.

The Plan also recognises

the impact of COVID‑19 and commits that at an operational level,

deliverables will involve response and recovery initiatives specifically to

deal with the current and future uncertainty caused by the pandemic. A specific

deliverable has been included to address mental health.

Subject to any adjustments resulting from the public consultation period (see

below), the YAP 2020‑2022 content will be finalised with some

modifications to graphic design and presentation. The document will be a

mixture of words and graphics to make content digestible, engaging and user

friendly.

Consultation/Advertising:

As per Council Policy No.

4.1.5 – Community Consultation it is proposed to seek community feedback

and input on the Draft YAP 2020‑2022 through a 21-day public comment

period. This will include:

· Seeking

general community feedback through:

o public

comment through the YAP Imagine Vincent page;

o notices

on the City’s website, social media channels, Library and Local History

Centre and Beatty Park; and

o attendance

at pop up events and sporting clubs where appropriate.

· Targeted

engagement with key stakeholders through:

o direct

contact with youth who provided feedback during the consultation phase;

o direct

conversation with local youth service providers and schools; and

o directly

send the document to CYPAG members and the existing Vincent Youth Network.

Legal/Policy:

Nil.

Risk Management Implications:

Low: There is low

risk to Council considering adoption of the Youth Action Plan 2020‑2022.

Strategic Implications:

This is in keeping with

the City’s Strategic Community Plan 2018-2028:

Connected

Community

We have enhanced opportunities for our community to build

relationships and connections with each other and the City.

We are an inclusive, accessible and equitable City for all.

Our community facilities and spaces are well known and well

used.

Thriving Places

Our town centres and gathering spaces are safe, easy to use

and attractive places where pedestrians have priority.

SUSTAINABILITY IMPLICATIONS:

Nil.

Financial/Budget Implications:

Specific actions and

deliverables within the Youth Action Plan 2020-2022 will be delivered through

allocations in the 2020/2021 operating budget and subsequent budgets subject to

Council consideration. Administration will also seek grant funding

through the Federal and State Governments as opportunities arise.

Ordinary Council Meeting Agenda 28

July 2020

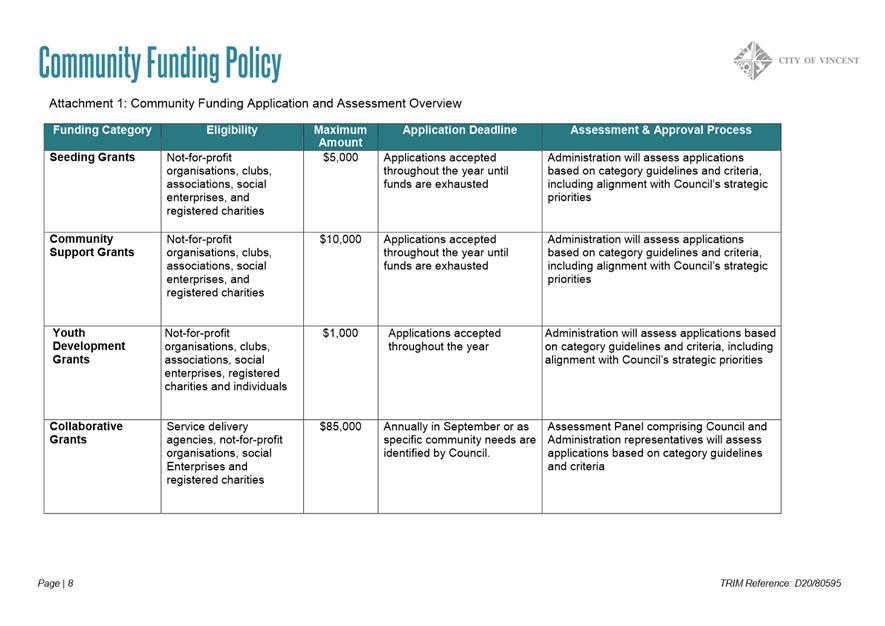

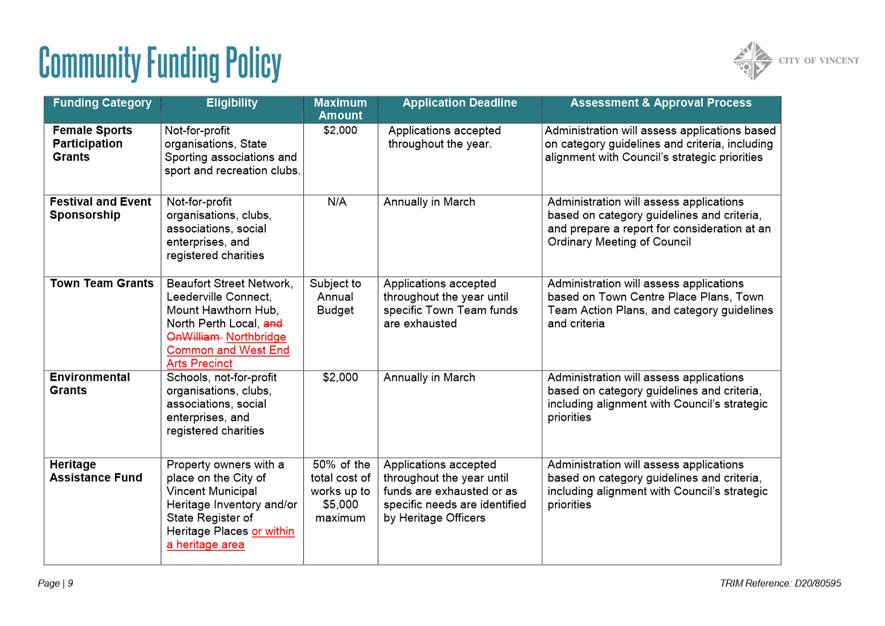

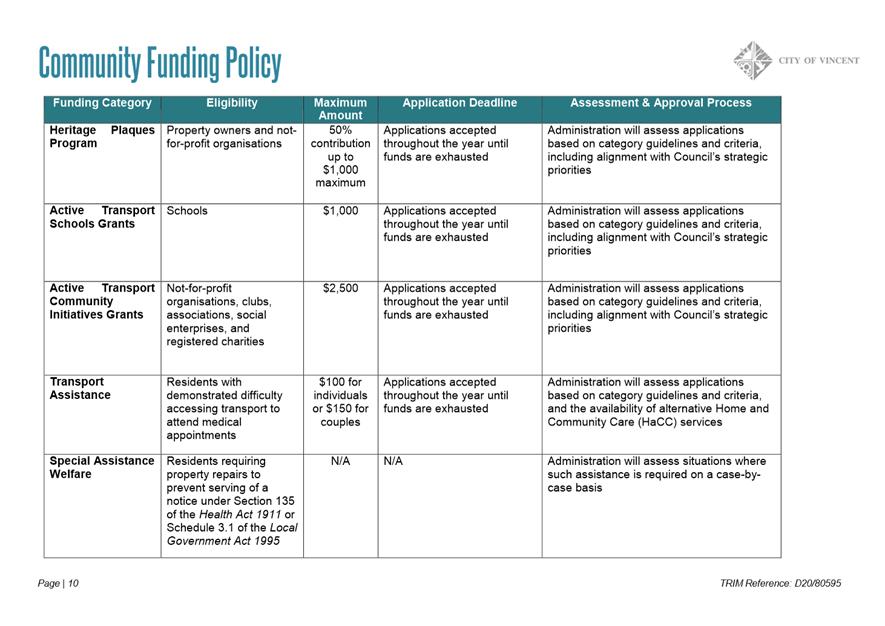

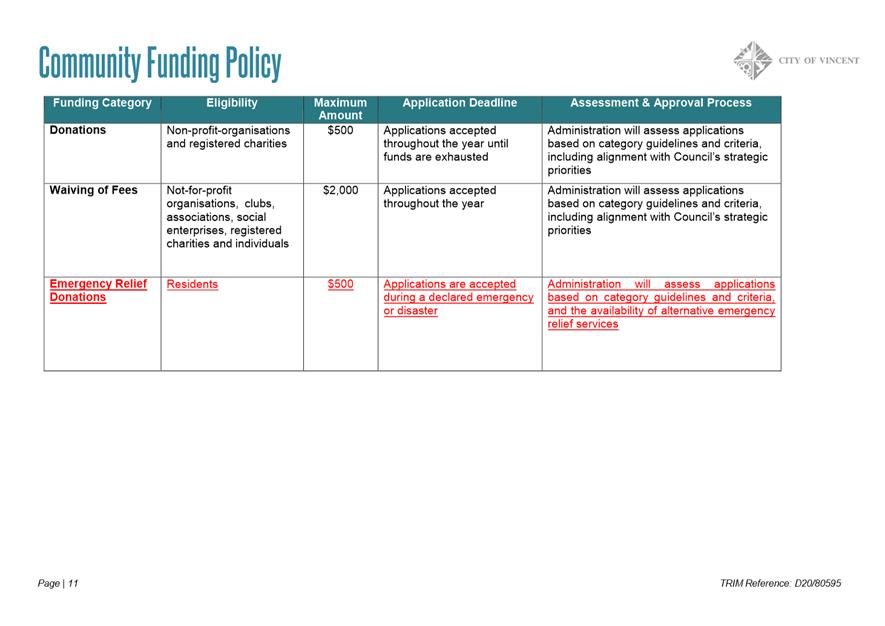

11.2 Advertising

of Amendment to Community Funding Policy - Emergency Relief Donations for

Seniors and the Vulnerable

Attachments: 1. Draft

Policy 3.10.11 - Community Funding ⇩

|

Recommendation:

That

Council:

1. APPROVES

the amendment to Policy 3.10.11 – Community Funding, at Attachment 1;

2. AUTHORISES

the Chief Executive Officer to provide local public notice of the amended

Policy 3.10.11 – Community Funding for a period of 21 days; and

3. NOTES

that at the conclusion of the public notice period any submissions received

would be presented to Council for consideration.

|

Purpose of Report:

To seek Council’s

authorisation to obtain public feedback on an amendment to Policy 3.10.11

– Community Funding for ‘Emergency Relief Donations’ (Attachment

1).

