AGENDA

Late Reports

Council Briefing

18 June 2019

|

Time: |

6pm |

|

Location: |

Administration and Civic Centre 244 Vincent Street, Leederville |

David MacLennan

Chief Executive Officer

AGENDA

Late Reports

Council Briefing

18 June 2019

|

Time: |

6pm |

|

Location: |

Administration and Civic Centre 244 Vincent Street, Leederville |

David MacLennan

Chief Executive Officer

Council Briefing Agenda 18 June 2019

7 Community and Business Services

7.1 Investment Report as at 31 May 2019

7.2 Authorisation of Expenditure for the Period 1 May 2019 to 31 May 2019

7.3 Financial Statements as at 31 May 2019

7.4 Adoption of 2019/20 Annual Budget [ABSOLUTE MAJORITY DECISION REQUIRED]

7.6 City Homelessness Framework Committee - Draft Action Plan

8.2 Community Budget Submissions 2019/20

8.7 Report and minutes of Audit Committee meeting held on 11 June 2019

9 Motions of Which Previous Notice Has Been Given

5.4 No. 11 (Lot: 4; S/P: 7727) Douglas Street, Perth - Proposed Change of Use to Unlisted Use (Dog Day Care)

TRIM Ref: D19/78781

Author: Fiona Atkins, Urban Planner

Authoriser: Jay Naidoo, Manager Development & Design

Ward: South

Attachments: 1. Consultation

and Location Map ⇩ ![]()

2. Daily Operations

and Procedures ⇩ ![]()

3. Waste Management

Plan ⇩ ![]()

4. Site Plan ⇩ ![]()

5. Traffic Impact

Report ⇩ ![]()

6. Strata Plan ⇩ ![]()

7. Signage Plans ⇩ ![]()

8. Acoustic Report ⇩ ![]()

9. Administration

Response to Summary of Submissions ⇩ ![]()

10. Applicant's Response to

Summary of Submissions ⇩ ![]()

11. Determination Advice Notes ⇩ ![]()

|

That Council, in accordance with Section 31 of the State Administrative Tribunal Act 2004, the provisions of the City of Vincent Local Planning Scheme No. 2 and the Metropolitan Region Scheme, SETS ASIDE the City’s decision of 18 March 2019 and APPROVES the application for the Change of Use to an Unlisted Use (Dog Day Care) at No. 11 (Lot: 4; S/P:7727) Douglas Street, Perth, in accordance with plans provided in Attachment 4, subject to the following conditions, with the associated determination advice notes in Attachment 11: 1. Use of Premises 1.1 The premises shall be used for the purposes of the care of dogs as detailed in the Daily Operations and Procedures date stamped 28 April 2019; 1.2 A maximum of 35 dogs per day shall be cared for at any one time; 1.3 The hours of operation shall be limited to between 6:30am and 5:30pm Monday to Friday; 1.4 The overnight boarding of dogs shall not permitted on the premises; 1.5 Dogs shall not be permitted in common areas on the site other than for access to and from the premises, and must be on a leash; and 1.6 The pick up and drop off of dogs shall be scheduled, being no less than 10 minutes apart, and for no more than four dogs being scheduled to be picked up or dropped off at any time; 2. Time Limited Approval This approval is granted for a term of 12 months from the date the use commences, after which time the use shall cease to operate unless a further approval is sought; 3. Operational Management Use of the premises shall be carried out in accordance with the Daily Operations and Procedures date stamped 28 April 2019 or any revised Procedure approved by the City. The Procedure shall be reviewed in within the first six months of the use commencing, with any changes identified during this review or by the City, being incorporated into an updated Procedure approved by the City as part of the review; 4. Waste Management 4.1 Waste shall be managed in accordance with the Waste Management Plan date stamped 3 December 2018; and 4.2 A plan indicating the location of a bin store of sufficient size and suitably accessible to accommodate the City’s bin requirement shall be lodged with and approved by the City prior to the commencement of the use. The bin store shall be provided in accordance with the plan approved by the City prior to the occupation or use of the development and to the satisfaction of the City; and 5. Bicycle Parking A minimum of four bicycle bays are to be provided onsite. Bicycle bays must be provided at a location convenient for staff to access. The bicycle facility shall be designed in accordance with AS2890.3. |

Purpose of Report:

To reconsider the City’s decision of 18 March 2019 to refuse an application for development approval for a Change of Use to an Unlisted Use (Dog Day Care) at No. 11 Douglas Street, Perth, as invited by the State Administrative Tribunal (SAT).

PROPOSAL:

The application proposes a Dog Day Care for a maximum of 35 dogs at any time within a tenancy that has two floors. The dogs would be managed by a maximum of four staff at any one time. The Dog Day Care is proposed to offer grooming, behavioural training and general day to day care of dogs that would include socialising with other dogs, feeding and playing.

The applicant has proposed the following as part of the operation of the use:

Operating Hours

Dogs would be present on-site Monday to Friday between 6:45am and 5:30pm, aside from dogs on their first day of dog day care that would arrive at 6:30am. The applicant is not proposing for the premises to be open on public holidays or on weekends.

New Clients

All new dogs would be required to arrive at 6.30am on their first day and would be assessed by a dog behaviourist/ day care supervisor to observe the dog’s behaviour and ability to interact with other dogs. This would take approximately an hour. The behaviourist/ day care supervisor would apply discretion as to whether a dog would be accepted.

Drop Off and Pick Up

The Dog Day Care would require clients to use an online booking system to confirm the dates and times in which their dog would attend the day care. The system would be set up with 10 minute intervals so that only a pre-arranged number of dogs could be dropped off between 6:45am and 9:00am and picked up between 4:00pm and 5:30pm. This is to assist with managing parking and to minimise the number of dogs being picked up and dropped off at any time.

Dogs that visit the premises for grooming only would also be booked in for day care, and would be required to also pre-book drop off and pick up dates and times. It is intended for grooming dogs to be picked up by 2:00pm to assist with managing parking when the majority of other dogs on the premises are collected from 4:00pm.

There are seven marked bays available on-site, plus available on-street parking along Newcastle Street and Douglas Street.

Rules and Requirements

All dogs attending the Dog Day Care are to be:

· At least 5 months of age;

· Up to date with all immunisations;

· Non-aggressive and non-protective over food or toys;

· Sterilised/ de-sexed;

· Using effective flea control;

· Dog and people friendly (no aggressive, dangerous and/ or dominant behaviour); and

· In good general health (no limping, lameness, contagious disease, parasites, illness or the like).

Dog Behaviour

If a dog becomes aggressive, barks excessively or seems distressed the following steps are taken:

· They are removed from the situation.

· Taken to the vacant playroom by the supervisor until calm.

· They are then encouraged back to the play area.

· If the situation persists the owner is contacted.

· Dog would be secluded until owner has arrived.

· Conduct report given to the owner upon pick up and the dog would not be welcome back.

The Daily Operations and Procedures setting out the management regime for the proposed Dog Day Care is included as Attachment 2. Floor plans of the proposal are included as Attachment 4.

The applicant is also proposing four bicycle racks to the rear of the premises and has advised that they are intending to install acoustic insulation on the common wall shared with neighbouring tenancy No. 9 Douglas Street. Details of this additional acoustic insulation has been not been provided to enable Administration to consider its appropriateness to effectively reduce noise emanating from the premises, and was not accounted for in the acoustic report submitted in support of the application. The additional acoustic insulation has not been included in the assessment of this proposal.

Background:

|

Landowner: |

Brunswick Holdings Pty Ltd |

|

Applicant: |

Amanda Deurloo |

|

Date of Application: |

4 December 2018 |

|

Zoning: |

MRS: Industrial LPS2: Zone: Commercial R Code: N/A |

|

Built Form Area: |

Mixed Use |

|

Existing Land Use: |

Warehouse |

|

Proposed Use Class: |

Unlisted Use (Dog Day Care) |

|

Lot Area: |

446m2 |

|

Right of Way (ROW): |

No |

|

Heritage List: |

No |

An application for development approval was submitted to the City on 4 December 2018. The application proposed the following:

· Four staff at any one time;

· A maximum of 45 dogs at any one time;

· Hours of operation being from Monday to Friday, 6:45am till 5:30pm; and

· Four parking bays provided for the exclusive use of the premises.