Background:

Council policies are

reviewed at regular intervals to ensure that they reflect current legislative

and regulatory requirements, align with best practice across the local

government sector and current Council strategies and priorities.

Policy

3.10.11 – Community Funding was reviewed and adopted in June 2017,

with further amendments approved in June 2017, July 2018 and September 2018 to

include the youth development grant and female sports participation grant

categories.

To enable immediate

implementation of the Emergency Relief Donations for seniors, people in

hardship and the vulnerable initiative, Administration has completed an

additional review and prepared an amendment to Policy 3.10.11 – Community

Funding.

Details:

On 15 March 2020, the

Western Australian Government declared a State of Emergency under the Emergency

Management Act and a Public Health Emergency under the Public Health Act in

response to the COVID-19 pandemic.

A number of restrictions

were introduced by the Federal and State Government in response to COVID-19 in

an effort to contain the spread of the disease. Many of the measures resulted

in loss of income and independence and had negative impacts on the health and

wellbeing of residents within the City. In particular those who are

vulnerable including seniors, people with chronic health conditions, Aboriginal

and Torres Strait Islander peoples, culturally and linguistically diverse

people and people with disability.

Whilst a range of

measures were implemented by Federal and State Governments, as well as

assistance available through charities and relief organisations, some residents

did not meet the criteria for assistance programs, or were simply unaware or

unable to access the assistance.

Many businesses

transitioned into offering services online only, which then became a potential

barrier to some vulnerable and isolated residents, particularly seniors and

people with disability. These residents were advised to stay at home at all

times due to their vulnerability to COVID-19 and their access to basic items

became challenging.

The addition of the

Emergency Relief Donations for seniors, people in hardship and the vulnerable

will provide the City with the ability to provide immediate and timely

assistance to those who are in crisis. The City will facilitate

essentials such as food and household consumables.

This relief measure was

identified in the early stages of the COVID pandemic, where City officers

became aware of persons in crisis. On those occasions, these officers

personally purchased food and supplies.

Administration will

ensure that all reasonable steps are taken to determine if assistance can and

should be provided through another existing emergency relief program prior to

providing any funding.

Where it is identified

that a resident has the financial means to pay for consumables, but is unable

to purchase online or over the phone, arrangements would be made with local

suppliers to purchase goods with reimbursement from the resident being sought

through the City’s financial management system.

Residents would be

eligible for up to $500 worth of emergency relief assistance under this program

over a six-month period. All donations would be in the form of purchase of

goods or services and there would be no distribution of cash. It is anticipated

that there will only be a low level of demand for this program given the

City’s demographics and the availability of other emergency relief,

however this program will be an important safety net for our community now and

in the future.

It is anticipated that

strong support would be received from local grocery stores for this initiative

and delivery could be provided from the existing Vincent Community Support

Network. For residents who are unable to prepare their own meals,

Administration would utilise the existing partnership with Stirling Community

Care for the delivery of Meals on Wheels, as well as investigating

opportunities for meal delivery through local businesses.

While this funding stream

has specifically been developed in response to the COVID-19 emergency, it has

been structured to enable the City to activate this funding in any declared

State or Local Emergency.

Consultation/Advertising:

In accordance with the

City’s Policy 4.1.1 – Adoption and Review of Policies, public

notice of the new policy will be provided for a period exceeding 21 days in the

following ways:

· on

the City’s website, social media and e-newsletter;

· in

the local newspapers; and

· on

the notice board at the City’s Administration and Library and Local

History Centre.

Risk Management Implications:

Low: It is a

low risk for Council to provide local public notice of the amended Policy

3.10.11 – Community Funding.

Legal/Policy:

Public notice of the

proposed amendment is required.

City’s Policy 4.1.1

– Adoption and Review of Policies sets out the process for repealing and

adopting policies.

Strategic Implications:

This is in keeping with

the City’s Strategic Community Plan 2018-2028:

Innovative

and Accountable

We are open and accountable to an engaged community.

SUSTAINABILITY IMPLICATIONS:

Nil.

Financial/Budget Implications:

Administration expects

that up to $5,000 could be allocated from the existing budget and would remain

subject to the normal budget process.