The proposal was advertised in accordance with Policy No. 4.1.5 - Community Consultation for a period of 21 days. A total of five objections were received, one submission expressing concern and one submission in support of the proposal.

The application was determined under delegated authority as not more than five objections were received. On 18 March 2019, Administration resolved to refuse the application for the following reasons:

1. The proposed use does not satisfy the objectives of the City of Vincent’s Local Planning Scheme No. 2 for the Commercial zone, as the development is proposed to operate at a scale and intensity that is not compatible or complimentary to the adjoining commercial development; and

2. Having regard to clause 67(m) and 67(n) of the Planning and Development (Local Planning Scheme) Regulations 2015, the proposed development is not considered compatible with the adjoining commercial uses due to the proposed scale and intensity of the use, which is considered to have a detrimental impact on the adjoining commercial tenancies.

On 5 April 2019, the applicant lodged an application for review with the State Administrative Tribunal (SAT) pursuant to Section 31 of the State Administrative Tribunal Act 2004. Through the SAT mediation process, the applicant has modified the proposal to address the reasons for refusal and the City has been invited to reconsider the modified proposal.

Details:

Summary Assessment

The table below summarises the planning assessment of the proposal against the provisions of the City of Vincent Local Planning Scheme No. 2 (LPS2), the City’s Policy No. 7.1.1 – Built Form and the Perth Parking Policy 2014. In each instance where the proposal requires the discretion of Council, the relevant planning element is discussed in the Detailed Assessment section following from this table.

|

Planning Element |

Use Permissibility/ Deemed-to-Comply |

Requires the Discretion of Council |

|

Land Use |

|

ü |

|

Car Parking |

ü |

|

|

Bicycle Facilities |

ü |

|

|

Signage |

|

ü |

Detailed Assessment

The deemed-to-comply assessment of the element that requires the discretion of Council is as follows:

|

Land Use |

|

|

Deemed-to-Comply Standard |

Proposal |

|

Local Planning Scheme No. 2

“P” Use |

Unlisted Use (Dog Day Care) |

|

Advertising Signs |

|

|

Deemed-to-Comply Standard |

Proposal |

|

Policy No. 7.5.2 – Signs and Advertising

Wall signs

Where placed directly over door openings, to have a minimum clearance of 2.7m from the finished ground level. |

The proposed signage would have a minimum clearance of approximately 2.0m above finished ground level. |

The above elements of the proposal do not meet the specified deemed-to-comply standards and are discussed in the Comments section below.

Consultation/Advertising:

Community consultation for the original application was undertaken in accordance with the Planning and Development (Local Planning Schemes) Regulations 2015 for a period of 21 days commencing on 9 January 2019 and concluding on 30 January 2019. Community consultation was undertaken by means of a sign on-site, a notice in the local newspaper, a notice on the City’s website and 19 letters being mailed to all adjoining owners and occupiers as shown in Attachment 1, in accordance with the City’s Policy No. 4.1.5 – Community Consultation.

A total of seven submissions were received, comprising five objections, one submission expressing concern and one submission of support. A summary of the concerns raised within the submissions is as follows:

· Concerns regarding noise;

· Concerns regarding odour;

· Parking issues, particularly during drop off and pick up time; with a high demand for street parking in the area;

· Dogs getting loose and becoming a nuisance; and

· Other tenants leaving due to the noise produced and intensity of proposed use.

The amended proposal that is the subject of this report was advertised for a period of 14 days, commencing 1 May 2019 and concluding on 15 May 2019. The application was advertised for a 14 day period as established with the SAT during mediation. Community consultation was undertaken by means of written notification being mailed to all adjoining owners and occupiers that were previously consulted with and a notice on the City’s website.

A total of eight submissions were received, comprising seven objections and one submission in support. A summary of the main concerns raised within the submissions is as follows:

· The number of dogs cared for on site would exceed 35;

· The lack of suitable car parking available on site for pick up/ drop off and resultant parking issues with a high demand for street parking in the area;

· Health and hygiene concerns;

· Concerns regarding noise;

· Concerns regarding odour, health and hygiene, including inadequate storage of faeces;

· Dogs getting loose and becoming a nuisance;

· Impact on the rear yard which is a shared space with other tenancies;

· Unsuitability of the use in the area; and

· The use being inconsistent with the objectives of the Commercial zone, and incompatible and detrimental to the amenity of the adjoining commercial properties and residential properties in the locality.

The applicant has provided a response to the submissions and this is included as Attachment 9. A summary of submissions and Administration’s comments are provided in Attachment 10.

Design Review Panel (DRP):

Referred to DRP: No

Legal/Policy:

· Planning and Development Act 2005;

· Planning and Development (Local Planning Schemes) Regulations 2015;

· City of Vincent Local Planning Scheme No. 2;

· Policy No. 4.1.5 – Community Consultation;

· Policy No. 7.5.2 - Signs and Advertising; and

· Perth Parking Policy 2014.

Local Planning Scheme No. 2

The proposed land use is not specifically identified in the land use table in LPS2 and could not reasonably be determined as falling within the interpretation of one of the listed uses in LPS2. The proposal is considered as an Unlisted Use. In accordance with Clause 18(4) where a use class is not specifically referred to in the zoning table, the City is to:

(a) Determine that the use is consistent with the objectives of a particular zone and is therefore a use that may be permitted in the zone subject to conditions imposed by the local government; or

(b) Determine that the use may be consistent with the objectives of a particular zone and give notice under clause 64 of the deemed provisions before considering an application for development approval for the use of the land; or

(c) Determine that the use is not consistent with the objectives of a particular zone and is therefore not permitted in the zone.

Council is required to consider if the use is consistent with the objectives of the Commercial zone. LPS2 includes the following objectives for the Commercial zone:

· To facilitate a wide range of compatible commercial uses that support sustainable economic development within the City.

· To ensure development design incorporates sustainability principles, with particular regard to waste management and recycling and including but not limited to solar passive design, energy efficiency and water conservation.

· To maintain compatibility with the general streetscape, for all new buildings in terms of scale, height, style, materials, street alignment and design of facades.

· To ensure that development is not detrimental to the amenity of adjoining owners or residential properties in the locality.

Delegation to Determine Applications:

This matter has been referred to Council in accordance with the City’s Delegated Authority Register as the application received more than five objections during the community consultation period.

Risk Management Implications:

There are minimal risks to Council and the City’s business function when Council exercises its discretionary power to determine a planning application.

Strategic Implications:

This is in keeping with the City’s Strategic Community Plan 2018-2028:

Innovative and Accountable

We are open and accountable to an engaged community.

SUSTAINABILITY IMPLICATIONS:

Nil.

Financial/Budget Implications:

Nil.

Comments:

Land Use

The application proposes a day care for up to 35 dogs, with a maximum of four staff. Activities on site would include grooming, behavioural training and general day to day care of dogs including playing, resting and feeding. The dogs would be accommodated within numerous rooms over two levels within the subject tenancy.

Objections were received during the community consultation period identifying the use as being a source off noise and odour emissions and incompatible with other existing land uses sensitive to these emissions.

The subject tenancy abuts an interior design business at 9 Douglas Street, and beyond this a coffee roasting business at No. 7 Douglas Street. Office tenancies are located to the north of the site on Newcastle Street. The subject tenancy is located within a Commercial zone as per LPS2, and is also within the City’s West End Arts Precinct. The surrounding commercial area is reasonably well tenanted and contains a variety of commercial and industrial uses, including art galleries, offices, and panel beating shops. The locality is bound by Newcastle Street, Loftus Street and Leederville Parade, with the Graham Farmer Freeway also in close proximity.

An objective of the Commercial zone in LPS2 is ‘to ensure that development is not detrimental to the amenity of the adjoining owners or residential properties in the locality’. The City’s reasons for refusal of the original application were related to the number of dogs proposed at the site and the potential impacts of the proposal on the surrounding area not being adequately managed. The management plans provided by the applicant were not considered to satisfactorily mitigate the potential issues created by 45 dogs at the subject site. For these reasons, Administration determined that 45 dogs on site with the management regime proposed at the time would not be compatible or complimentary to the adjoining land uses.

The applicant has made changes to their proposal in order to address the reasons for refusal. The revised proposal includes a reduction in the maximum number of dogs to 35. The Daily Operations and Procedures, included as Attachment 2, has also been updated to provide further detail of how dogs would be managed, particularly in relation to antisocial dogs or behaviour which may be considered to cause a nuisance, as well as adopting an approach of online bookings in order to stagger pick up and drop off to address car parking availability.

The proposed use is considered to meet the objectives of the Commercial zone for the following reasons:

· The revised proposal to accommodate a reduced number of 35 dogs is supported by an updated detailed operational procedure and management plan that would reduce the scale and intensity of the Dog Day Care use;

· The site is located within an established Commercial area that accommodates a wide range of non‑residential land uses. These uses have varying scales and intensities, and varying degrees of impact on the amenity of the area. The modified proposal would be consistent and compatible with the prevailing non-residential land uses in the area;

· The applicant has prepared and provided reports and management plans relating to traffic, noise and waste to demonstrate compliance with relevant requirements, and to reduce and minimise adverse off-site impacts on the amenity of adjoining owners. The Dog Day Care conducted in accordance with the management practices proposed to be put in place would not compromise the amenity of the locality;

· The nearest residential property to the subject site is approximately 60 metres to the north across Newcastle Street and the use would not have adverse impacts on these residents; and

· There is existing ambient noise from the area’s location adjacent and nearby to major transport corridors which produce transport noise from passing traffic, and from existing non-residential land uses.

Signage

The application proposes signage at the front and rear of the property to advertise the business logo and name, being ‘Happy Tails Doggy Daycare’. Plans of the signage are included in Attachment 7.

The signage is proposed to have a minimum clearance of 2.0 metres in lieu of the required 2.7 metres between the bottom of the sign and the natural ground level as per the requirements of the City’s signage policy. The purpose of this policy requirement is to ensure that signage is of sufficient height above ground level to allow clearance and to ensure that it does not pose a safety threat to passing pedestrians.

The signs are supported for the following reasons:

· The signs are proposed to be positioned clear from the top of the entry and exit doors, and to be fixed flat against the external walls of the tenancies;

· The number and size of the walls signs are consistent with that permitted under the Policy No. 7.5.2 – Signs and Advertising;

· The signage is commensurate with the need for advertising activities offered from the premises;

· The signage is not proposed to be illuminated or contain flashing or running lights; and

· The colour and design of the signage would not be detrimental to the quality of the Commercial area.

Vehicle Parking and Bicycle Parking

The subject tenancy is located within the Department of Transport’s Perth Parking Management Area. The City’s Policy No. 7.7.1 - Non Residential Parking Requirements do not apply. The Perth Parking Management Area has a requirement for a maximum number of bays dependant on the location of the site. The maximum number of bays required for this site is 200 bays.

Objections were received during community consultation identifying that the arrangements for car parking and drop off and pick up of dogs were uncertain, difficult to manage and would result in inadequate car parking.

The applicant has stated that the subject tenancy shares eight parking bays with the two other tenancies on the site, being Nos. 7 and 9 Douglas Street. The applicant is of the view that the tenant of No. 11 Douglas Street is entitled to 54 per cent of the parking bays, with Nos. 7 and 9 Douglas Street entitled to 23 per cent each. This would equate to four bays being allocated to No. 11 Douglas Street and two bays each to Nos. 7 and 9. Of the bays available on-site, one is a disabled access bay and one is a loading bay.

There are seven marked bays on-site. The area on-site accommodating car parking is shown as common property on the strata plan, included as Attachment 6. The allocation of bays is to be determined by the strata owners. In the absence of any documentation confirming alternative arrangements, it is not clear what right the applicant has to exclusively use four car parking bays on-site. There are no bays sign posted or marked on-site for exclusive use by tenancies.

The car parking arrangements for the use is supported having regard for the following:

· The Dog Day Care would increase the traffic coming and going from the site during drop off and pick up times. The application proposes that dogs would be dropped off between 6:45am and 9:00am (aside from new dogs that would be dropped off at 6.30am) and picked up between 4:00pm and 5:30pm, Monday to Friday (excluding public holidays). No dogs would be kept on-site overnight. The amended proposal includes the need for clients to book online so as they are allocated a 10-15 minute drop off and pick up window, in an effort to reduce the potential for traffic and parking issues. The applicant has advised that there would not be more than four dogs scheduled to be dropped off or pick up at any time. The reduction in the number of maximum dogs from 45 to 35 would decrease the number of trips to and from the site, and staggered pick up and drop off times would limit the maximum number of clients on the premises at any one time. This would assist in reducing the impact on parking and traffic around the site.

· Aside from on-site car parking bays available to all tenancies, clients dropping and picking up their dogs would be able to utilise on-street parking which is available in the surrounding area, including:

o Eight half-hour parking bays available on Douglas Street;

o Two quarter-hour parking bays on Newcastle Street near the corner of Douglas Street;

o Seven two-hour parking bays on Newcastle Street between Douglas Street and Tandy Street;

o 12 two-hour parking bays along Drummond Street, in close proximity to the Douglas Street entrance; and

o Additional time limited parking located further along Drummond Street.

The time limit of these street parking bays applies from 8:00am to 5:30pm Monday to Friday. The City’s survey data on the street parking on Douglas Street collected for three separate days in November 2018 indicates that the occupancy rate was approximately 75 percent. It is considered that there are sufficient car parking bays in close proximity to the site to support the pick up and drop off of dogs.

· The subject tenancy’s location in Perth means that it is accessible by foot for clients in the surrounding area, and this provides an alternate mode of transport for pick up and drop off for customers. The site is accessible via public transport, with the nearest bus stops on Newcastle Street being approximately 100 metres from the subject site and City West and Leederville train stations each being 900 metres away from the subject site. Although public transport may not assist for the pickup and drop off of the dogs, the availability of public transport would assist in alleviating the demand for staff parking at the site. Four bicycle racks for staff use are also proposed to be installed at the rear of the property. The applicant has confirmed that staff would be required to catch public transport or cycle to the site, with only the manager’s car intended to be on-site. Though it is difficult to mandate that all staff must use alternate modes of transport to attend the site, the accessibility of the site may encourage this and reduce the reliance on driving.

· The proposed Unlisted Use (Dog Day Care) is compliant with the requirements of the Perth Parking Management Area, presenting no variation to the required maximum number of bays permitted.

The accessible nature of the site, pick up and drop off arrangements and the prevalence of time limited street parking in the area means that the impacts of car parking and traffic can be adequately managed so as to not have a negative impact on the amenity of the surrounding area.

Waste Management

Objections were received during community consultation regarding odour from dog faeces.

The applicant has submitted a Waste Management Plan to demonstrate how dog faeces would be managed and removal from the site. A copy of the Waste Management Plan is included as Attachment 3.

The applicant is intending to immediately collect all faeces during the day using a plastic bag and store the faeces in a large freezer, which would be used as a storage receptacle until the rubbish collection days. The freezing would decrease any odour or disease that may otherwise be generated by the proposed amount of waste. The applicant would be contracting Cleartech Waste Management for the dog faeces removal. The faeces would be collected on Tuesdays and Fridays, so as not to coincide with the waste and recycling collection by the City that occurs on Wednesday. The applicant has also provided a list of their hygiene and cleaning standards and requirements to ensure that odour is controlled and pests are effectively managed.

Administration is satisfied that the Waste Management Plan would mitigate the potential for odour from the proposed business, and is compliant with the relevant health and environment legislation. A condition of approval has been recommended to require the on-going implementation of the identified waste management measures by the operator, to the satisfaction of the City. A bin enclosure is also required to be provided on-site for the storage, cleaning and maintenance of bins as required under the City’s Health Local Law 2004. This has been recommended as a condition of development approval.

Safety and Nuisance

Concerns were raised during community consultation regarding the safety and nuisance associated with having a Dog Day Care in this location and that some dogs may not be controlled in common areas outside of the tenancy in common areas and demonstrate aggressive behaviour.