Ordinary Council Meeting Agenda 28

July 2020

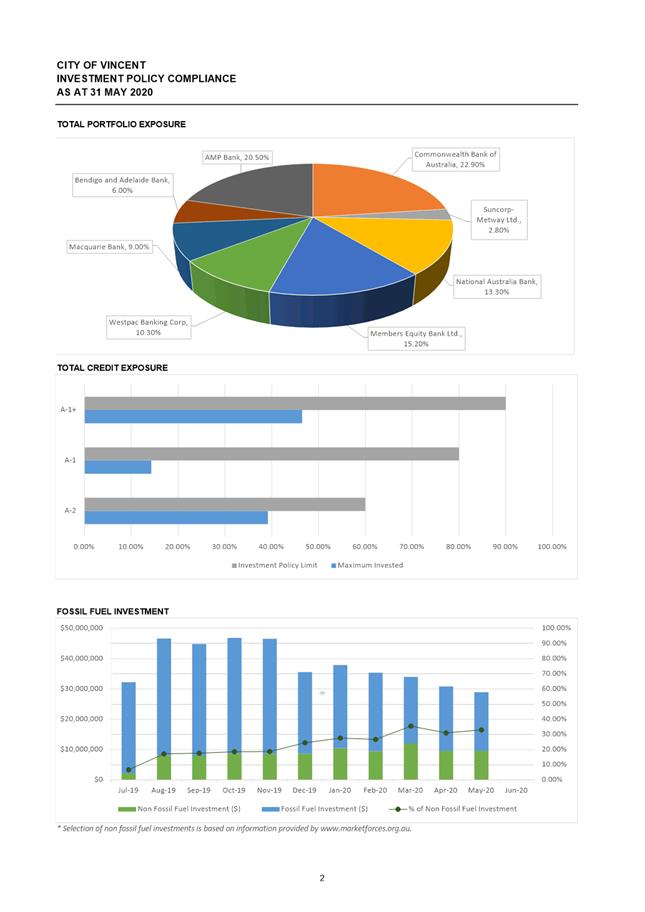

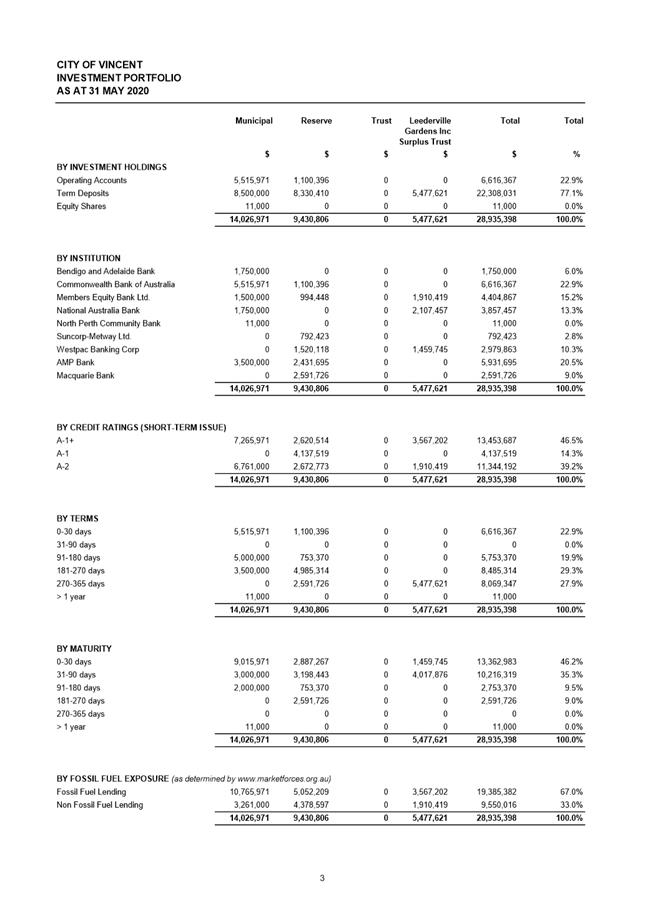

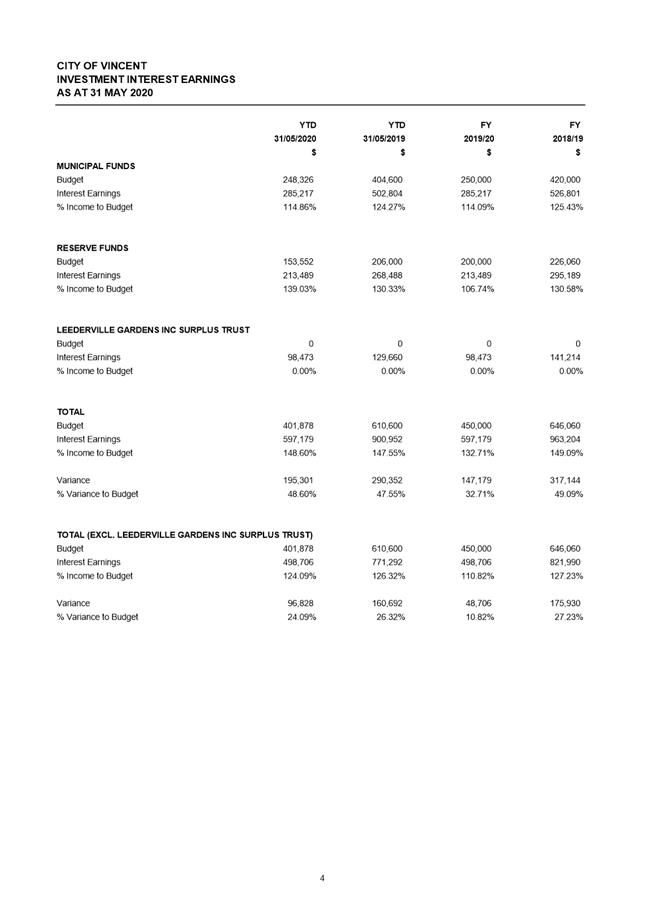

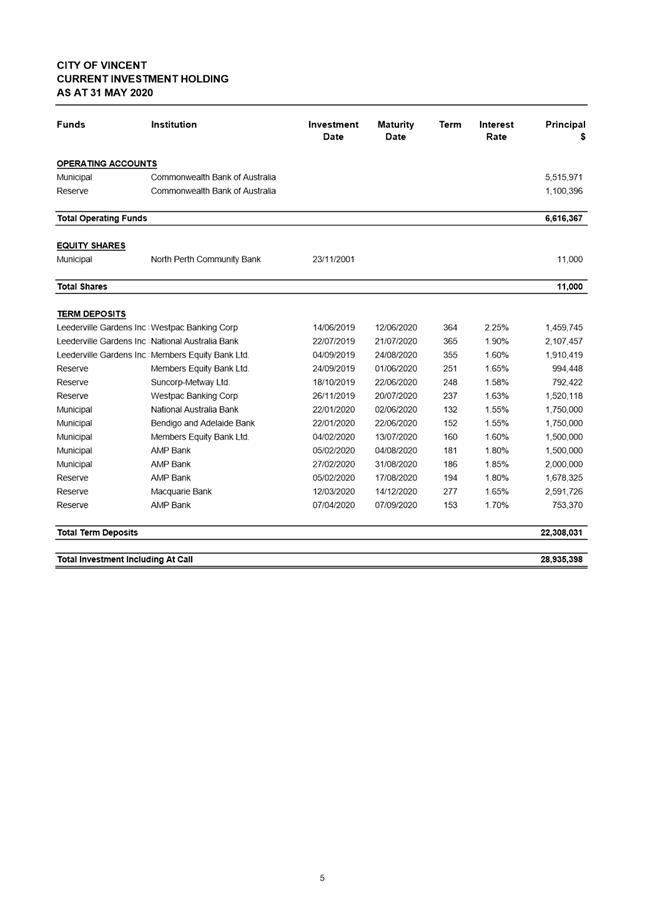

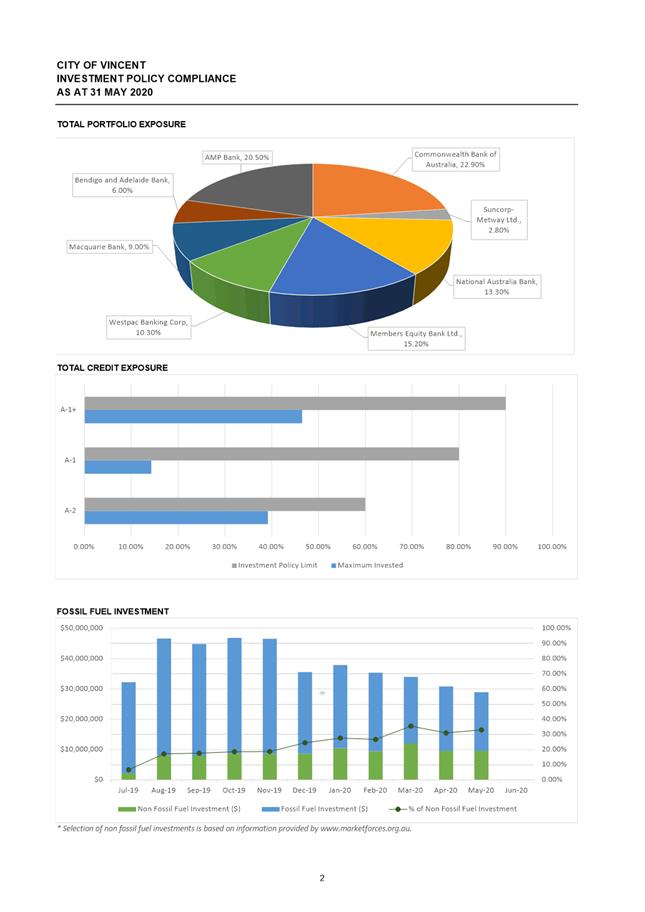

11.3 Investment

Report as at 31 May 2020

Attachments: 1. Investment

report as at 31 May 2020 ⇩

|

Recommendation:

That Council NOTES

the Investment Report for the month ended 31 May 2020 as detailed in

Attachment 1.

|

Purpose of Report:

To advise Council of the

nature and value of the City’s investments as at 31 May 2020 and the

interest earned year to date.

Background:

The City’s surplus

funds are invested in bank term deposits for various terms to facilitate

maximum investment returns in accordance to the City’s Investment Policy

(No. 1.2.4).

Details of the

investments are included in Attachment 1 and outline the following

information:

· Investment

performance and policy compliance charts;

· Investment

portfolio data;

· Investment

interest earnings; and

· Current

investment holdings.

Details:

The City’s

investment portfolio is diversified across several accredited financial

institutions.

As at 31 May 2020, the

total funds held in the City’s operating account (including on call) is

$28,935,398 compared to $33,384,520 for the period ending 31 May 2019.

The

total term deposit investments for the period ending 31 May 2020 is $22,319,031

compared to $29,469,158 for the period ending 31 May 2019. The total term deposit and fund

amounts have reduced compared to last year for cash flow management purposes to

cover operating and capital expenditure requirements.

In

addition, the City foresees that investments in the short term will decline to

ensure the City’s short to medium term liquidity position is sustainable

during the COVID-19 pandemic.

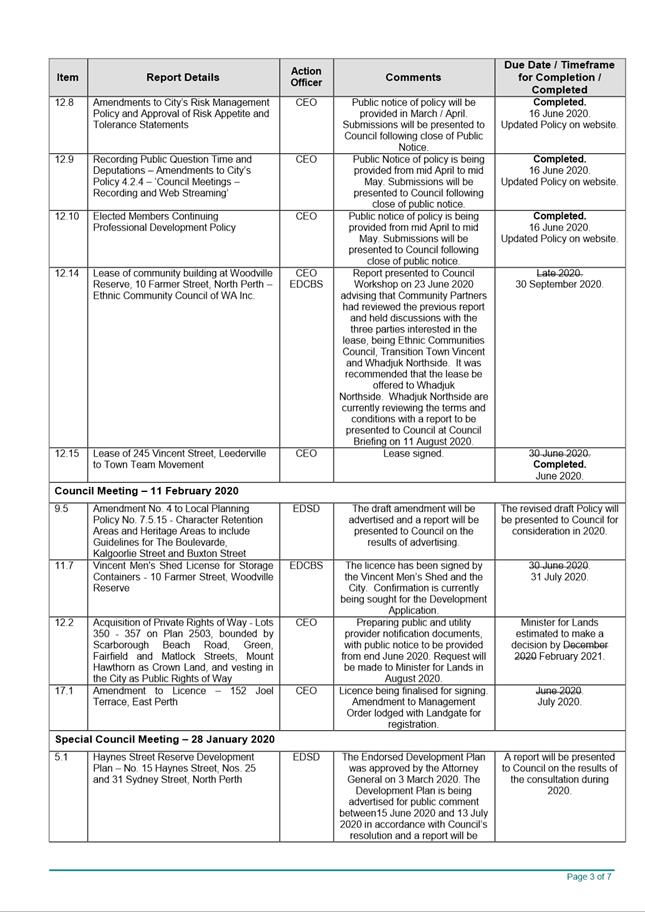

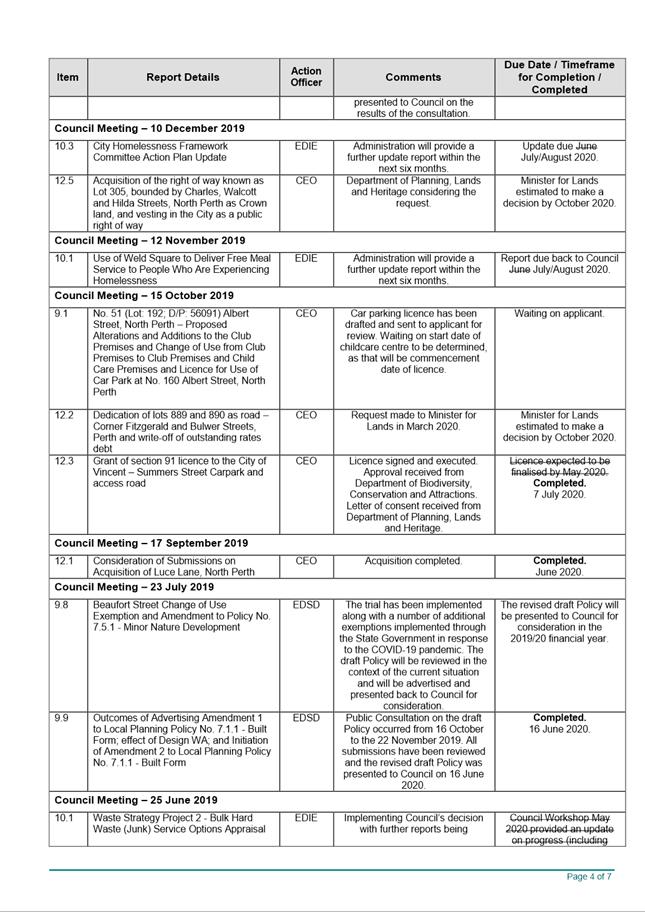

The following table shows

funds under management for the previous and current year:

|

Month

|

2018/19

|

2019/20

|

|

Ended

|

Total funds

held

|

Total term

deposits

|

Total funds

held

|

Total term

deposits

|

|

July

|

$26,826,861

|

$23,990,516

|

$32,209,493

|

$26,105,854

|

|

August

|

$44,327,708

|

$37,499,275

|

$49,641,327

|

$44,977,692

|

|

September

|

$44,209,274

|

$40,651,147

|

$44,876,698

|

$41,017,535

|

|

October

|

$44,463,021

|

$41,180,325

|

$46,846,286

|

$37,782,515

|

|

November

|

$44,188,761

|

$42,678,504

|

$46,118,236

|

$36,123,083

|

|

December

|

$40,977,846

|

$38,667,039

|

$38,557,295

|

$34,633,796

|

|

January

|

$42,109,674

|

$35,225,189

|

$37,915,806

|

$33,773,707

|

|

February

|

$44,227,308

|

$36,178,794

|

$35,377,640

|

$33,681,961

|

|

March

|

$39,157,958

|

$32,739,750

|

$33,969,162

|

$28,466,025

|

|

April

|

$36,427,902

|

$31,019,902

|

$30,832,893

|

$25,975,451

|

|

May

|

$33,384,520

|

$29,469,158

|

$28,935,398

|

$22,319,031

|

|

June

|

$30,503,765

|

$25,613,648

|

|

|

Total accrued interest

earned on investments as at 31 May 2020 is:

|

Total Accrued Interest Earned on Investment

|

Budget Adopted

|

Budget

Revised

|

Budget YTD

|

Actual YTD

|

% of FY Budget

|

|

Municipal

|

$370,000

|

$250,000

|

$248,326

|

$285,217

|

114.86%

|

|

Reserve

|

$278,688

|

$200,000

|

$153,552

|

$213,489

|

139.03%

|

|

Subtotal

|

$648,688

|

$450,000

|

$401,878

|

$498,706

|

124.09%

|

|

Leederville Gardens

Incl. Surplus Trust*

|

$0

|

$0

|

$0

|

$98,473

|

0.00%

|

|

Total

|

$648,688

|

$450,000

|

$401,878

|

$597,179

|

148.60%

|

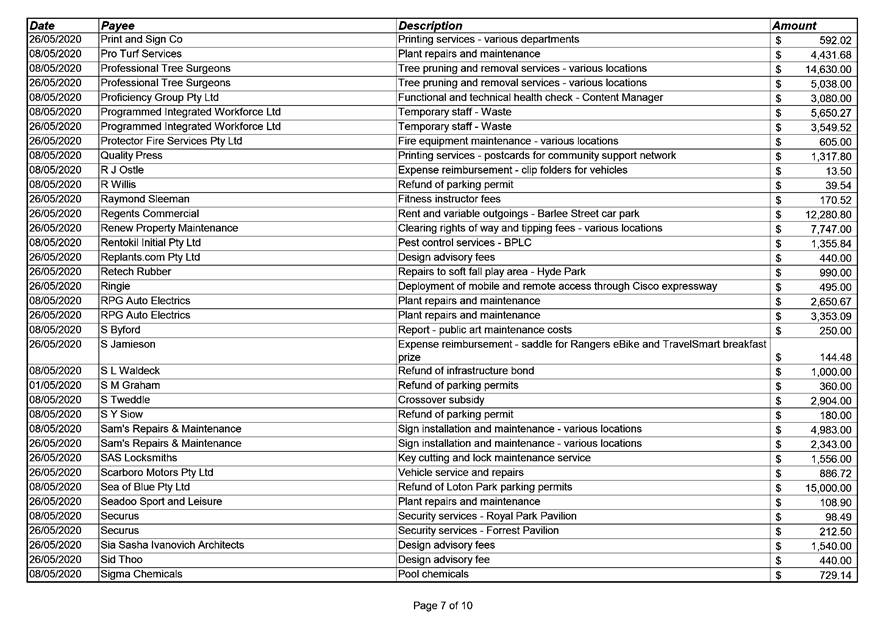

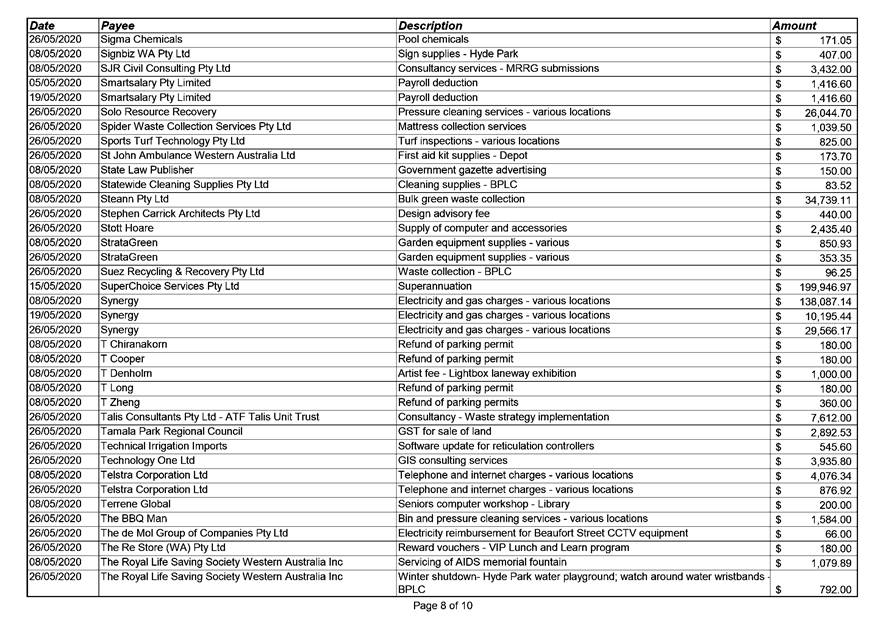

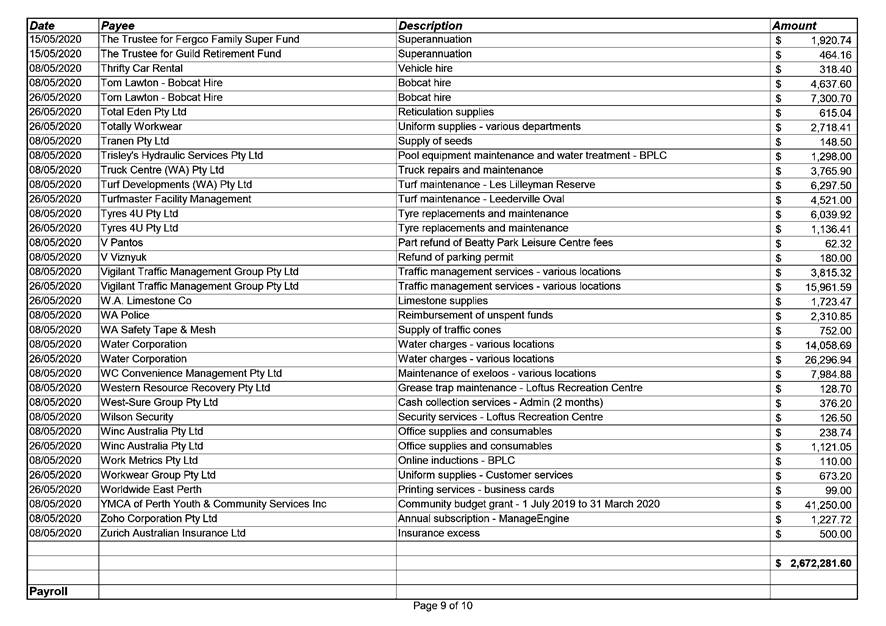

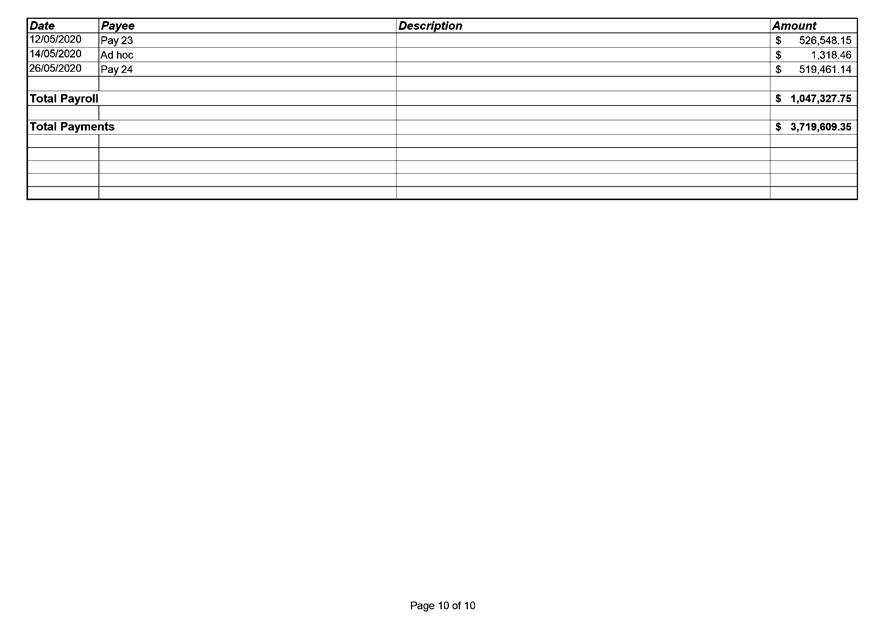

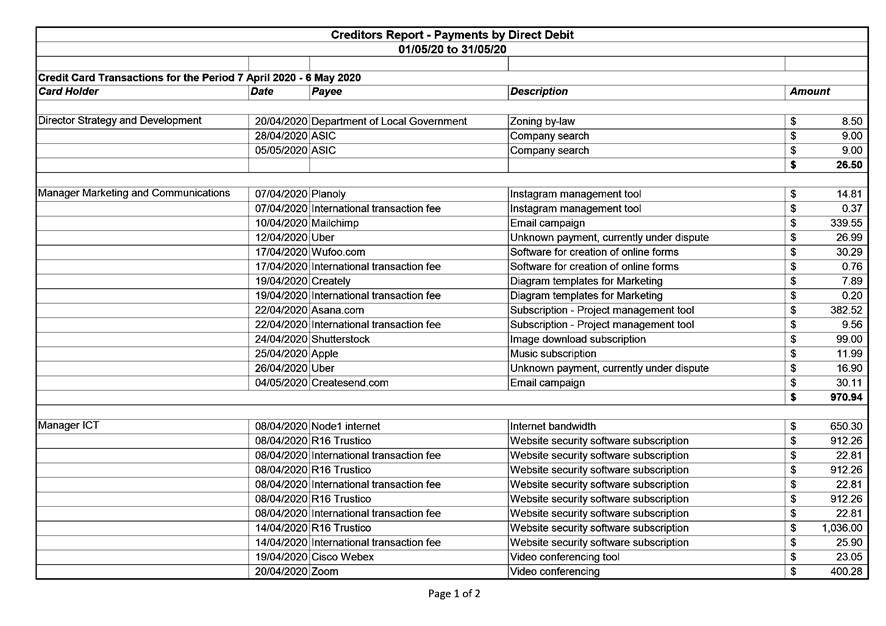

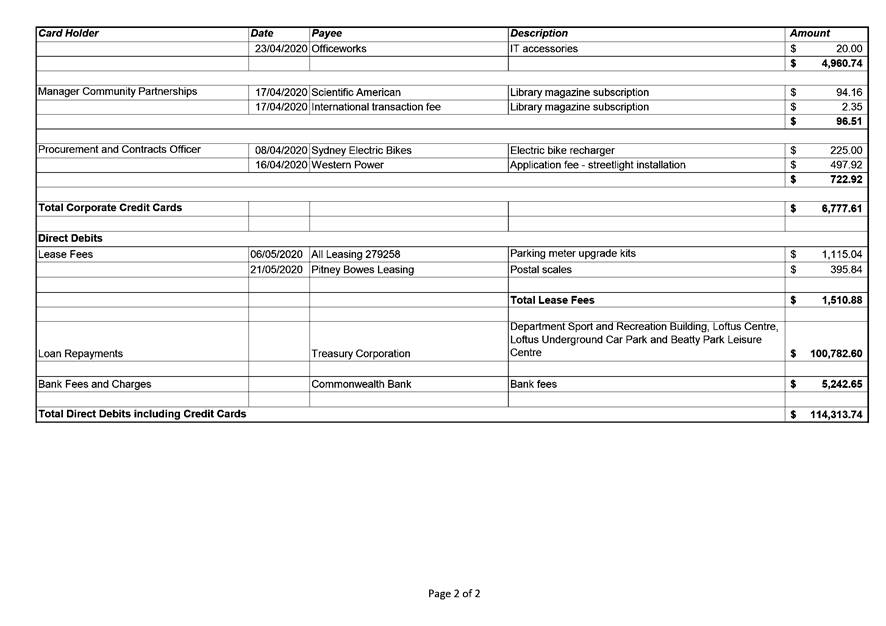

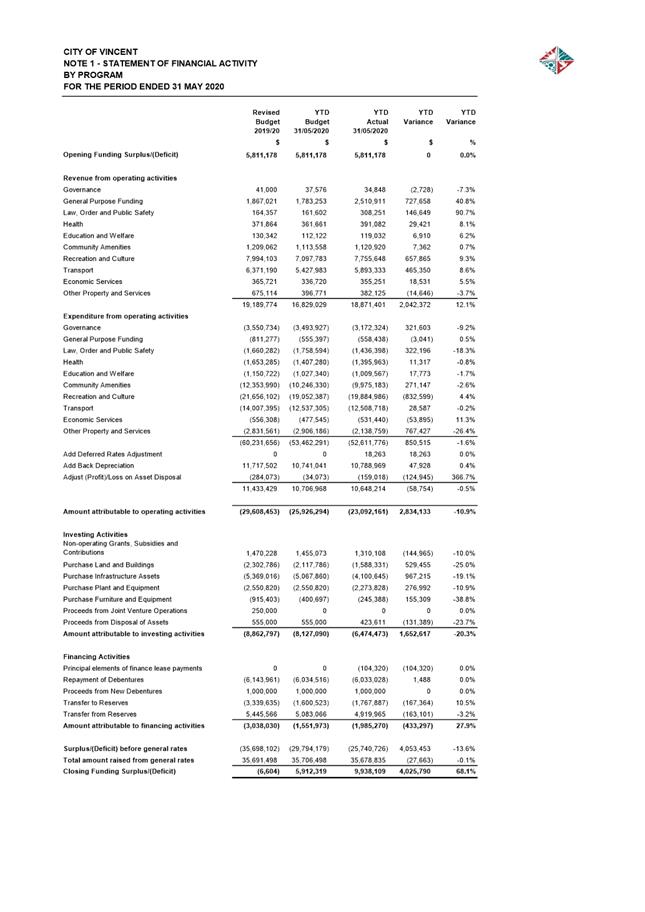

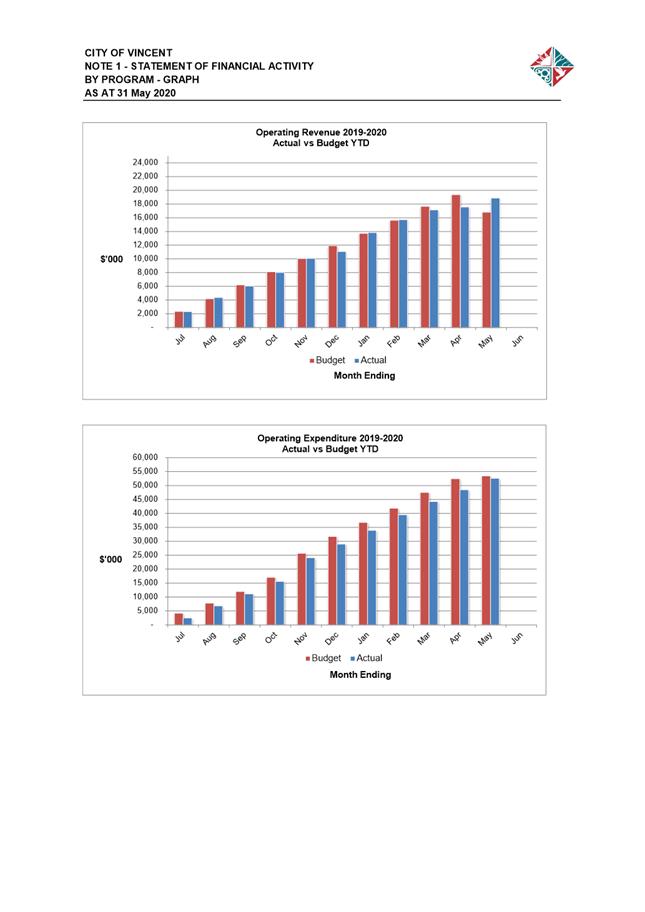