The subject tenancy has numerous rooms within the building that would allow the dogs to be contained to ensure they would not escape from the building and onto public streets or other properties. All dogs would be required to be on leash when entering and exiting the premises to further limit the risk of dogs escaping from an owner’s control.

The applicant has advised that aggressive dogs would not be accepted at the Dog Day Care and that all new dogs would be assessed by a staff member trained in animal behaviour prior to being accepted.

The applicant has confirmed that the common area at the rear of Nos. 7-11 Douglas Street is not going to be used by the dogs and does not form part of the proposal. The applicant has advised that the staff may use the rear area to sit during their breaks, but would not be used for play or toileting of the dogs.

It is recommended that any approval granted includes a condition that dogs are not permitted into the common areas of the strata lot except for entry and exit to the site, and must be on a leash when doing so.

Noise

Objections were received during community consultation regarding noise emitted from barking dogs and how this would be managed.

The applicant submitted an acoustic report prepared by a qualified acoustic consultant, Acoustics & Audio Production dated 30 November 2018, in support of the proposed use. The report was updated during the assessment process to include specific reference to noise impacts on Nos. 7 and No. 9 Douglas Street and has been included as Attachment 8.

The acoustic assessment has been prepared on the assumption that well managed dog care facilities that have adequate management practices would limit noise emissions from barking dogs and that dog barking is restricted. The report findings are based on 10 dogs barking at the same time and present for less than 10 percent of the time. The report sets out that this is an unlikely event as the dogs would be under constant supervision of a carer.

The level of noise permitted within a Commercial area under the Environmental Protection (Noise) Regulations 1997 is higher than the noise level permitted within a residential area, allowing varied uses to operate within these areas. The report concludes that the proposed Dog Day Care would comply with the required noise levels as per the Environmental Protection (Noise) Regulations 1997 when measured at nearby and adjoining commercial properties, including Nos. 7 and 9 Douglas Street. Although the subject tenancy does share a wall with a tenancy accommodating an interior design showroom and office, the noise generated would still remain compliant with the requirements of the Environmental Protection (Noise) Regulations 1997. The report was prepared in support of the previous application and is based on noise generated from 45 dogs on-site. As the amended application proposes a reduced number of up to 35 dogs, the noise produced from the site would continue to comply with noise limits.

In relation to dog behaviour and management, the applicant has also advised that if a dog does not settle at the day care centre and continues to bark and/ or whine it would be provided with one on one time with a staff member to calm the dog and address the behaviour. Staff would have knowledge of dog behaviour and training techniques. If the situation with the dog cannot be resolved the owners would be contacted to collect the dog.

Time Limited Approval

The Dog Day Care use could be conducted without generating nuisance detrimental to the amenity of the area through the implementation of the detailed operational and management regime set out by the applicant. The use is supported on this basis. The proposal is reliant on the application of the detailed management arrangements to control noise, odour and parking availability. Having regard for community concerns, it is acknowledged that there is no certainty that the management practices would be maintained at a level that would avoid nuisance to neighbouring properties, as well as the practicality of its implementation day to day, such as the staggered pick up and drop off arrangements.

A time limited approval is available to Council and it is recommended that an initial approval be issued for a 12 month period. This would allow the applicant to demonstrate that the use can be managed successfully and provides an opportunity to monitor its operation so that the management procedure can be reviewed. The applicant would be required after the 12 month period to re-apply for development approval to continue to operate. Any such application would be advertised to the surrounding owners and occupants before being determined.

7 Community and Business Services

TRIM Ref: D19/83592

Author: Nirav Shah, Coordinator Financial Services

Authoriser: Michael Quirk, Executive Director Community and Business Services

Attachments: 1. Investment

Report 31 May 2019 ⇩ ![]()

|

That Council NOTES the Investment Report for the month ended 31 May 2019 as detailed in Attachment 1. |

Purpose of Report:

To advise Council of the nature and value of the City’s investments as at 31 May 2019 and the interest earned year to date.

Background:

The City’s surplus funds are invested in bank term deposits for various terms to facilitate maximum investment returns in accordance to the City’s Investment Policy (No. 1.2.4).

Details of the investments are included in Attachment 1 and outline the following information:

· Investment performance and policy compliance charts;

· Investment portfolio data;

· Investment interest earnings; and

· Current investment holdings.

Details:

The City’s investment portfolio is diversified across several accredited financial institutions.

As at 31 May 2019, the total funds held in the City’s operating account (including on call) is $33,384,520, compared to $30,338,407 for the period ending 31 May 2018. This position is as a result of year to date capital expenditure being underspent relative to the year to date budget.

Total term deposit investments for the period ending 31 May 2019 are $29,469,158 compared to $31,019,902 in the previous month. The decrease in the balance of term deposits is to ensure cash flows are managed effectively to accommodate operational needs.

The following Table shows funds under management for the previous and current year:

|

Month |

2017/18 |

2018/19 |

||

|

Ended |

Total funds held |

Total term deposits |

Total funds held |

Total term deposits |

|

July |

$23,433,728 |

$21,212,649 |

$26,826,861 |

$23,990,516 |

|

August |

$30,161,860 |

$27,714,651 |

$44,327,708 |

$37,499,275 |

|

September |

$40,305,364 |

$37,944,911 |

$44,209,274 |

$40,651,147 |

|

October |

$41,087,462 |

$38,947,823 |

$44,463,021 |

$41,180,325 |

|

November |

$41,716,473 |

$39,482,047 |

$44,188,761 |

$42,678,504 |

|

December |

$38,768,084 |

$37,065,389 |

$40,977,846 |

$38,667,039 |

|

January |

$39,498,741 |

$36,147,499 |

$42,109,674 |

$35,225,189 |

|

February |

$39,217,278 |

$36,665,928 |

$44,227,308 |

$36,178,794 |

|

March |

$36,377,700 |

$34,622,001 |

$39,157,958 |

$32,739,750 |

|

April |

$33,647,074 |

$31,177,278 |

$36,427,902 |

$31,019,902 |

|

May |

$30,338,407 |

$28,712,736 |

$33,384,520 |

$29,469,158 |

|

June |

$28,409,157 |

$24,687,341 |

- |

- |

Total accrued interest earned on investments as at 31 May 2019 is:

|

|

Annual Budget |

YTD Budget |

YTD Actual |

% of YTD Budget |

|

Municipal |

$420,000 |

$404,600 |

$501,154 |

123.86% |

|

Reserve |

$226,060 |

$206,000 |

$268,488 |

130.33% |

|

Sub-total |

$646,060 |

$610,600 |

$769,642 |

126.05% |

|

|

||||

|

Leederville Gardens Inc. Surplus Trust* |

$0 |

$0 |

$129,660 |

N/A |

*Interest estimates for Leederville Gardens Inc. Surplus Trust were not included in the 2018/19 Budget as actual interest earned is held in trust that is restricted.

The City has obtained a weighted average interest rate of 2.47% for current investments including the operating account and 2.70% excluding the operating account. The Reserve Bank 90 days accepted bill rate for May 2019 is 1.54%. As summarised in the table above, year to date actual interest earnings are tracking higher than the year to date budgeted amount.

Sustainable investments

The City’s Investment Policy states that preference “is to be given to investments with institutions that have been assessed to have no current record of funding fossil fuels, providing that doing so will secure a rate of return that is at least equal to alternatives offered by other institutions”. Administration currently uses Marketforces.org.au to assist in assessing whether a bank promotes non-investments in fossil fuel related entities.

As at 31 May 2019, 37.36% of the City’s investments are held in financial institutions considered to be investing in non-fossil fuel related activities.

Consultation/Advertising:

Nil.

Legal/Policy:

The power to invest is governed by the Local Government Act 1995.

6.14. Power to invest

(1) Money held in the municipal fund or the trust fund of a local government that is not, for the time being, required by the local government for any other purpose may be invested as trust funds under the Trustees Act 1962 Part III.

(2A) A local government is to comply with the regulations when investing money referred to in subsection (1).

(2) Regulations in relation to investments by local governments may —

(a) make provision in respect of the investment of money referred to in subsection (1); and

[(b) deleted]

(c) prescribe circumstances in which a local government is required to invest money held by it; and

(d) provide for the application of investment earnings; and

(e) generally provide for the management of those investments.

Further controls are established through the following provisions in the Local Government (Financial Management) Regulations 1996:

19. Investments, control procedures for

(1) A local government is to establish and document internal control procedures to be followed by employees to ensure control over investments.

(2) The control procedures are to enable the identification of —

(a) the nature and location of all investments; and

(b) the transactions related to each investment.

19C. Investment of money, restrictions on (Act s. 6.14(2)(a))

(1) In this regulation —

authorised institution means —

(a) an authorised deposit‑taking institution as defined in the Banking Act 1959 (Commonwealth) section 5; or

(b) the Western Australian Treasury Corporation established by the Western Australian Treasury Corporation Act 1986;

foreign currency means a currency except the currency of Australia.

(2) When investing money under section 6.14(1), a local government may not do any of the following —

(a) deposit with an institution except an authorised institution;

(b) deposit for a fixed term of more than 3 years;

(c) invest in bonds that are not guaranteed by the Commonwealth Government, or a State or Territory government;

(d) invest in bonds with a term to maturity of more than 3 years;

(e) invest in a foreign currency.

Council has delegated the authority to invest surplus funds to the Chief Executive Officer or his delegate to facilitate prudent and responsible investment.

Administration has established guidelines for the management of the City’s investments, including maximum investment ratios as shown in the following table:

|

Short Term Rating (Standard & Poor’s) or Equivalent |

Direct Investments Maximum % with any one institution |

Managed Funds Maximum % with any one institution |

Maximum % of Total Portfolio |

|||

|

Policy |

Current position |

Policy |

Current position |

Policy |

Current position |

|

|

A1+ |

30% |

24.7% |

30% |

Nil |

90% |

52.8% |

|

A1 |

25% |

3.0% |

30% |

Nil |

80% |

3.0% |

|

A2 |

20% |

19.8% |

n/a |

Nil |

60% |

44.2% |

Risk Management Implications:

Low: Administration has developed effective controls to ensure funds are invested in accordance with the City’s Investment Policy. This report enhances transparency and accountability for the City’s investments.

Strategic Implications:

This is in keeping with the City’s Strategic Community Plan 2018-2028:

Innovative and Accountable

Our resources and assets are planned and managed in an efficient and sustainable manner.

Our community is aware of what we are doing and how we are meeting our goals.

Our community is satisfied with the service we provide.

We are open and accountable to an engaged community.

SUSTAINABILITY IMPLICATIONS:

Nil.

Financial/Budget Implications:

The financial implications of this report are as noted in the details section of the report. Administration is satisfied that appropriate and responsible measures are in place to protect the City’s financial assets.

TRIM Ref: D19/80024

Author: Nikki Hirrill, Accounts Payable Officer

Authoriser: Michael Quirk, Executive Director Community and Business Services

Attachments: 1. Payments

by EFT, BPAY and Payroll May 19 ⇩ ![]()

2. Payments

by Cheque May 19 ⇩ ![]()

3. Payments

by Direct Debit May 19 ⇩ ![]()

|

That Council RECEIVES the list of accounts paid under delegated authority for the period 1 May 2019 to 31 May 2019 as detailed in Attachments 1, 2 and 3 as summarised below:

|

Purpose of Report:

To present to Council the expenditure and list of accounts paid for the period 1 May 2019 to 31 May 2019.

Background:

Council has delegated to the Chief Executive Officer (Delegation No. 1.14) the power to make payments from the City’s Municipal and Trust funds. In accordance with Regulation 13(1) of the Local Government (Financial Management) Regulations 1996 a list of accounts paid by the Chief Executive Officer is to be provided to Council, where such delegation is made.

The list of accounts paid must be recorded in the minutes of the Council Meeting.

Details:

The Schedule of Accounts paid for the period 1 May 2019 to 31 May 2019, covers the following:

|

FUND |

CHEQUE NUMBERS/ BATCH NUMBER |

AMOUNT |

|

Municipal Account (Attachment 1, 2 and 3) |

|

|

|

EFT and BPAY Payments |

2398 - 2412 |

$4,314,670.61 |

|

Payroll by Direct Credit |

May 2019 |

$1,381,643.24 |

|

Sub Total |

|

$5,696,313.85 |

|

|

|

|

|

Cheques |

|

|

|

Cheques |

82501 - 82518 |

$27,528.94 |

|

Cancelled cheque |

82505 |

-$75.60 |

|

Sub Total |

|

$27,453.34 |

|

|

|

|

|

Direct Debits, including credit cards |

|

|

|

Lease Fees |

|

$25,423.21 |

|

Loan Repayments |

$149,997.22 |

|

|

Bank Charges – CBA |

|

$24,913.58 |

|

Credit Cards |

|

$8,689.78 |

|

Sub Total |

|

$209,023.79 |

|

|

|

|

|

Total Payments |

|

$5,932,790.98 |

consulting/advertising:

Not applicable.

Legal/Policy:

Regulation 12(1) and (2) of the Local Government (Financial Management) Regulations 1996 refers, i.e.-

12. Payments from municipal fund or trust fund, restrictions on making

(1) A payment may only be made from the municipal fund or the trust fund —

· if the local government has delegated to the CEO the exercise of its power to make payments from those funds — by the CEO; or

· otherwise, if the payment is authorised in advance by a resolution of Council.

(2) Council must not authorise a payment from those funds until a list prepared under regulation 13(2) containing details of the accounts to be paid has been presented to Council.

Regulation 13(1) and (3) of the Local Government (Financial Management) Regulations 1996 refers, i.e.-

13. Lists of Accounts

(1) If the local government has delegated to the CEO the exercise of its power to make payments from the municipal fund or the trust fund, a list of accounts paid by the CEO is to be prepared each month showing for each account paid since the last such list was prepared -

· the payee’s name;

· the amount of the payment;

· the date of the payment; and

· sufficient information to identify the transaction.

(3) A list prepared under sub regulation (1) is to be —

· presented to Council at the next ordinary meeting of Council after the list is prepared; and

· recorded in the minutes of that meeting.

Risk Management Implications:

Low: Management systems are in place which establish satisfactory controls, supported by the internal and external audit functions. Financial reporting to Council increases transparency and accountability.

Strategic Implications:

This is in keeping with the City’s Strategic Community Plan 2018-2028:

Innovative and Accountable

Our resources and assets are planned and managed in an efficient and sustainable manner.

Our community is aware of what we are doing and how we are meeting our goals.

Our community is satisfied with the service we provide.

We are open and accountable to an engaged community.

SUSTAINABILITY IMPLICATIONS:

Not applicable.

Financial/Budget Implications:

All municipal fund expenditure included in the list of payments is in accordance with Council’s annual budget.

TRIM Ref: D19/86582

Author: Nirav Shah, Coordinator Financial Services

Authoriser: Michael Quirk, Executive Director Community and Business Services

Attachments: 1. Financial

Statements as at 31 May 2019 ⇩ ![]()

|

That Council RECEIVES the financial statements for the month ended 31 May 2019 as shown in Attachment 1. |

Purpose of Report:

To present the statement of financial activity for the period ended 31 May 2019.

Background:

Regulation 34 (1) of the Local Government (Financial Management) Regulations 1996 requires a local government to prepare each month a statement of financial activity including the sources and applications of funds, and as compared to the budget.

Details:

The following documents, included as Attachment 1, comprise the statement of financial activity for the period ending 31 May 2019:

|

Note |

Description |

Page |

|

|

|

|

|

1. |

Statement of Financial Activity by Program Report and Graph |

1-3 |

|

2. |

Statement of Comprehensive Income by Nature or Type Report |

4 |

|

3. |

Net Current Funding Position |

5 |

|

4. |

Summary of Income and Expenditure by Service Areas |

6-64 |

|

5. |

Capital Expenditure and Funding and Capital Works Schedule |

65-77 |

|

6. |

Cash Backed Reserves |

78 |

|

7. |

Rating Information and Graph |

79-80 |

|

8. |

Debtors Report |

81 |

|

9. |

Beatty Park Leisure Centre Financial Position |

82 |

Comments on the Statement of Financial Activity (as at Attachment 1):

Operating revenue is reported separately by ‘Program’ and ‘Nature or Type’ respectively. The significant difference between the two reports is that operating revenue by ‘Program’ includes ‘Profit on sale of assets’ and the report for Nature or Type’ includes ‘Rates revenue’.