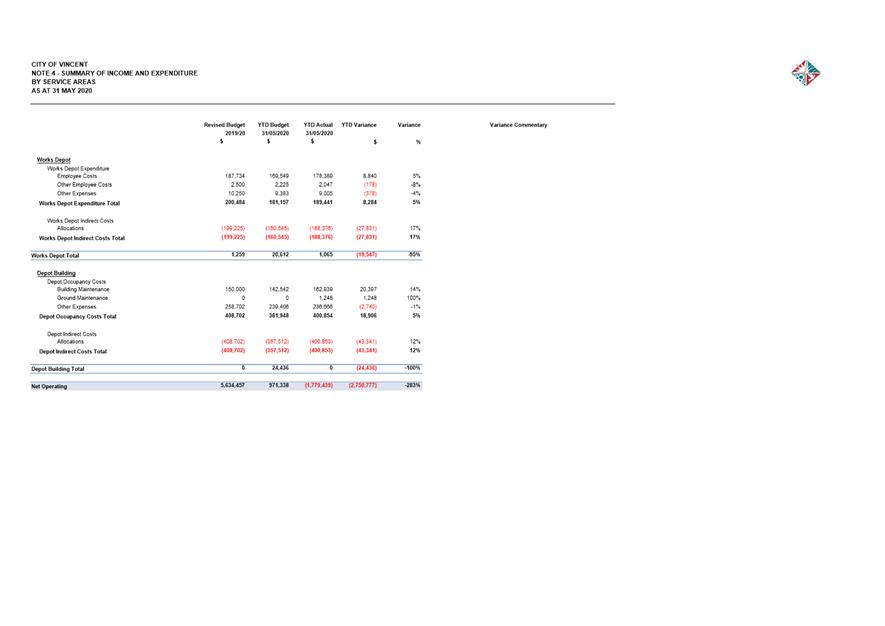

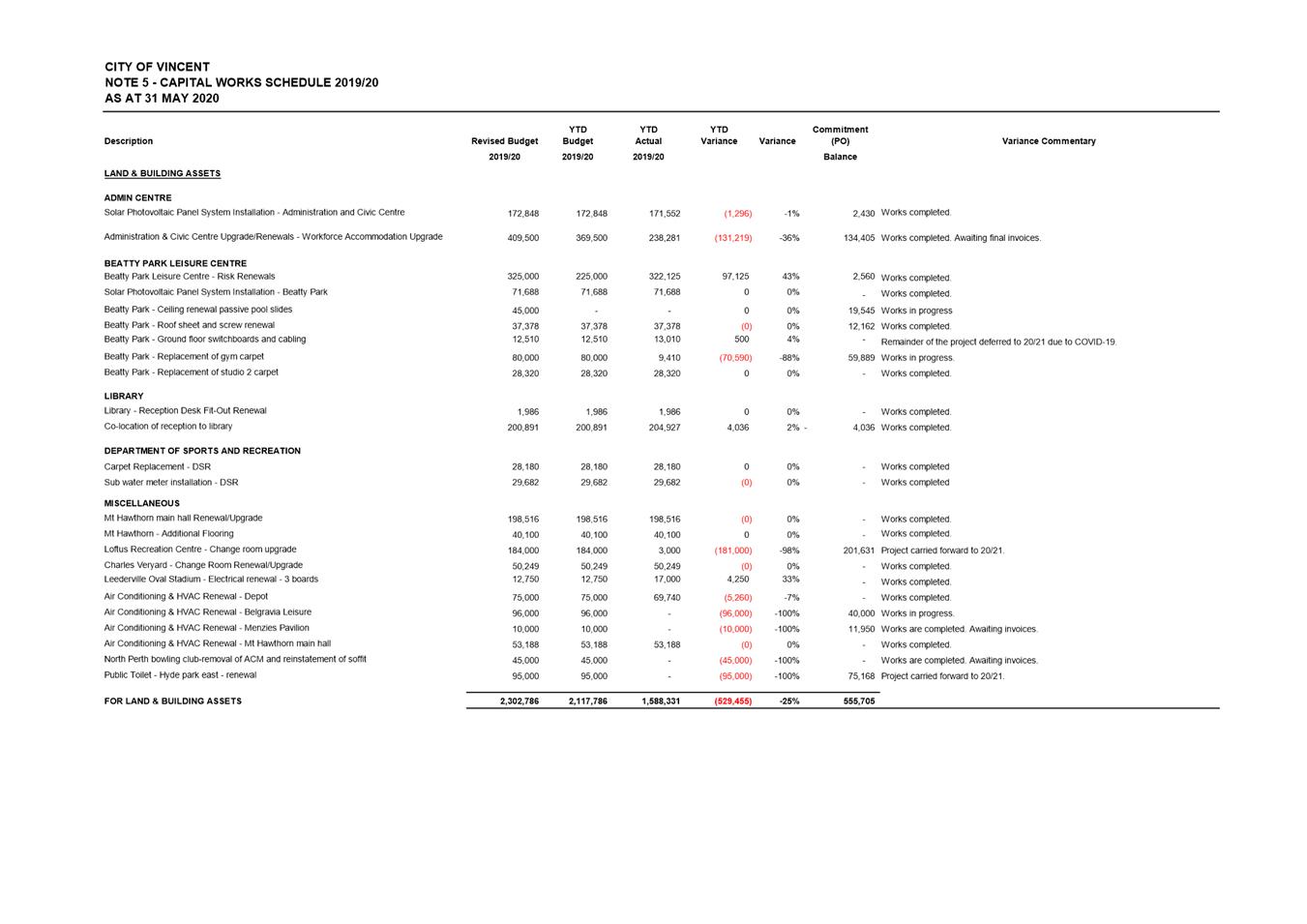

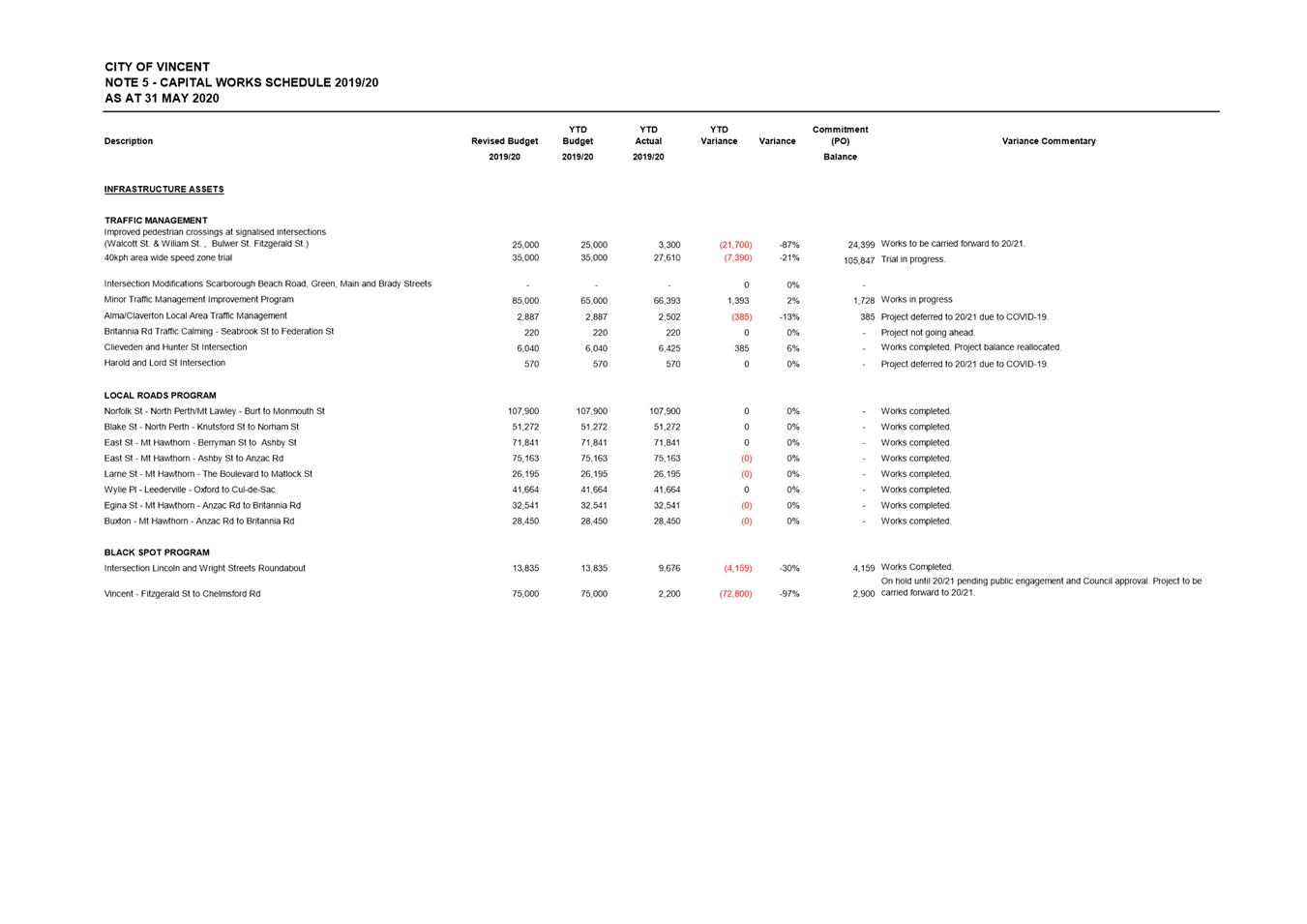

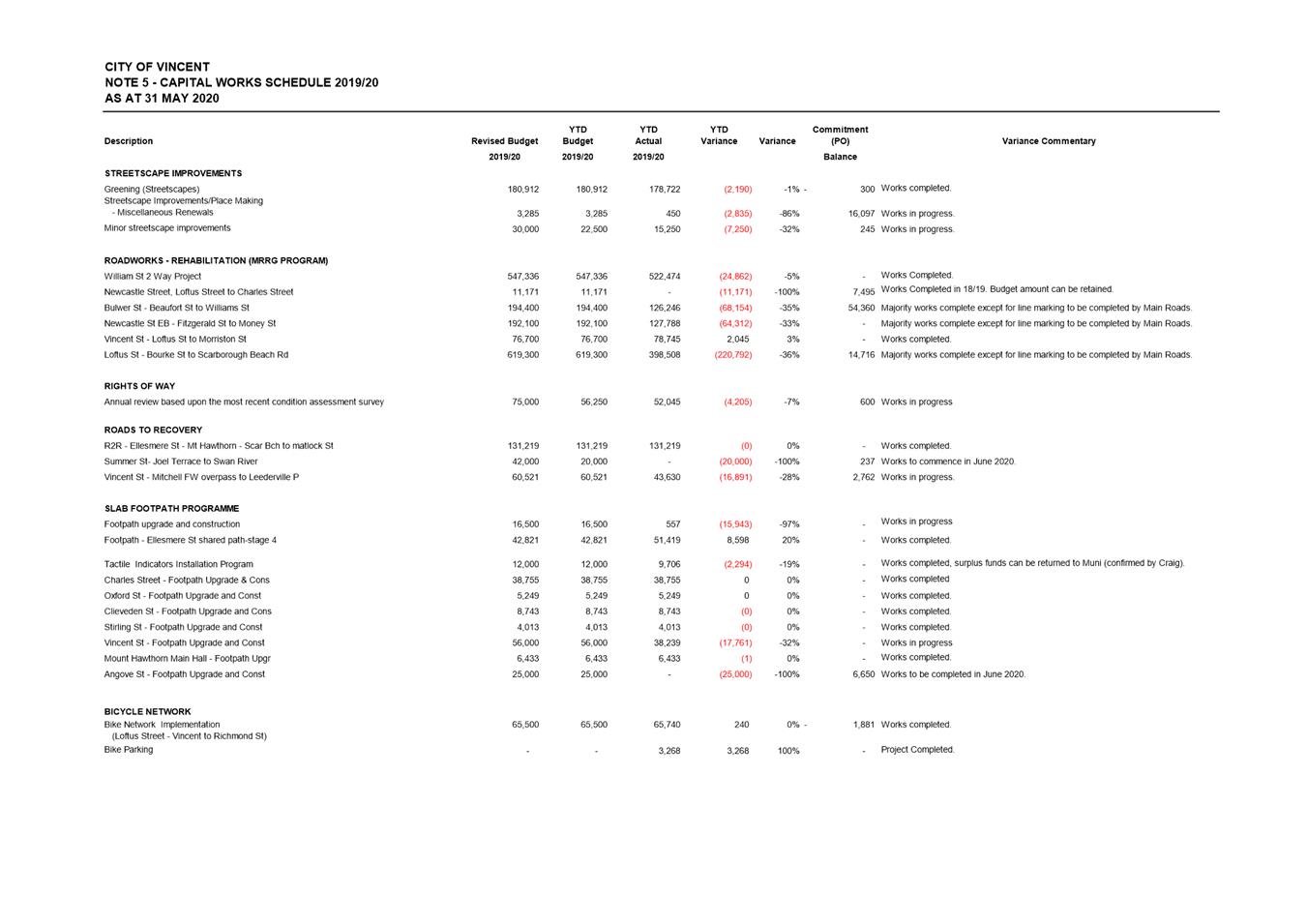

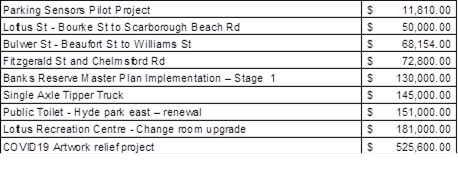

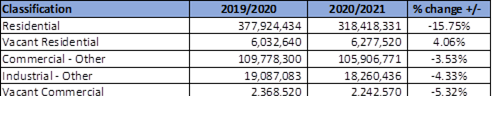

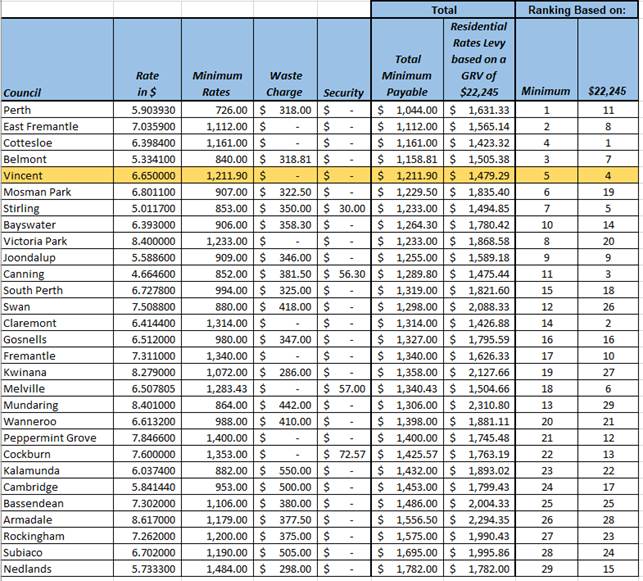

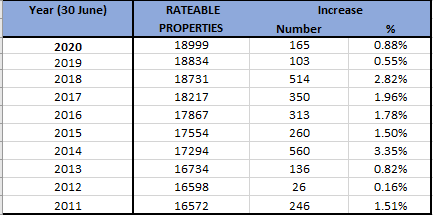

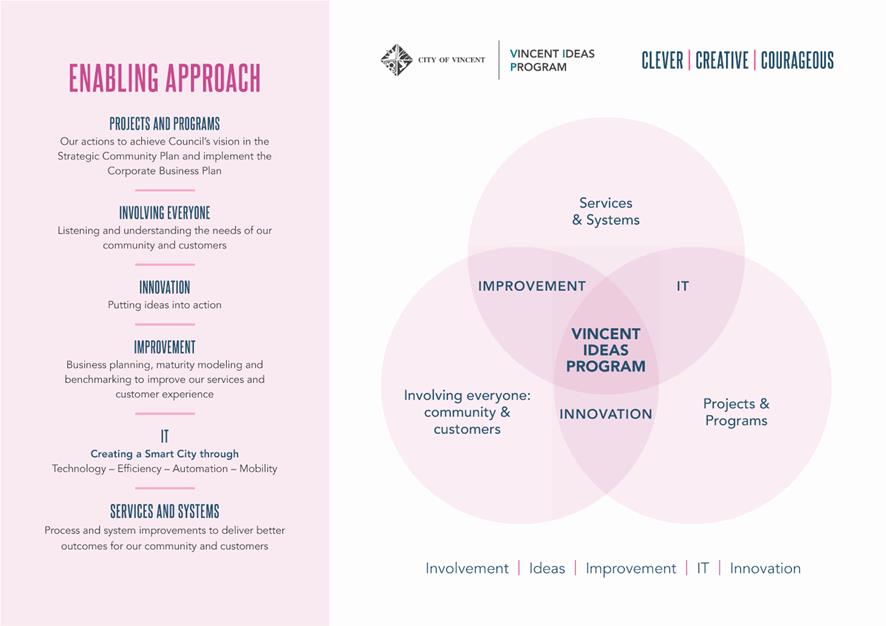

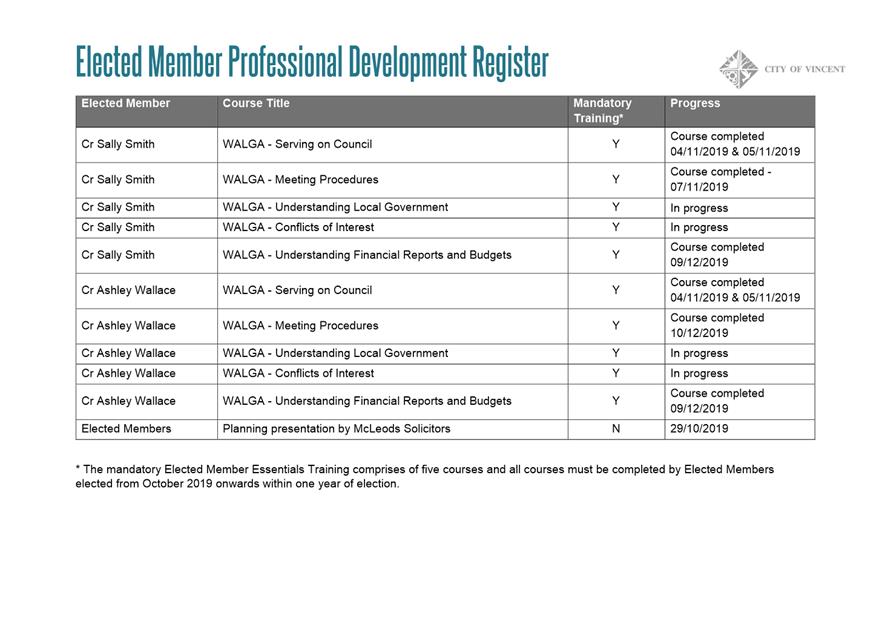

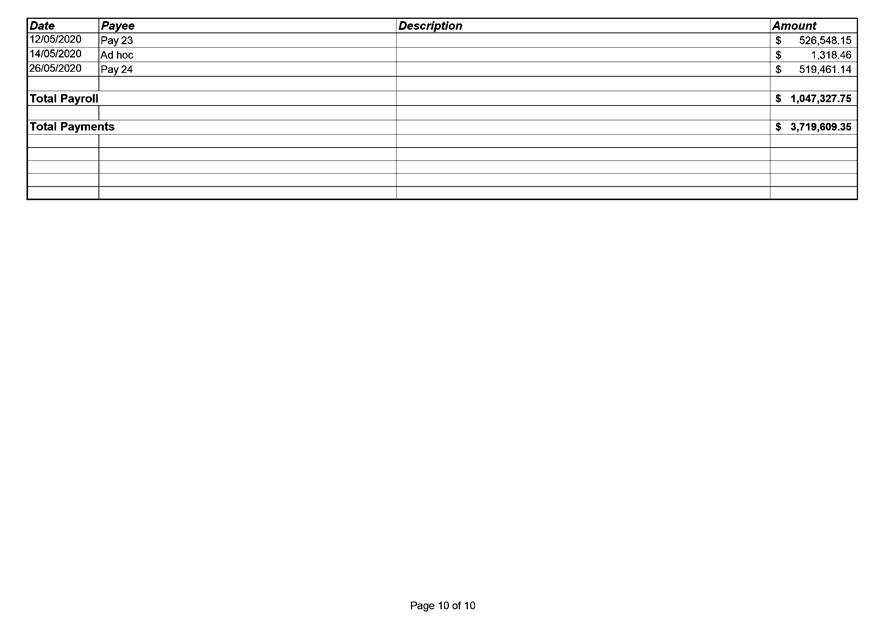