Revenue by Program is tracking higher than the year to date budgeted revenue by $1,171,084 (6%). The following items materially contribute to this position: -

· Interest Earnings from investments relating to Municipal & Reserve funds are tracking higher by $160,692 (General Purpose funding);

· Parking Infringements and fines increased by $248,913 (Transport);

· Recognition of monies transferred from trust for contributions relating to Percent of Art (Community Amenities); and

· Recognition of additional income due to unclaimed monies that have been held in trust for greater than 10 years - $321,248 (Community Amenities).

Revenue by Nature or Type is tracking higher than the budgeted revenue by $777,909 (1%). The following items materially contributed to this position: -

· ‘Operating grants, subsidies and contributions’ reflects a budget to actual surplus of $434,726 that is materially contributed from the receipt of monies from percentage of art contributions ($200,050);

· ‘Other revenue’ reflects a budget to actual surplus of $151,513 that is mainly due to the recognition of unclaimed monies from the trust fund ($321,248). However, this increase is offset by $206,000 over budget of recoups for ongoing variable for Leederville oval; and

· ‘Interest earnings’ reflects a budget to actual surplus of $188,095 as a result of higher than anticipated interest earnings from investments.

Expenditure by Program reflects an under-spend of $833,240 (2%) compared to the year to date budget.

All programs excluding ‘Other Property and services’ reflects an under-spend largely contributed by operating projects being carried forward to next financial year.

‘Other Property and services’ reflects an over-spend of $211,077 largely contributed by budget timing variances.

Expenditure by Nature or Type reflects an under-spend of $659,758 (1%) compared to the year to date budget. The following items materially contributed to this position: -

· Materials and contracts reflects an under-spend of $1,592,487. This variance is largely contributed by timing of on-going works and operating projects that have not commenced as yet resulting in the works being carried forward to 2019/20; and

· Employee costs reflects an over-spend of $873,355 largely contributed to labour costs being under budgeted in some services areas, timing variances and one-off redundancy payments made during the year.

Opening Surplus Bought Forward – 2018/19

The opening net surplus position brought forward for 2018/19 was $5,524,405 as stated in the 2017/2018 audited financial statements.

As at 31 May 2019, the surplus amount is $10,925,749 compared to the year to date budgeted amount of $6,061,660. This variance is largely comprised of a reduction in expenditure for works relating to capital works. The table in Note 5 provides a summarised breakdown of the expenditure activity in each asset category.

Content of Statement of Financial Activity

An explanation of each report in the Statement of Financial Activity (Attachment 1), along with some commentary, is below:

1. Statement of Financial Activity by Program Report (Note 1 Page 1)

This statement of financial activity shows operating revenue and expenditure classified by Program.

2. Statement of Comprehensive Income by Nature or Type Report (Note 2 Page 4)

This statement of financial activity shows operating revenue and expenditure classified by Nature or Type.

3. Net Current Funding Position (Note 3 Page 5)

‘Net current assets’ is the difference between the current assets and current liabilities; less committed assets and restricted assets.

4. Summary of Income and Expenditure by Service Areas (Note 4 Page 6 – 64)

This statement shows a summary of operating revenue and expenditure by service unit including variance commentary.

5. Capital Expenditure and Funding Summary (Note 5 Page 65 - 77)

The Table below summarises the ‘2018/2019 capital expenditure budget by program’ as at 31 May 2019. The full capital works program is listed in detail in Note 5 of Attachment 1.

|

|

Current Budget |

YTD |

YTD |

Remaining Budget |

|

|

$ |

$ |

$ |

% |

|

Land and Buildings |

2,535,542 |

2,340,519 |

1,559,616 |

38.5% |

|

Infrastructure Assets |

7,474,682 |

7,188,405 |

4,440,347 |

40.6% |

|

Plant and Equipment |

2,972,882 |

2,105,614 |

863,014 |

71.0% |

|

Furniture and Equipment |

969,870 |

874,142 |

98,551 |

89.8% |

|

Total |

13,952,976 |

12,508,680 |

6,961,527 |

50.1% |

|

FUNDING |

Current Budget |

YTD |

YTD |

Remaining Budget |

|

|

$ |

$ |

$ |

% |

|

Own Source Funding - Municipal |

9,603,667 |

8,337,049 |

4,668,700 |

51.4% |

|

Cash Backed Reserves |

1,996,478 |

1,818,800 |

854,476 |

57.2% |

|

Capital Grant and Contribution |

1,872,868 |

1,872,868 |

1,131,780 |

39.6% |

|

Other (Disposals/Trade In) |

479,963 |

479,963 |

306,571 |

36.1% |

|

Total |

13,952,976 |

12,508,680 |

6,961,527 |

50.1% |

Note: Detailed analysis is included on page 65 - 77 of Attachment 1.

6. Cash Backed Reserves (Note 6 Page 78)

The cash backed reserves schedule provides a detailed summary of the movements in the reserves portfolio, including transfers to and from the reserve. The balance as at 31 May 2019 is $12,430,347.

7. Rating Information (Note 7 Page 79 – 80)

The notices for rates and charges levied for 2018/19 were issued on 26 July 2018.

The Local Government Act 1995 provides for ratepayers to pay rates by four instalments. The due dates for each instalment are:

|

First Instalment |

31 August 2018 |

|

Second Instalment |

31 October 2018 |

|

Third Instalment |

04 January 2019 |

|

Fourth Instalment |

04 March 2019 |

Total rates collected, as at 31 May 2019 is $35,153,293. Furthermore, the outstanding rates debtors balance is $730,670 including deferred rates ($95,513).

Final instalment notices have been issued to ratepayers that have defaulted on their instalment payments. Thereafter the debt will be handed over for further debt collection.

8. Receivables (Note 8 Page 81)

Trade receivables outstanding as at 31 May 2019 is $2,392,896, of which $1,622,437 has been outstanding for over 90 days. Administration has been regularly following up all outstanding items by issuing reminders when they are overdue, subsequently initiating a formal debt collection process for when payments remain outstanding for long periods of time.

Below is a summary of the items that have been outstanding for over 90 days:

· $1,297,980 (80.0%) relates to unpaid infringements (plus costs) over 90 days. Infringements that remain unpaid for more than two months are sent to the Fines Enforcement Registry (FER), which then collects the outstanding balance on behalf of the City for a fee. The debtor balance has reduced by $28,107 compared to last month.

Due to the aged nature of some of the unpaid infringements, the provision for doubtful debts has been increased this year and an amount of $1,066,403 has been transferred to long term infringement debtors (non-current portion); and

· $225,300 (13.9%) relates to cash in lieu of car parking debtors. Administration has entered into special payment arrangements with long outstanding cash in lieu parking debtors to enable them to pay over a fixed term of five years.

9. Beatty Park Leisure Centre – Financial Position report (Note 9 Page 82)

As at 31 May 2019, the operating deficit for the centre is $1,669,631 compared to the year to date budgeted amount of $1,572,628.

10. Explanation of Material Variances (Note 4 Page 6 – 64)

The materiality thresholds used for reporting variances are 10% and/or $20,000 respectively. This means that variances will be analysed and separately reported when they are more than 10% (+/-) of the year to date budget or where that variance exceeds $20,000 (+/-). This threshold was adopted by Council as part of the budget adoption for 2018/19 and is used in the preparation of the statements of financial activity when highlighting material variance in accordance with Financial Management Regulation 34(1) (d).

In accordance to the above, all material variances as at 31 May 2019 have been detailed in the variance comments report in Attachment 1.

11. Treatment of assets less than $5,000

The following amendment has been made to s6.10 Regs.17 (A) (5) of the Local Government Act:

An asset is to be excluded from the assets of a local government if the fair value of the asset as at the date of acquisition by the local government is under $5,000.

As a result, Administration has reallocated the expenditure relating to the affected assets under this new threshold from capital to operating. The impact of this change is an increase in year to date operating expenditure by $255,211 resulting in a negative impact on the net position for the year.

Administration will perform a similar exercise for prior year acquisitions to ensure full compliance with the new legislative requirements.

Consultation/Advertising:

Not applicable.

Legal/Policy:

Section 6.4 of the Local Government Act 1995 requires a local government to prepare an annual financial report for the preceding year and other financial reports as prescribed.

Regulation 34 (1) of the Local Government (Financial Management) Regulations 1996 requires the local government to prepare a statement of financial activity each month, reporting on the source and application of funds as set out in the adopted annual budget.

A statement of financial activity and any accompanying documents are to be presented at an Ordinary Meeting of the Council within two months after the end of the month to which the statement relates.

Section 6.8 of the Local Government Act 1995, specifies that a local government is not to incur expenditure from its Municipal Fund for an additional purpose except where the expenditure is authorised in advance by an absolute majority decision of Council.

Risk Management Implications:

Low: Provision of monthly financial reports to Council fulfils relevant statutory requirements and is consistent with good financial governance.

Strategic Implications:

Reporting on the City’s financial position is aligned to with the City’s Strategic Community Plan 2018-2028:

Innovative and Accountable

Our resources and assets are planned and managed in an efficient and sustainable manner.

Our community is aware of what we are doing and how we are meeting our goals.

Our community is satisfied with the service we provide.

We are open and accountable to an engaged community.

SUSTAINABILITY IMPLICATIONS:

Not applicable.

Financial/Budget Implications:

Council Briefing Agenda 18 June 2019

TRIM Ref: D19/86827

Author: John Paton, Executive Manager - Office of the CEO

Authoriser: David MacLennan, Chief Executive Officer

Attachments: 1. Draft

Budget 2019/20 - Commentary ⇩ ![]()

2. Financial

Statements 2019/20 Budget ⇩ ![]()

3. Draft Capital

Budget 2019/20 ⇩ ![]()

4. Summary of Draft

Income and Expenditure by Directorate ⇩ ![]()

5. Fees and Charges

Schedule 2019/20 ⇩ ![]()

Purpose of Report:

To consider for adoption the City’s Budget for the 2019/20 financial year, including imposition of differential and minimum rates, adoption of fees and charges and other consequential matters arising from the budget papers.

Background:

Between 1 June and 31 August each year, local governments are required to prepare and adopt a budget for the financial year. As in past years, in preparing the budget, Administration has compiled and analysed relevant information, held a series of budget workshops with Council Members and invited Community Budget Submissions (CBS) aligned to the priorities in the City’s Strategic Community Plan 2018 – 2028 (SCP). The Draft Budget was therefore progressively compiled, in consideration of current circumstances, community submissions and the annual review of the Corporate Business Plan (CBP).

A key part of the budget development is identifying the ‘budget deficiency’ to be made up from the levying of council rates. Once an estimate of that budget deficiency is known, local governments are required to give local public notice of any intention to levy differential rates.

At the Special Meeting of Council held on 21 May 2019, Council considered a report (Item 4.1) dealing with a proposal to introduce Differential and Minimum Rates in order to fund the budgeted deficit of $35,466,820.

The following rating strategy was considered:

· 0.5% of the increase would be generated from the annual growth in the rate base;

· 2.9% increase in the rate in the dollar for Residential;

· 1.5% increase to Vacate Commercial and the Other (Commercial/Industrial) category; and

· 2.9% increase to minimum rates.

As a result, the following resolution was adopted:

That Council:

1. ADVERTISES by local public notice, in accordance with Section 6.36(1) of the Local Government Act 1995 for a period of 21 days its intention to levy the following differential rates and minimum rates in 2019/20 and invites submissions on the proposal from electors and ratepayers:

|

|

2019/20 |

|

|

Rating Category |

Rate in the dollar |

Minimum rate |

|

Residential |

0.06663 |

$1,214.30 |

|

Commercial Vacant |

0.12817 |

$1,537.40 |

|

Other |

0.06718 |

$1,214.30 |

2. NOTES any public submissions received in response to 1 above will be presented to Council for consideration.

The Budget Commentary document has been updated (Attachment 1) to monitor progression and provide a consistent overview of the financial position, budget influences and sustainability strategies of the City.

Details:

The 2019/20 Draft Budget as presented, includes the following components:

· Statutory Budget Statements (Attachment 2)

o Statement of Comprehensive Income by Nature or Type – this statement details the operating income and expenditure categorised by the nature of the income or expenditure, together with non-operating (capital) grants and profit/loss on asset disposal. Details of the 2018/19 Adopted Budget, together with projected (forecast) Actual are included for comparative purposes.

o Statement of Comprehensive Income by Program – this statement categorises the income and expenditure by the Program (function) it applies to. This schedule also details the distribution of the profit and loss and capital grants by Program.

o Rate Setting Statement (RSS) – identifies the amount of rates that need to be levied to allow the City to undertake all annual activities, once all income is recognised, non-cash items are adjusted back, Reserve transfers are incorporated and opening and closing balances are factored in.

o Statement of Cash Flows – this statement reflects how cash and cash equivalents have been generated and used over the reporting period.

o Explanatory notes to the Statements.

· 2019/20 Draft Capital Budget (Attachment 3)

· Summary of Income and Expenditure by Directorate (Attachment 4).

· Fees and Charges Schedule (Attachment 5)

Operating Budget

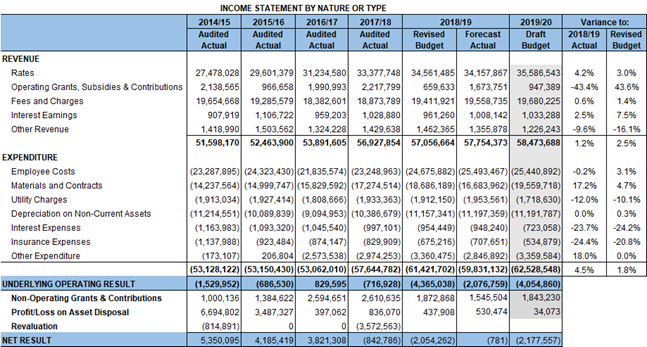

The above Table shows the movements in the Operating Budget since 2014/15, with the percentage variation between 2018/19 and the Draft Budget. Key factors contributing to the variations are detailed below:

REVENUE

Rates: The budget is reflecting an overall increase of 3.0%, attributed to a 0.5% increase in the rate base and a 2.9% and 1.5% increase in the rate-in-$ and minimum rate for the Residential and Other category respectively. Growth for 2019/20 is expected to remain similar to 2018/19.

Grants/Subsidies/Contributions: 50% of the 2019/20 Financial Assistance Grant is forecast to be received in advance and recorded as revenue for 2018/19, which is inconsistent with the Revised Budget. A corresponding value has been factored into the Opening Balance for 2019/20. There is also revenue of $260,000 to recognise a transfer from Trust of Percent for Art contributions, which will in turn be transferred to Reserve.

Fees and Charges The budget is reflecting a 1.4% increase over the 2018/19 Budget.

Interest Earnings Overall interest revenue is forecast to increase by 2.5% on the 2018/19 forecast result.

Other Revenue: Attributable to reimbursements and sundry income. This income area can vary each year depending on circumstances contributing to sundry income.

EXPENDITURE

Employee Costs: The Budget is reflecting a 3.1% increase on the prior year Revised Budget, but is closely aligned to the Forecast Actual for 2018/19. The Budget includes a provision for annual salary increments plus a component for additional positions to assist in delivering and enhancing City services.

Materials and Contracts: A 4.7% increase is proposed, with increases spread across a variety of operational areas, including one-off expenses for the 2019 local government elections and triennial GRV revaluation. This budget also commits significant funding towards a range of new operating initiatives, with a component carried forward from 2018/19, contributing to the variance between 2018/19 Forecast Actual and Draft Budget.

Utility Charges A 10% reduction is directly related to savings attributed to the installation of solar panels on four of the city’s major buildings.

Interest Expenses A key feature of the budget is a $4.2m principal repayment on one of the City’s loans. As a result, interest expenses are forecast to reduce by 24% in 2019/20.