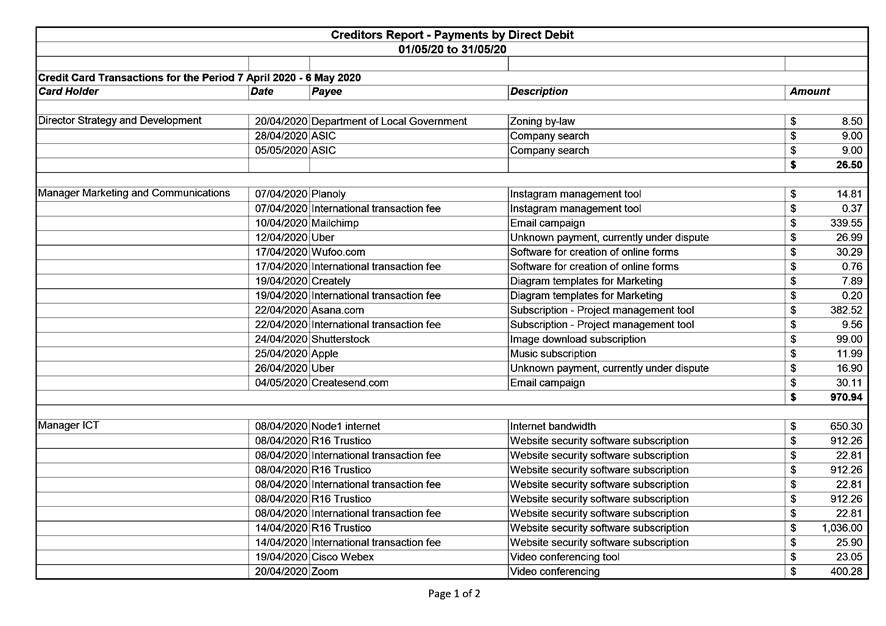

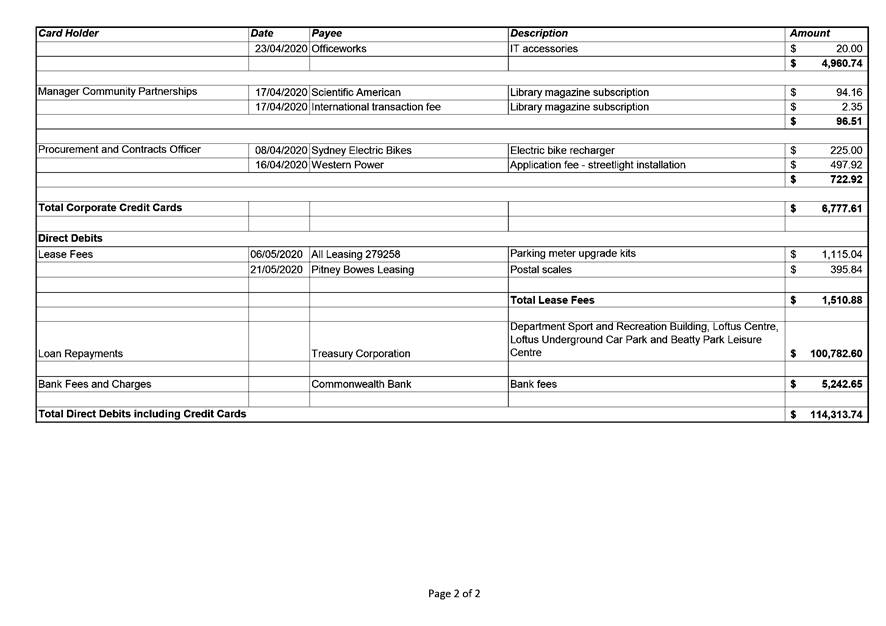

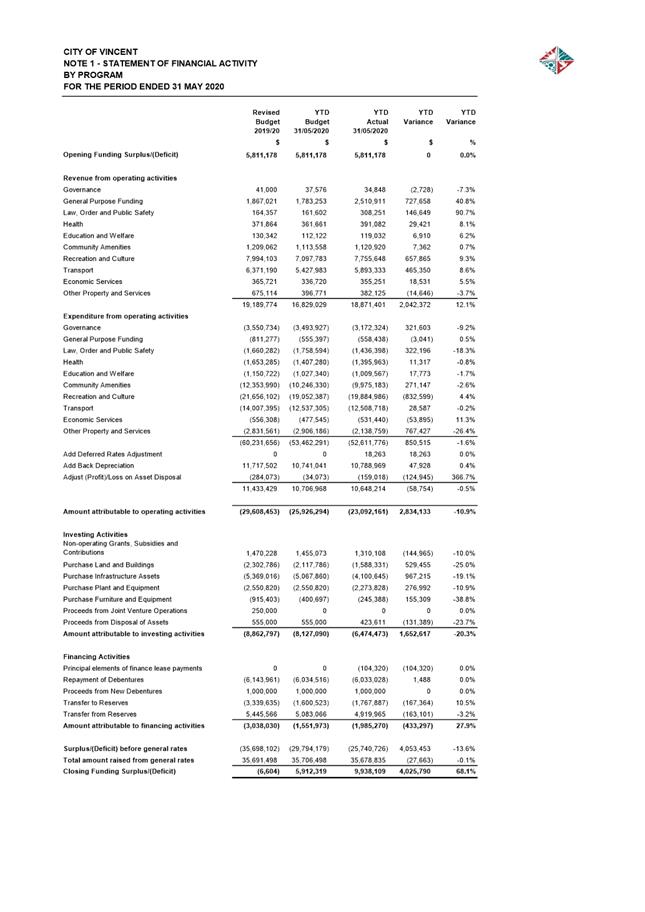

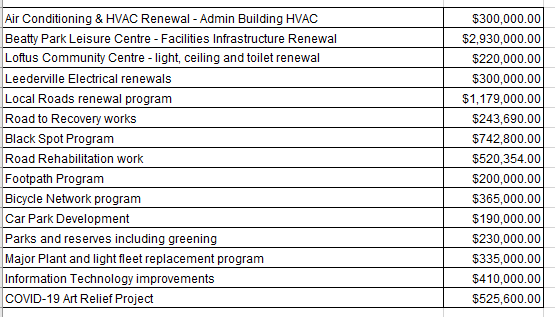

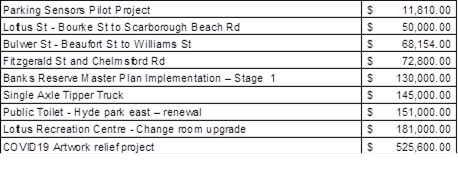

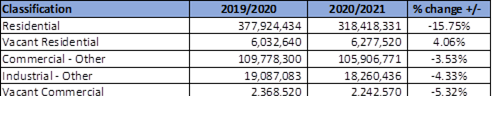

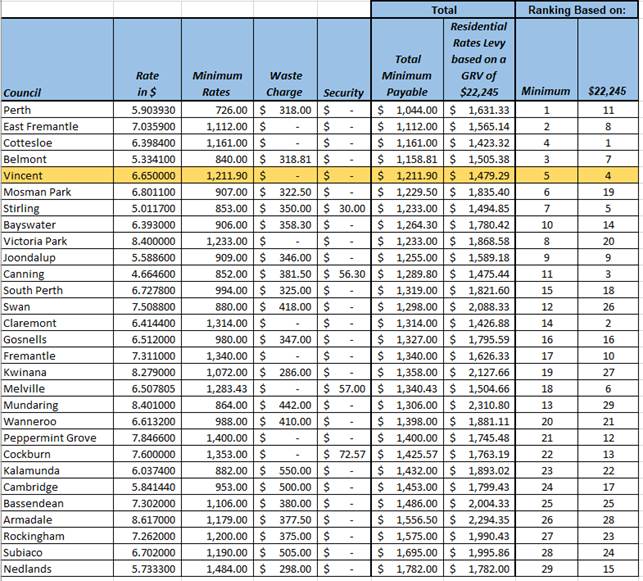

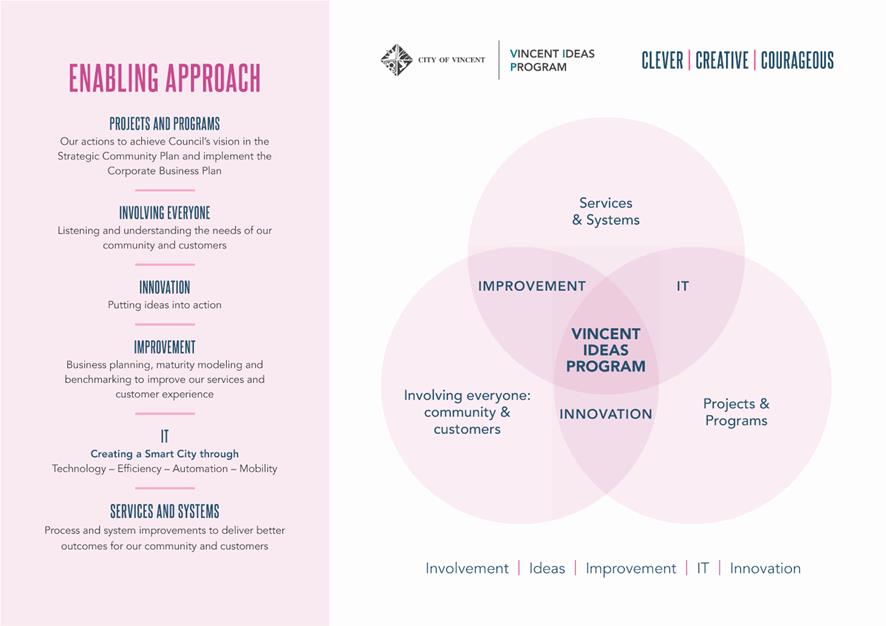

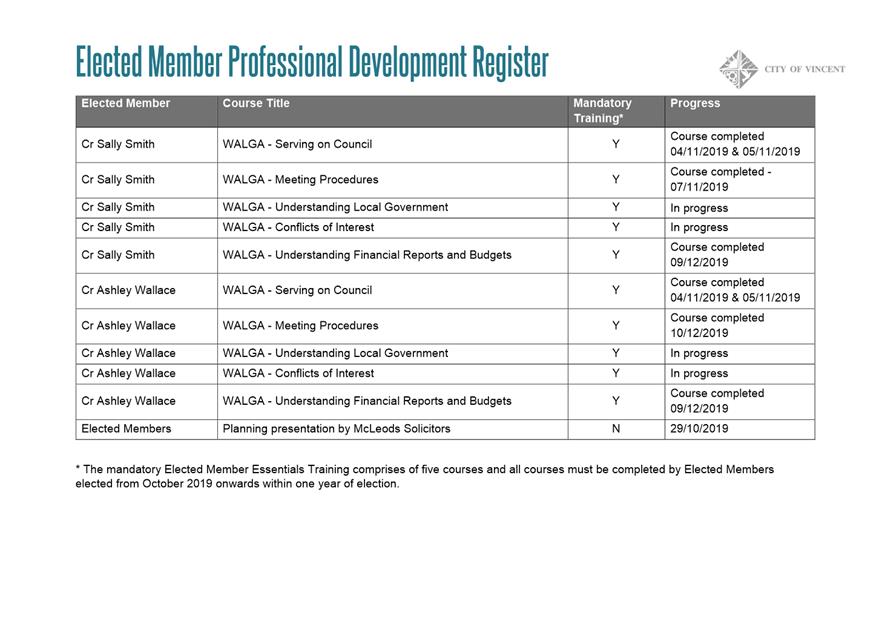

*Interest estimates for Leederville Gardens Inc.