Other Expenditure: Budget is consistent with the previous year.

Non-Operating Budget

As detailed in the Statement of Comprehensive Income by Nature or Type (and Program), the following Non-Operating transactions are proposed for 2019/20:

· Capital Grants directly associated with the Capital Works Program (including carry forward funding) totalling $1,843,230;

· Profit on asset disposals of $241,185. This takes into account the current ‘book value’ of assets being sold against the total proceeds from the sale. This is a non-cash transaction.

· Loss on asset disposals of $207,112. As with the above ‘profit’, this item reflects those assets where the proceeds are lower than the current book value.

· The RSS specifies $555,000 for Proceeds from Disposal of Assets, which relates to the actual sale/trade-in of plant listed for replacement in the 2019/20 Capital Works Program.

Financing Activities

The Rate Setting Statement lists the following annual financing activities scheduled for 2019/20:

· Repayment of long term borrowings - loan principal repayments of $6,132,377, which includes a $5.2m ‘balloon’ repayment on Loan No. 2 – 246 Vincent Street, Leederville.

· Proceeds from new borrowings – the above balloon repayment is being funded from a $4.2m transfer from Reserve, with the residual balance being refinanced over 5 years.

· Transfers to Reserves of $1,088,515 including a $500,000 contribution towards the cost of implementation of the FOGO (Food Organic Garden Organics) initiative in 2020/21 and a $280,000 transfer of cash in lieu contributions for parking and percent for art to the respective reserves. The balance is the transfer and allocation of interest earnings.

· Transfer from Reserves of $5,597,436, with $1,380,000 funding capital projects and $4,217,436 for the loan repayment.

Capital Budget

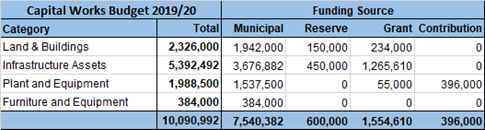

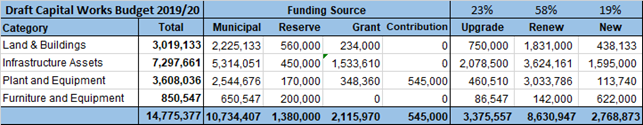

The 2019/20 Draft Capital Works Program (Attachment 3) lists total new projects to the value of $10,090,992 as summarised below:

Following a review of the progress of works in 2018/19 an additional amount of Carry Forward projects to the value of $4,684,385, has been added to the Capital Works Budget. The following Table then summarises the full budget for capital expenditure in 2019/20.

Whilst the carry forward total is significant, it is noted that of the $1.62m carried forward under Plant and Equipment, orders to the value of $1.47m have been raised with delivery expected early in 2019/20.

It is also important to note that carry forward projects come forward with their relevant funding, so they have no impact on the demand for rates in 2019/20. In the case of the Municipal funded projects, the equivalent funding is factored into the Opening Balance, whereas the receipt of a Grant and Reserve funding is transferred to be recognised in 2019/20.

Cash Backed Reserves

The Reserve Fund Statement (Attachment 2 page 20) and Rate Setting Statement reflect transfers to Reserves of $1,088,515 (including $278,688 interest earnings), with the transfer from Reserves totalling $5,597,436, thereby providing in 2019/20 for a net outflow from the City’s Reserves of $4,508,921.

The transfers from Reserve are funding specific projects listed in the Draft Capital Budget to the value of $1,380,000, with $4,217,436 being applied towards the balloon loan repayment referenced above under Financing Activities.

Transfers to Reserves are made up of the following:

· $278,688 interest earnings from the Reserves and reflects the anticipated income listed in the Operating Budget.

· $260,200 transfer from Trust to the Percentage for Public Art Reserve.

· $50,000 transfer to Cash in Lieu Parking Reserve from contributions received.

· $500,000 transfer to Strategic Waste Management Reserve to contribute towards the implementation costs of the Food Organics Garden Organics (FOGO) service in 2020/21.

Consultation/Advertising:

Two consultation processes have been implemented in the lead-up to consideration of the annual budget.

CONSULTATION 1 Community Budget Submissions aligned to Council Priorities

At the Ordinary Meeting of Council held 16 October 2018, Council adopted the current SCP, which established six strategic priority areas. As in previous years, submissions were invited from the community, aligned to the six Priorities for consideration in the development of the 2019/20 Annual Budget.

Notices were published in the Voice News (9 February) and Guardian Express (12 February), the City’s Facebook page, Twitter, E-News and the City’s website, with submissions closing on 5 March 2019.

A separate report is listed under this agenda dealing with the outcome of the Community Budget Submissions.

CONSULTATION 2 Intention to Implement Differential and Minimum Rates - Section 6.36(1) of the Act

Notices which included relevant details of Council’s intention to impose Differential and Minimum Rates and an invitation for submissions from electors and ratepayers in respect to the proposed differential rates were published in the:

· Perth Voice: Saturday, 25 May and 4 June; and

· Guardian Newspapers: Tuesday, 28 May and 1 June.

Additionally, the information was published on the following website pages:

· News item/public notice - https://www.vincent.wa.gov.au/news/

· Rates information page - https://www.vincent.wa.gov.au/council/rates/rates-information.aspx

· Community Consultations page - https://www.vincent.wa.gov.au/consultations/

Submissions were required to be made in writing and provided by 4pm 14 June 2019.

At the time of preparing this report, the submission was still open, so the information below relates to the submissions received to date. An update will be provided for the Briefing Session.

In response to the invitation, two submissions were received. As Council is required to consider any submissions received before imposing differential rates, a copy of the full submissions have been provided separately to all Council Members, however the key issues raised have been summarised below, along with Administration’s comments:

Payam Golestani – Beaufort Street, Mount Lawley (Submission Attached)

Business conditions for all retailers have been quite challenging ever since the GFC. Over the last several years we have witnessed the permanent closure of some 25 small businesses on Beaufort Street. For the first time in decades, we have vacant properties on Beaufort Street that have been vacant for more than 2 years.

The 2015 Valuer General’s GRV valuation of a some 80-100sqm C grade retail space on Beaufort Street is $40,000 - $50,000 PA. If that valuation was taken to be correct why is it that we cannot achieve a successful lease at that rate or even at 50% of that amount since 2015?

Despite the tough retail environment the variable outgoings which largely comprised of Council Rates have become a major impediment once its factored into the overall cost of leasing a vacant space.

It is on these basis that I propose if Vincent Council is not prepared to help us to increase the foot traffic on Beaufort Street, please please please remove the shackles which hinders the very survival of day trading on Beaufort Street.

I urge the Council to reduce the rates by 50% - 80% for businesses directly fronting Beaufort Street to let them survive and allow new business to get established – in time you will be proven that as a result of your foresight you will help creating a vibrant ribbon development, which we all love to see - we will see more business activity more residential developments increased investments in capital and labour and general improvements in statics and street appeal of business thus increasing inflow of more residents in the area - this will translate directly into more revenue for Vincent Council in fullness of time.

Administration Comment

Rates are levied based on land use or zoning, not by location, therefore it is not possible to impose a differential rate based on a specific location or area. In addition, whilst the budget deficiency equates to a requirement for an additional 3%, of which growth will deliver 0.5%, consideration was given to the economic climate and therefore the rating strategy recommended a modest 1.5% increase to commercial properties and a 2.9% increase for residential.

John Siamos – Salisbury Street, Leederville (Submission Attached)

I write to request that the City of Vincent review the change to the differential rates advertised and submitted to council on 21 May 2019 at a Special Council Meeting.

The meeting stated that the City intends to increase rates by 2.9% for the 2019/20 year. The document also shows that the council has increased rates since 2017 by 2.9%, 2.7% and 3.0% last year. I believe that the City is not managing its funds and expenditure prudently with such increases well above Perth Inflation and Perth wages growth rates. As ratepayers we expect the council to manage within the economic condition s that present themselves each and every year, just as landowners and families are expected to do.

I therefore request that for the 2019/20 year, the City reduce the stated increase to be in line with Perth inflation rate, as the City has already charged well over that benchmark for the past three years.

Administration Comment